Answered step by step

Verified Expert Solution

Question

1 Approved Answer

30 ABC bank wishes to achieve the lowest possible level of interest rate risk, as measured by its DGAP.ABC bank wishes to maintain its current

30

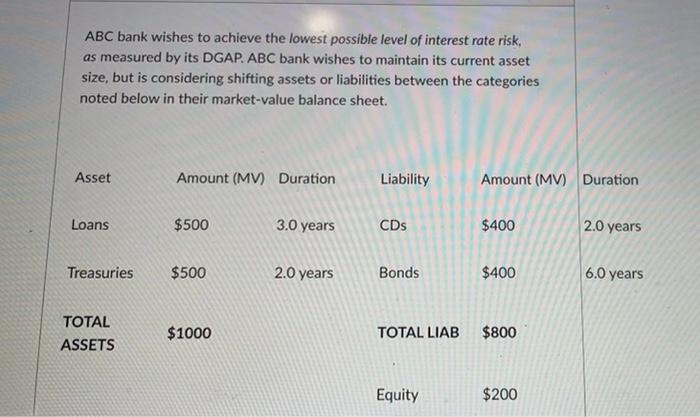

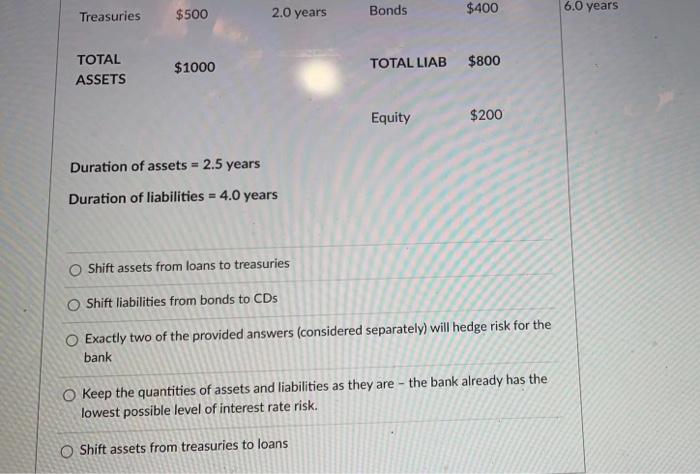

ABC bank wishes to achieve the lowest possible level of interest rate risk, as measured by its DGAP.ABC bank wishes to maintain its current asset size, but is considering shifting assets or liabilities between the categories noted below in their market value balance sheet. Asset Amount (MV) Duration Liability Amount (MV) Duration Loans $500 3.0 years CDs $400 2.0 years Treasuries $500 2.0 years Bonds $400 6.0 years TOTAL ASSETS $1000 TOTAL LIAB $800 Equity $200 Treasuries $500 2.0 years Bonds $400 6.0 years TOTAL ASSETS $1000 TOTAL LIAB $800 Equity $200 Duration of assets = 2.5 years Duration of liabilities = 4.0 years Shift assets from loans to treasuries O Shift liabilities from bonds to CDs Exactly two of the provided answers (considered separately) will hedge risk for the bank O Keep the quantities of assets and liabilities as they are - the bank already has the lowest possible level of interest rate risk. Shift assets from treasuries to loans

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started