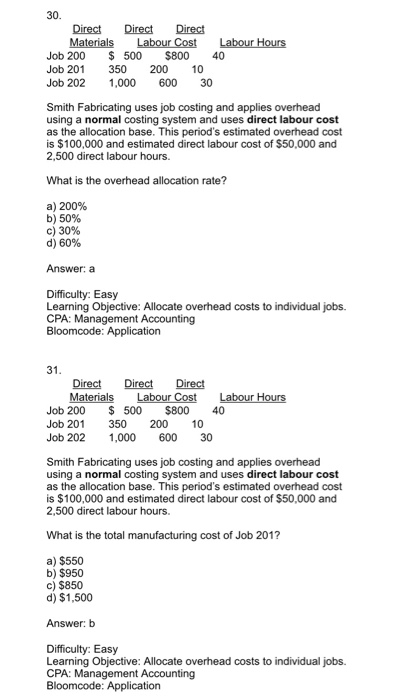

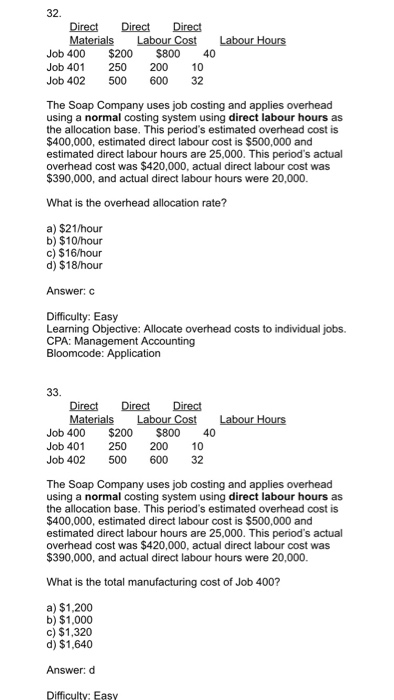

30 Direct Direct Job 200 500 $800 40 Job 201 350 200 10 Job 202 1,000 600 30 Smith Fabricating uses job costing and applies overhead using a normal costing system and uses direct labour cost as the allocation base. This period's estimated overhead cost is $100,000 and estimated direct labour cost of $50,000 and 2,500 direct labour hours. What is the overhead allocation rate? a) 200% b) 50% c) 30% d) 60% Answer: a Difficulty: Easy Learning Objective: Allocate overhead costs to individual jobs. 31 Direct Direct Direct Job 200 500 $800 40 Job 201 350 200 10 Job 202 1,000 600 30 Smih Fabricating uses job costing and applies overhead using a normal costing system and uses direct labour cost as the allocation base. This period's estimated overhead cost is $100,000 and estimated direct labour cost of $50,000 and 2,500 direct labour hours. What is the total manufacturing cost of Job 201? a) $550 b) $950 c) $850 d) $1,500 Answer: b Difficulty: Easy Learning Objective: Allocate overhead costs to individual jobs. 32. Direct Dit Direct Job 400 $200 $800 40 Job 401250 200 10 Job 402 500 600 32 The Soap Company uses job costing and applies overhead using a normal costing system using direct labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labour cost is $500,000 and estimated direct labour hours are 25,000. This period's actual overhead cost was $420,000, actual direct labour cost was $390,000, and actual direct labour hours were 20,000 What is the overhead allocation rate? a) $21/hour b) $10/hour c) $16/hour d) $18/hour Answer: c Difficulty: Easy Learning Objective: Allocate overhead costs to individual jobs. 33. Direct Direct Job 400 $200 Lan Labour Hours Job 401 250 200 10 Job 402 500 600 32 The Soap Company uses job costing and applies overhead using a normal costing system using direct labour hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labour cost is $500,000 and estimated direct labour hours are 25,000. This period's actual overhead cost was $420,000, actual direct labour cost was $390,000, and actual direct labour hours were 20,000. What is the total manufacturing cost of Job 400? a) $1,200 b) $1,000 c) $1,320 d) $1,640 Answer: d Difficulty: Easy