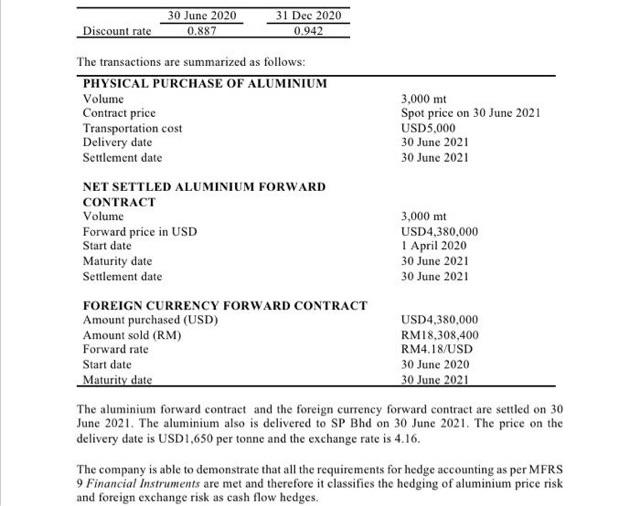

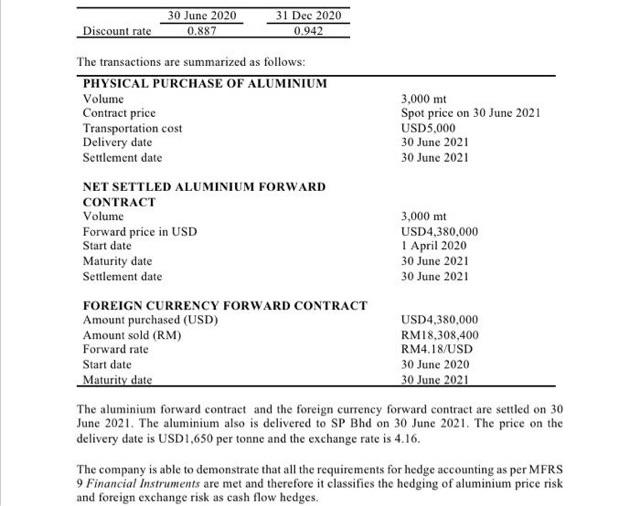

30 June 2020 31 Dec 2020 Discount rate 0.887 0.942 The transactions are summarized as follows: PHYSICAL PURCHASE OF ALUMINIUM Volume Contract price Transportation cost Delivery date Settlement date 3,000 mt Spot price on 30 June 2021 USD5,000 30 June 2021 30 June 2021 NET SETTLED ALUMINIUM FORWARD CONTRACT Volume Forward price in USD Start date Maturity date Settlement date FOREIGN CURRENCY FORWARD CONTRACT Amount purchased (USD) Amount sold (RM) Forward rate Start date Maturity date 3,000 mt USD4,380,000 1 April 2020 30 June 2021 30 June 2021 USD4,380,000 RM18.308,400 RM4,18/USD 30 June 2020 30 June 2021 The aluminium forward contract and the foreign currency forward contract are settled on 30 June 2021. The aluminium also is delivered to SP Bhd on 30 June 2021. The price on the delivery date is USD1,650 per tonne and the exchange rate is 4.16. The company is able to demonstrate that all the requirements for hedge accounting as per MFRS 9 Financial Instruments are met and therefore it classifies the hedging of aluminium price risk and foreign exchange risk as cash flow hedges. 30 June 2020 31 Dec 2020 Discount rate 0.887 0.942 The transactions are summarized as follows: PHYSICAL PURCHASE OF ALUMINIUM Volume Contract price Transportation cost Delivery date Settlement date 3,000 mt Spot price on 30 June 2021 USD5,000 30 June 2021 30 June 2021 NET SETTLED ALUMINIUM FORWARD CONTRACT Volume Forward price in USD Start date Maturity date Settlement date FOREIGN CURRENCY FORWARD CONTRACT Amount purchased (USD) Amount sold (RM) Forward rate Start date Maturity date 3,000 mt USD4,380,000 1 April 2020 30 June 2021 30 June 2021 USD4,380,000 RM18.308,400 RM4,18/USD 30 June 2020 30 June 2021 The aluminium forward contract and the foreign currency forward contract are settled on 30 June 2021. The aluminium also is delivered to SP Bhd on 30 June 2021. The price on the delivery date is USD1,650 per tonne and the exchange rate is 4.16. The company is able to demonstrate that all the requirements for hedge accounting as per MFRS 9 Financial Instruments are met and therefore it classifies the hedging of aluminium price risk and foreign exchange risk as cash flow hedges