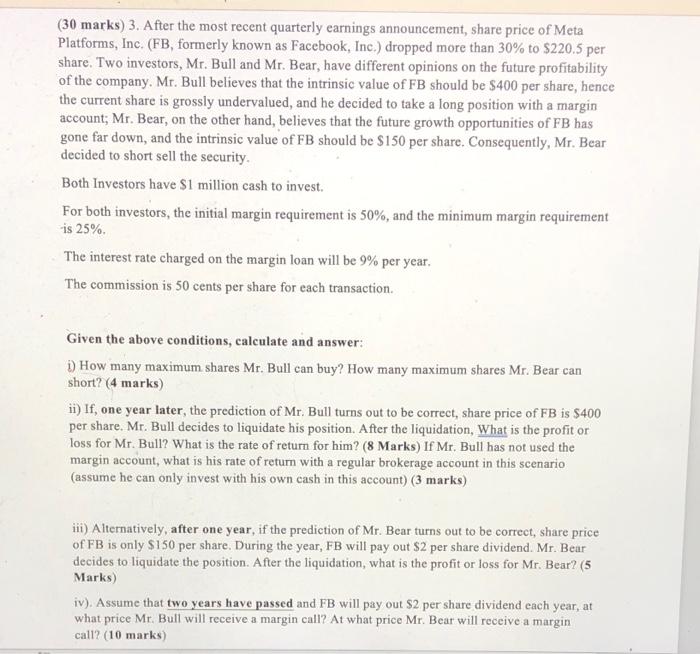

(30 marks) 3. After the most recent quarterly earnings announcement, share price of Meta Platforms, Inc. (FB, formerly known as Facebook, Inc.) dropped more than 30% to $220.5 per share. Two investors, Mr. Bull and Mr. Bear, have different opinions on the future profitability of the company. Mr. Bull believes that the intrinsic value of FB should be $400 per share, hence the current share is grossly undervalued, and he decided to take a long position with a margin account; Mr. Bear, on the other hand, believes that the future growth opportunities of FB has gone far down, and the intrinsic value of FB should be $150 per share. Consequently, Mr. Bear decided to short sell the security. Both Investors have $1 million cash to invest. For both investors, the initial margin requirement is 50%, and the minimum margin requirement is 25% The interest rate charged on the margin loan will be 9% per year. The commission is 50 cents per share for each transaction. Given the above conditions, calculate and answer: How many maximum shares Mr. Bull can buy? How many maximum shares Mr. Bear can short? (4 marks) ii) If, one year later, the prediction of Mr. Bull turns out to be correct, share price of FB is $400 per share. Mr. Bull decides to liquidate his position. After the liquidation, What is the profit or loss for Mr. Bull? What is the rate of return for him? (8 Marks) If Mr. Bull has not used the margin account, what is his rate of return with a regular brokerage account in this scenario (assume he can only invest with his own cash in this account) (3 marks) iii) Alternatively, after one year, if the prediction of Mr. Bear turns out to be correct, share price of FB is only $150 per share. During the year, FB will pay out $2 per share dividend. Mr. Bear decides to liquidate the position. After the liquidation, what is the profit or loss for Mr. Bear? (5 Marks) iv). Assume that two years have passed and FB will pay out $2 per share dividend each year, at what price Mr. Bull will receive a margin call? At what price Mr. Bear will receive a margin call? (10 marks) (30 marks) 3. After the most recent quarterly earnings announcement, share price of Meta Platforms, Inc. (FB, formerly known as Facebook, Inc.) dropped more than 30% to $220.5 per share. Two investors, Mr. Bull and Mr. Bear, have different opinions on the future profitability of the company. Mr. Bull believes that the intrinsic value of FB should be $400 per share, hence the current share is grossly undervalued, and he decided to take a long position with a margin account; Mr. Bear, on the other hand, believes that the future growth opportunities of FB has gone far down, and the intrinsic value of FB should be $150 per share. Consequently, Mr. Bear decided to short sell the security. Both Investors have $1 million cash to invest. For both investors, the initial margin requirement is 50%, and the minimum margin requirement is 25% The interest rate charged on the margin loan will be 9% per year. The commission is 50 cents per share for each transaction. Given the above conditions, calculate and answer: How many maximum shares Mr. Bull can buy? How many maximum shares Mr. Bear can short? (4 marks) ii) If, one year later, the prediction of Mr. Bull turns out to be correct, share price of FB is $400 per share. Mr. Bull decides to liquidate his position. After the liquidation, What is the profit or loss for Mr. Bull? What is the rate of return for him? (8 Marks) If Mr. Bull has not used the margin account, what is his rate of return with a regular brokerage account in this scenario (assume he can only invest with his own cash in this account) (3 marks) iii) Alternatively, after one year, if the prediction of Mr. Bear turns out to be correct, share price of FB is only $150 per share. During the year, FB will pay out $2 per share dividend. Mr. Bear decides to liquidate the position. After the liquidation, what is the profit or loss for Mr. Bear? (5 Marks) iv). Assume that two years have passed and FB will pay out $2 per share dividend each year, at what price Mr. Bull will receive a margin call? At what price Mr. Bear will receive a margin call? (10 marks)