30 min left

please solve all

i need step for 3 only rest answer only

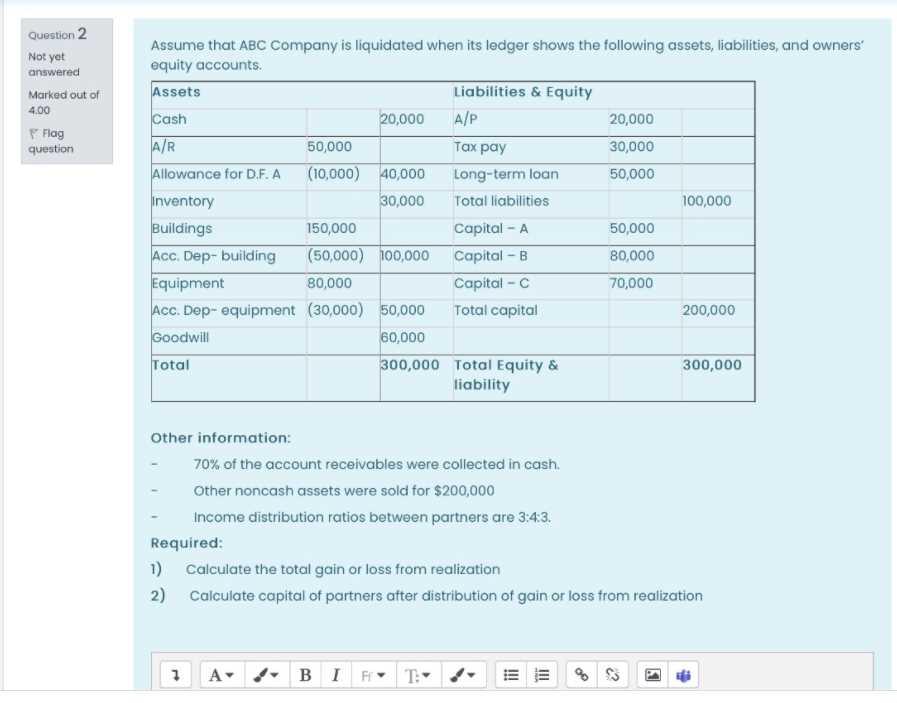

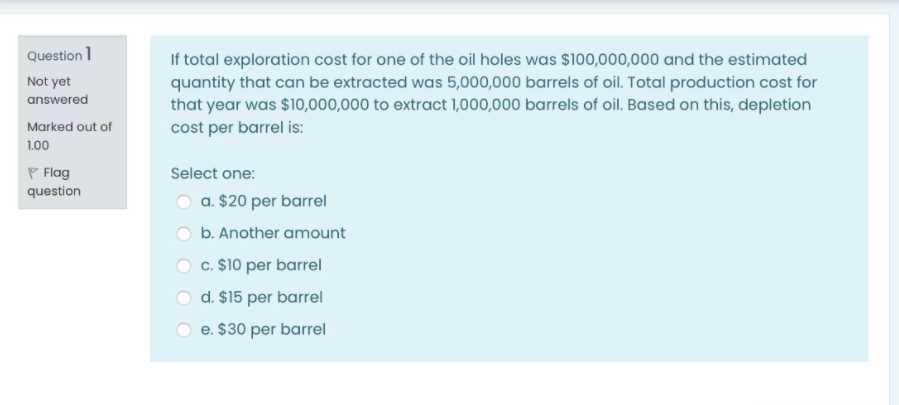

