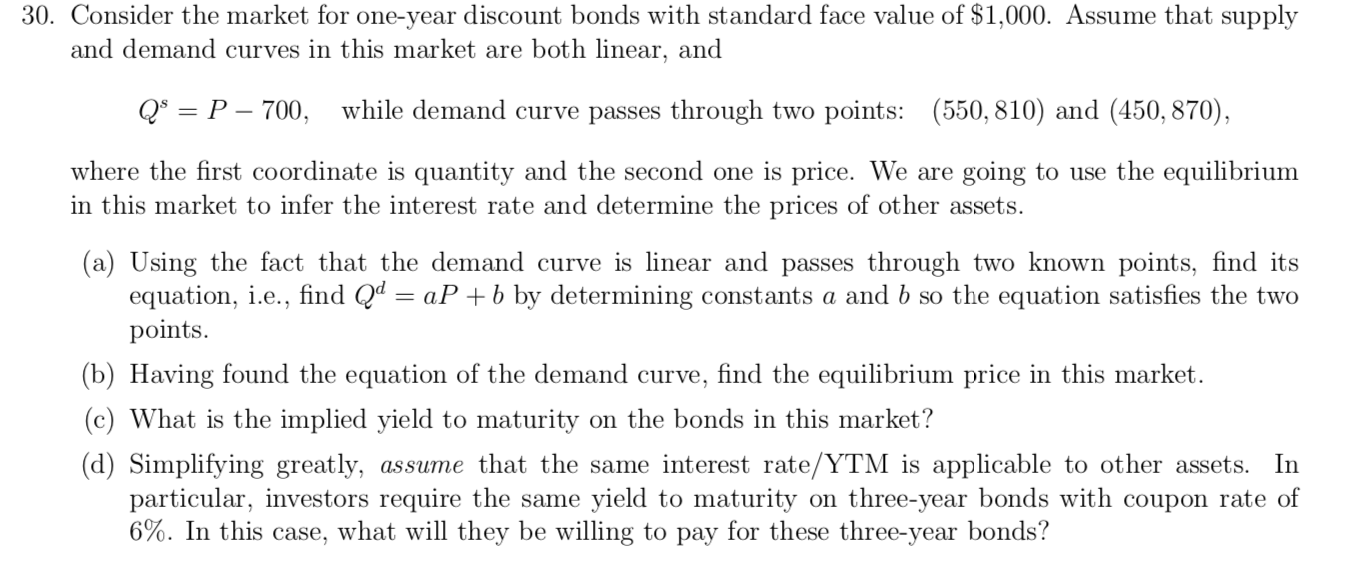

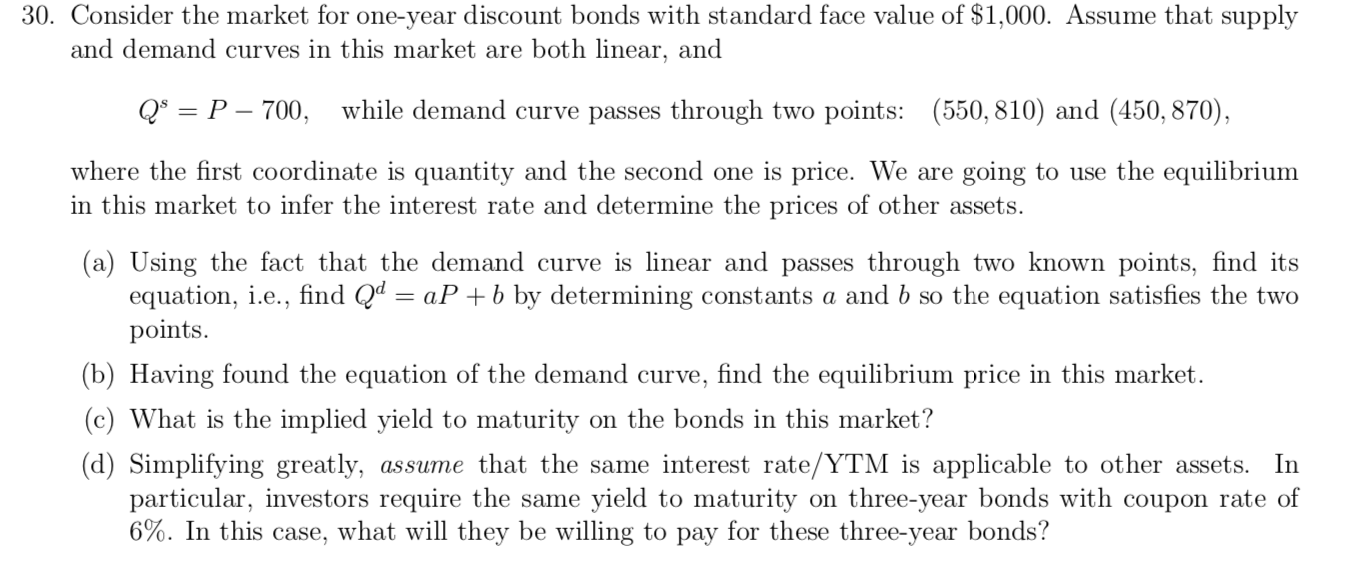

30. Consider the market for one-year discount bonds with standard face value of $1,000. Assume that supply and demand curves in this market are both linear, and Q$ = P 700, while demand curve passes through two points: (550,810) and (450, 870), where the first coordinate is quantity and the second one is price. We are going to use the equilibrium in this market to infer the interest rate and determine the prices of other assets. (a) Using the fact that the demand curve is linear and passes through two known points, find its equation, i.e., find Qd = aP +b by determining constants a and b so the equation satisfies the two points. (b) Having found the equation of the demand curve, find the equilibrium price in this market. (c) What is the implied yield to maturity on the bonds in this market? (d) Simplifying greatly, assume that the same interest rate/YTM is applicable to other assets. In particular, investors require the same yield to maturity on three-year bonds with coupon rate of 6%. In this case, what will they be willing to pay for these three-year bonds? 30. Consider the market for one-year discount bonds with standard face value of $1,000. Assume that supply and demand curves in this market are both linear, and Q$ = P 700, while demand curve passes through two points: (550,810) and (450, 870), where the first coordinate is quantity and the second one is price. We are going to use the equilibrium in this market to infer the interest rate and determine the prices of other assets. (a) Using the fact that the demand curve is linear and passes through two known points, find its equation, i.e., find Qd = aP +b by determining constants a and b so the equation satisfies the two points. (b) Having found the equation of the demand curve, find the equilibrium price in this market. (c) What is the implied yield to maturity on the bonds in this market? (d) Simplifying greatly, assume that the same interest rate/YTM is applicable to other assets. In particular, investors require the same yield to maturity on three-year bonds with coupon rate of 6%. In this case, what will they be willing to pay for these three-year bonds