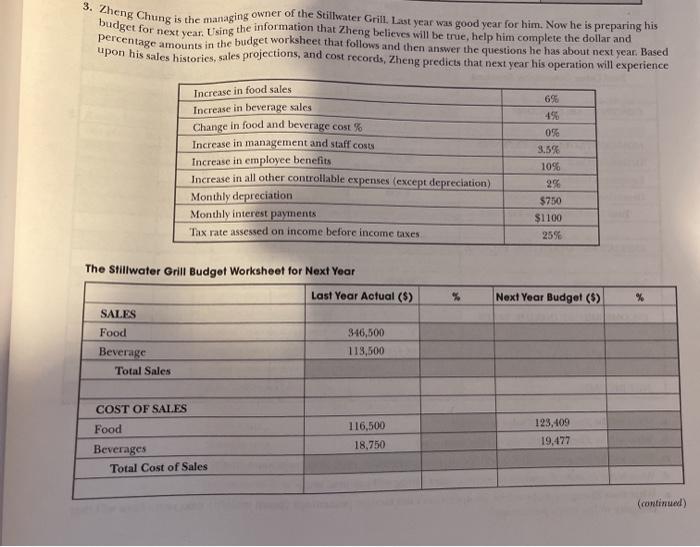

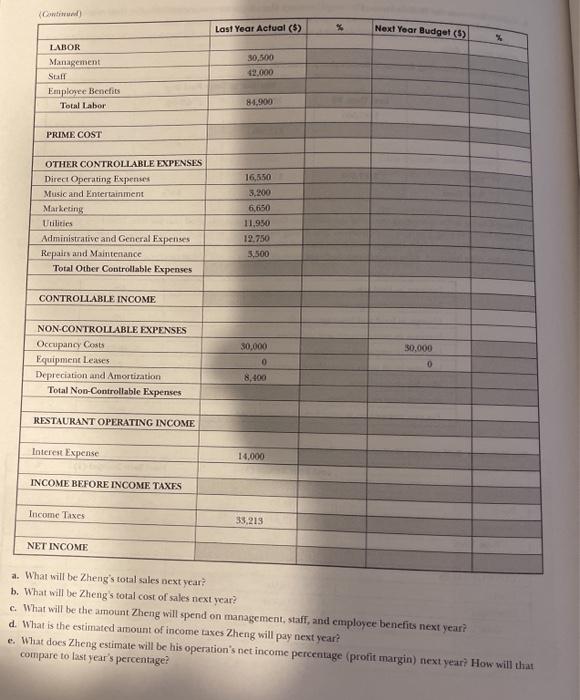

3. Zheng Chung is the managing owner of the Stillwater Grill. Last year was good year for him. Now he is preparing his budget for next year. Using the information that Zheng believes will be true, help him complete the dollar and percentage amounts in the budget worksheet that follows and then answer the questions he has about next year. Based upon his sales histories, sales projections, and cost records, Zheng predicts that next year his operation will experience 696 Increase in food sales Increase in beverage sales Change in food and beverage cost % Increase in management and staff costs Increase in employee benefits Increase in all other controllable expenses (except depreciation) Monthly depreciation Monthly interest payments Tax rate assessed on income before income taxes 0% 9.5% 10% 256 $750 $1100 25% % Next Year Budget (5) % The Stillwater Grill Budget Worksheet for Next Year Last Year Actual ($) SALES Food 346,500 Beverage 113,500 Total Sales COST OF SALES Food 116,500 18,750 123,409 19,477 Beverages Total Cost of Sales (continued) Cwl Last Year Actual ($) * Next Year Budget (5) LABOR Management Stall Employee Benefits Total Labor 30,300 42.000 84.900 PRIME COST OTHER CONTROLLABLE EXPENSES Direct Operating Expenses Music and Entertainment Marketing Utilities Administrative and General Expenses Repairs and Maintenance Total Other Controllable Expenses 16,550 3,200 6,650 11.950 12.750 3.500 CONTROLLABLE INCOME NON-CONTROLLABLE EXPENSES Occupancy Costs Equipment Leases Depreciation and Amortization Total Non-Controllable Expenses 30,000 0 30,000 0 RESTAURANT OPERATING INCOME Interest Expense 14.000 INCOME BEFORE INCOME TAXES Income Taxes 33.213 NET INCOME a. What will be Zheng's total sales next year? b. What will be Zheng's total cost of sales next year: c. What will be the amount Zheng will spend on management, staff, and employee benefits next year? d. What is the estimated amount of income taxes Zheng will pay next year? e. What does Zheng estimate will be his operation's net income percentage (profit margin) next year? How will that compare to last year's percentage