CONTINUING CASE

Investing Fundamentals

The triplets are now three and a half years old and Jamie Lee and Ross, both 38, are finally beginning to settle into a regular routine now that the triplets are a little more self-sufficient. The first three years were a blur of diapers, feedings,

baths, mounds of laundry, and crying babies! Jamie Lee and Ross finally had a welcomed dinner out on their own as Rosss parents were minding the triplets. They were having a conversation about their future and the future of the triplets. College expenses ($100,000) and their eventual retirement seem to be a major worry of both of them. They both have dreamed of owning a beach house when they retire. That could be another $350,000, thirty years from now. They wondered how they could possibly afford all of this.

They agreed that it was time to talk to an investment counselor but wanted to organize all of their financial information and discuss their familys financial goals before setting up the appointment.

Current Financial Situation

Assets (Jamie Lee and Ross combined):

Checking account: $4,500

Savings account: $20,000

Emergency fund savings account: $21,000

IRA balance: $32,000

Car: $8,500 (Jamie Lee) and $14,000 (Ross)

Liabilities (Jamie Lee and Ross combined):

Student loan balance: $0

Credit card balance: $4,000

Car loans: $2,000

Income:

Jamie Lee: $45,000 gross income ($31,500 net income after taxes)

Ross: $80,000 gross income ($64,500 net income after taxes)

Monthly Expenses:

Mortgage: $1,225

Property taxes: $400

Homeowners insurance: $200

IRA contribution $300

Utilities: $250

Food: $600

Baby essentials (diapers, clothing, toys, etc.): $200

Gas/maintenance: $275

Credit card payment: $400

Car loan payment: $289

Entertainment: $125

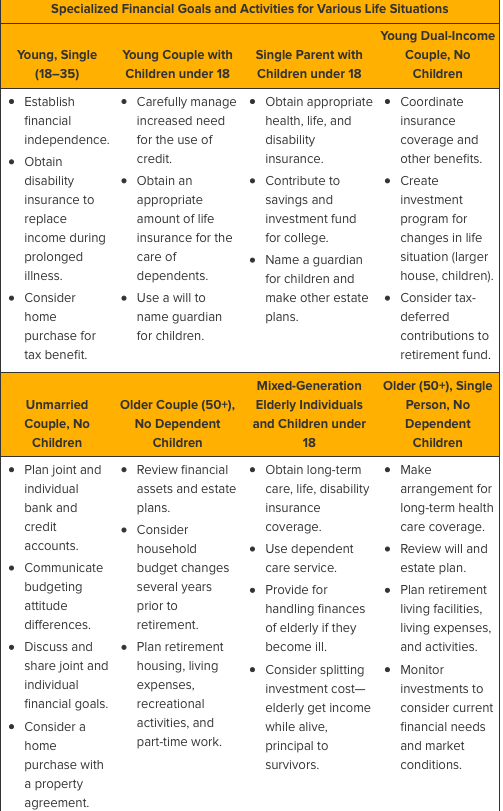

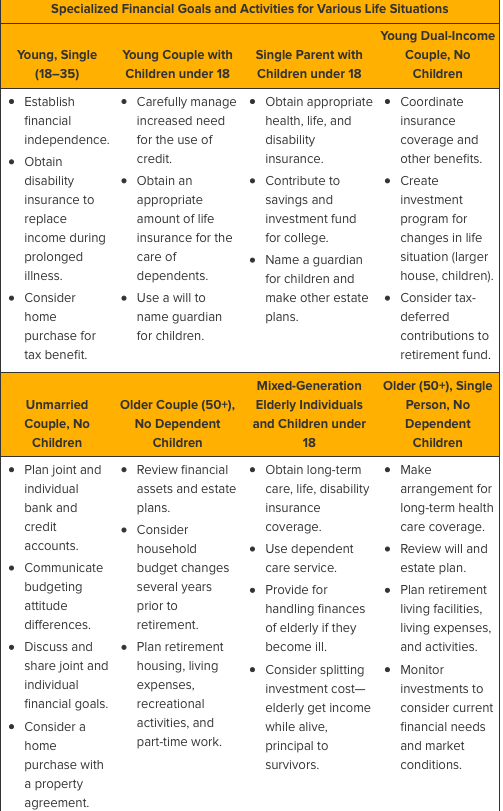

- Looking back to Chapter 1 and Exhibit 1-6, Financial goals and activities for various life situations, describe the life stage that corresponds with what Jamie Lee and Ross are experiencing right now. What are some of the financial activities that they should be participating in?

- After reviewing Jamie Lee and Rosss current financial situation, suggest specific and measurable short-term and long-term financial goals they can implement at this stage.

- Access the validity of Jamie Lee and Rosss Short- and long-term financial goals and objectives.

| Financial Question | Short-term Goals | Long-Term Goals |

| How much money do they need to satisfy their investment goals? | | |

| How will they obtain the money? | | |

| How long will it take them to obtain the money? | | |

| How much risk are they willing to assume in an investment program? | | |

| What possible economic or personal conditions could alter their investment goals? | | |

| Considering current Economic conditions, are their investment goals reasonable? | | |

| Are they willing to make the sacrifices necessary to ensure that they meet their investment goals? | | |

4. Using the formula determining the amount of growth investments investors should have, how much of Jamie Lee and Rosss assets should be allocated in growth investments? How should the remaining investments be distributed and what is the associated risk with each type of investment?