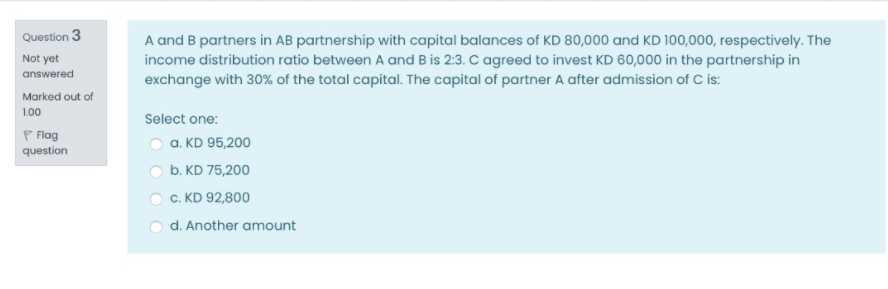

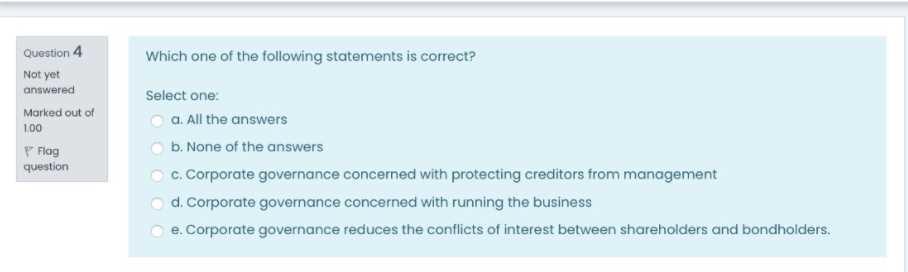

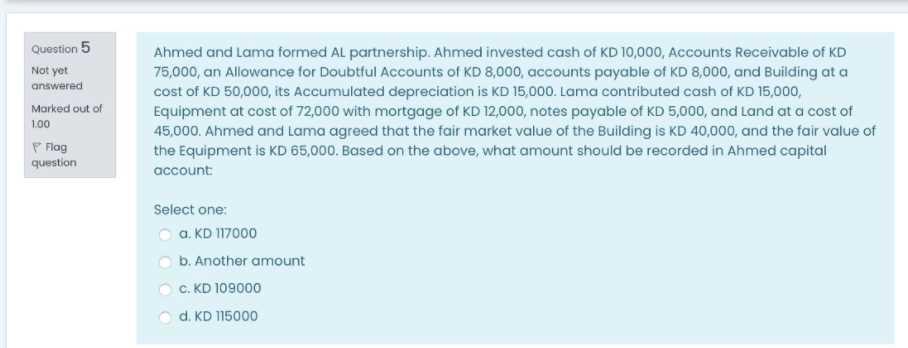

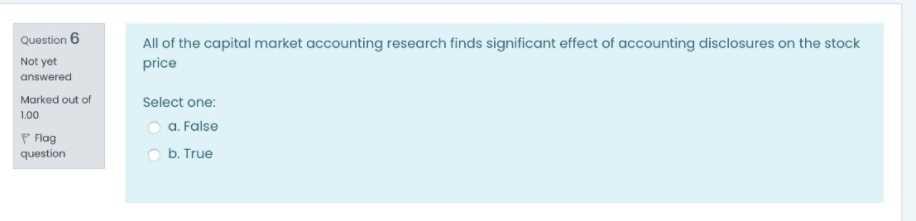

