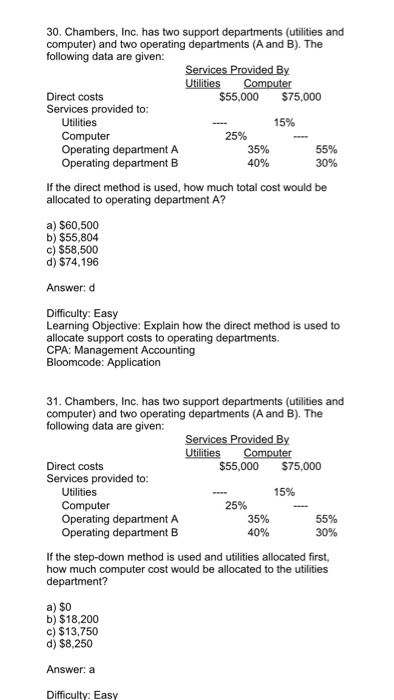

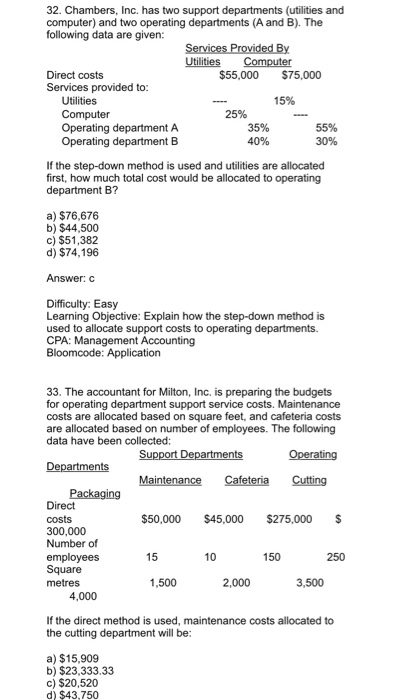

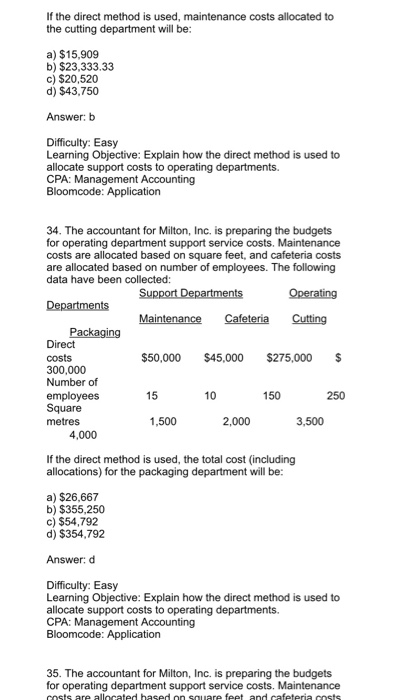

30. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer $55,000 $75,000 Direct costs Services provided to: 15% Utilities Computer Operating department A 25% 35% 40% 55% 30% If the direct method is used, how much total cost would be allocated to operating department A? a) $60,500 b) $55,804 c) $58,500 d) $74,196 Answer: d Difficulty: Easy Learning Objective: Explain how the direct method is used to allocate support costs to operating departments. CPA: Management Accounting 31. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer Direct costs Services provided to: $55,000 $75,000 Utilities Computer 15% 25% 35% 40% 55% 30% If the step-down method is used and utilities allocated first, how much computer cost would be allocated to the utilities a) $0 b) $18,200 c) $13,750 d) $8,250 Answer: a Difficulty: Easy 32. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer Direct costs Services provided to: $55,000 $75,000 Utilities 15% Computer 25% 35% 40% 55% 30% Operating departmentB If the step-down method is used and utilities are allocated first, how much total cost would be allocated to operating department B? a) $76,676 b) $44,500 c) $51,382 d) $74,196 Answer: C Difficulty: Easy Learning Objective:Explain how the step-down method is used to allocate support costs to operating departments. 33. The accountant for Milton, Inc. is preparing the budgets for operating department support service costs. Maintenance costs are allocated based on square feet, and cafeteria costs are allocated based on number of employees. The following data have been collected: Maintenance Cafeteria Cutting Direct costs 300,000 Number of employees Square metres $50,000 $45.000 $275,000 $ 10 150 250 1,500 2,000 3,500 4,000 If the direct method is used, maintenance costs allocated to the cutting department will be a) $15,909 b) $23,333.33 c) $20,520 d) $43,750 If the direct method is used, maintenance costs allocated to the cutting department will be: a) $15,909 b) $23,333.33 c) $20,520 d) $43,750 Answer: b Difficulty: Easy Learning Objective: Explain how the direct method is used to allocate support costs to operating departments. CPA: Management Accounting 34. The accountant for Milton, Inc. is preparing the budgets for operating department support service costs. Maintenance costs are allocated based on square feet, and cafeteria costs are allocated based on number of employees. The following data have been collected: Operating Maintenance Cafeteria Cutting Direct costs 300,000 Number of employees Square metres $50,000 $45,000 $275,000 S 15 10 150 250 1,500 2,000 3,500 4,000 If the direct method is used, the total cost (including allocations) for the packaging department will be: a) $26,667 b) $355,250 c) $54,792 d) $354,792 Answer: d Difficulty: Easy Learning Objective: Explain how the direct method is used to allocate support costs to operating departments. CPA: Management Accounting 35. The accountant for Milton, Inc. is preparing the budgets for operating department support service costs. Maintenance