5. Jamie Lee and Ross need to evaluate their emergency fund of $21,000 will their present emergency fund be sufficient to cover them should one of them lose their job?

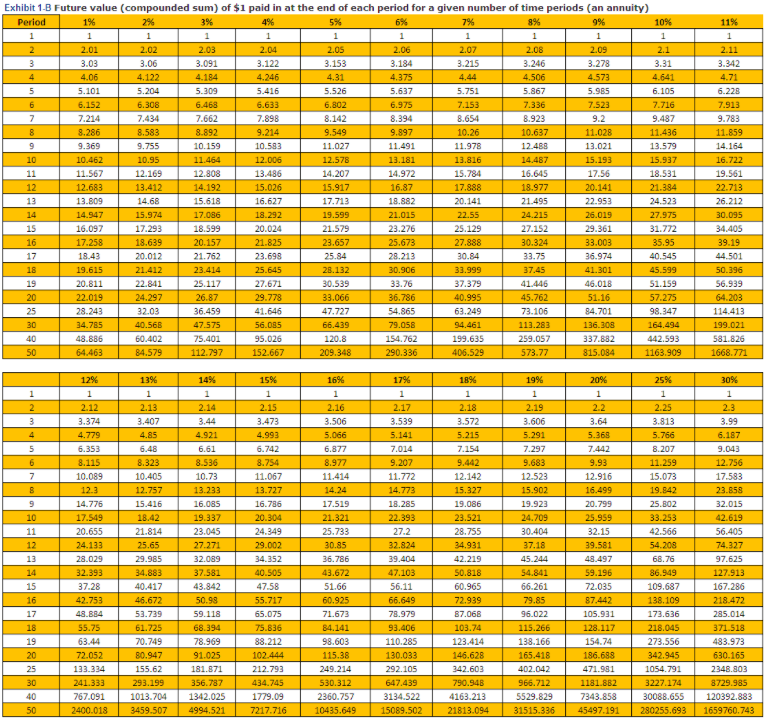

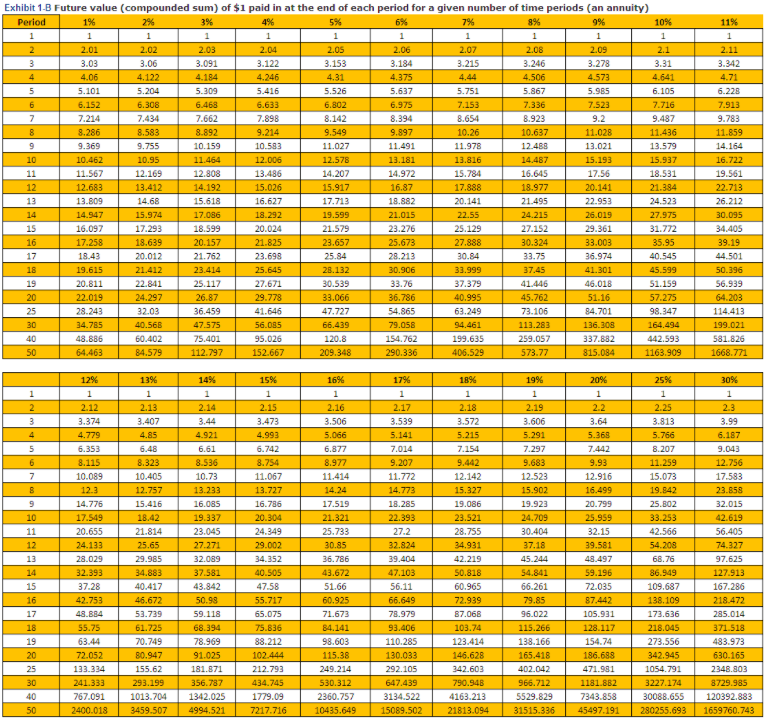

6. Jamie Lee and Ross agree that by accomplishing their short-term goals, they can budget $5,000 a year toward their long-term investment goals. They are estimating that with the allocations recommended by their financial adviser, that they will see an average return of 7 percent on their investments. The triplets will begin college in 15 years and will need $100,000 for tuition. Using Exhibit 1-B, Future Value in the Time Value of Money Appendix located after chapter 1, decide whether Jamie Lee and Ross will be on track to reaching their long-term financial goals of having enough money from their investments to pay the triplets tuition.

Specialized Financial Goals and Activities for Various Life Situations Young Dual-Income Young, Single (18-35) Young Couple with Children under 18 Single Parent with Children under 18 Children . Carefully manageObtain appropriateCoordinate financial independence. Obtain increased need for the use of credit. Obtain an appropriate amount of life insurance for the health, life, and insurance coverage and other benefits. insurance Contribute to savings and investment fund investment insurance to replace income during prolonged illness. Consider home changes in life situation (larger house, children). . Name a guardian dependents. for children and make other estate Consider tax plans. Use a will to name guardian for children. deferred contributions to retirement fund Unmarried Couple, No Older Couple (50+), No Dependent Children Mixed-Generation Elderly Individuals and Children under Older (50+), Single Person, No Children Children Plan joint andReview financial Obtain long-term Make arrangement for long-term health care coverage assets and estate care, life, disability insurance coverage individual bank and accounts. . Communicate budgeting Consider household budget changes several years pri retirement. Use dependent - Review will and care service Provide for handling finances estate plan. Plan retirement living facilities, living expenses, and activities. differences. Discuss andPlan retirement share joint and housing, living Consider splitting.Monitor individual financial goals.recreational become il expenses, investments to consider current financial needs and market conditions. investment cost- elderly get income activities, and part-time work. e Consider a home purchase with survivors. agreement. Exhibit 1-B Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annuity) 2. 3.122 3.153 3.31 3.342 5.526 5.985 8.142 26 11.978 436 13.579 10.159 13.021 13.4861 14.207 14.972 18.531 026 16.627 13 17.713 18.882 20.141 24.523 16.097 17.293 29.361 5.95 40.545 18.43 28.213 0.84 44.501 28.132 20.811 22.841 41.446 786 54.865 84.701 136.308 98.347 164.494 442.593 4.785 60.402 75.401 154.762 199.635 581.826 2.2 4.993 6.353 10.405 12.757 15.416 0.089 16.085 17.519 18.285 19.086 19.923 20.799 393 0.655 32.824 39.581 74.327 29.985 32.089 34.352 36.786 42.219 43.497 15 40.417 37.2 42.753 60.925 71.673 60.965 72.939 109.687 138.109 173.636 66.649 87.442 96.022 105.931 285.014 371.518 154.74 186.638 471.981 110.285 273.556 115.38 249.214 530.312 2360.757 10435.649 72. 133.334 165.418 630.165 2348.803 8729.985 120392.883 25 155.62 181.871 342.603 402.042 1054.791 647.439 3134.522 013.7041342.025 9.5074994.5 7343.858 30088.655 1 45497.1 67.091 1779.09 4163.213 5529.829 31515.336 018 5.693 1659760.743 Specialized Financial Goals and Activities for Various Life Situations Young Dual-Income Young, Single (18-35) Young Couple with Children under 18 Single Parent with Children under 18 Children . Carefully manageObtain appropriateCoordinate financial independence. Obtain increased need for the use of credit. Obtain an appropriate amount of life insurance for the health, life, and insurance coverage and other benefits. insurance Contribute to savings and investment fund investment insurance to replace income during prolonged illness. Consider home changes in life situation (larger house, children). . Name a guardian dependents. for children and make other estate Consider tax plans. Use a will to name guardian for children. deferred contributions to retirement fund Unmarried Couple, No Older Couple (50+), No Dependent Children Mixed-Generation Elderly Individuals and Children under Older (50+), Single Person, No Children Children Plan joint andReview financial Obtain long-term Make arrangement for long-term health care coverage assets and estate care, life, disability insurance coverage individual bank and accounts. . Communicate budgeting Consider household budget changes several years pri retirement. Use dependent - Review will and care service Provide for handling finances estate plan. Plan retirement living facilities, living expenses, and activities. differences. Discuss andPlan retirement share joint and housing, living Consider splitting.Monitor individual financial goals.recreational become il expenses, investments to consider current financial needs and market conditions. investment cost- elderly get income activities, and part-time work. e Consider a home purchase with survivors. agreement. Exhibit 1-B Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annuity) 2. 3.122 3.153 3.31 3.342 5.526 5.985 8.142 26 11.978 436 13.579 10.159 13.021 13.4861 14.207 14.972 18.531 026 16.627 13 17.713 18.882 20.141 24.523 16.097 17.293 29.361 5.95 40.545 18.43 28.213 0.84 44.501 28.132 20.811 22.841 41.446 786 54.865 84.701 136.308 98.347 164.494 442.593 4.785 60.402 75.401 154.762 199.635 581.826 2.2 4.993 6.353 10.405 12.757 15.416 0.089 16.085 17.519 18.285 19.086 19.923 20.799 393 0.655 32.824 39.581 74.327 29.985 32.089 34.352 36.786 42.219 43.497 15 40.417 37.2 42.753 60.925 71.673 60.965 72.939 109.687 138.109 173.636 66.649 87.442 96.022 105.931 285.014 371.518 154.74 186.638 471.981 110.285 273.556 115.38 249.214 530.312 2360.757 10435.649 72. 133.334 165.418 630.165 2348.803 8729.985 120392.883 25 155.62 181.871 342.603 402.042 1054.791 647.439 3134.522 013.7041342.025 9.5074994.5 7343.858 30088.655 1 45497.1 67.091 1779.09 4163.213 5529.829 31515.336 018 5.693 1659760.743