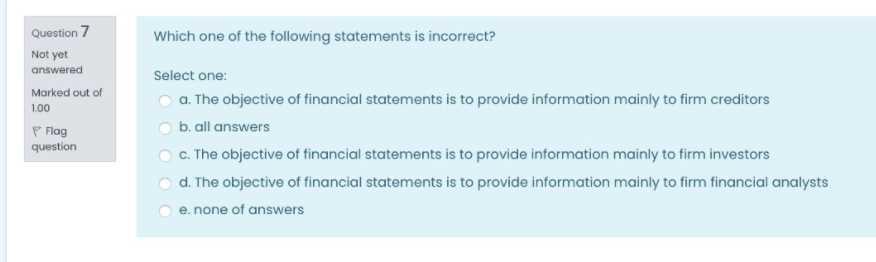

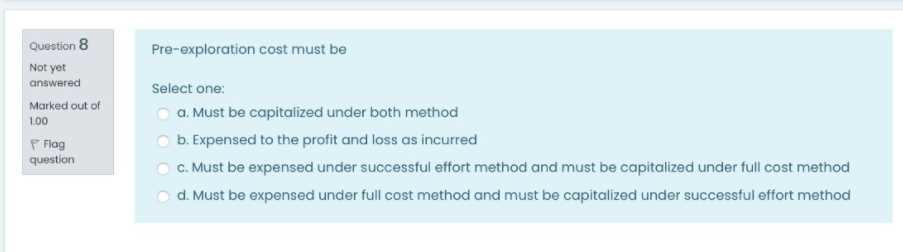

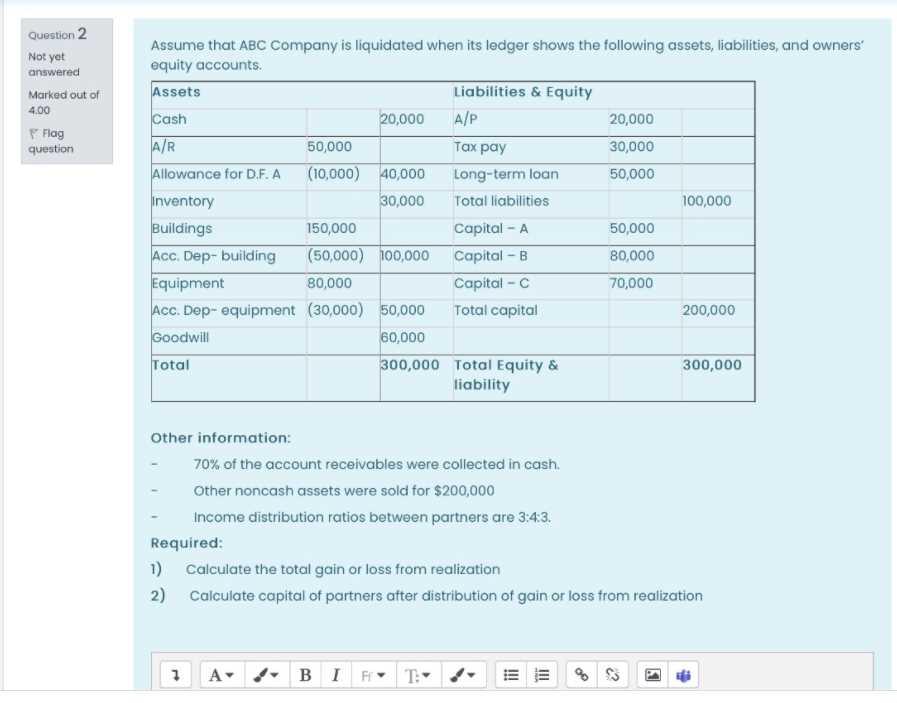

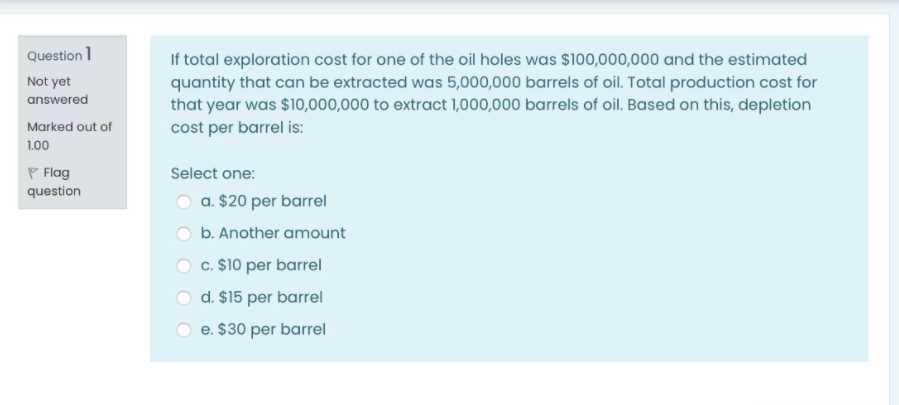

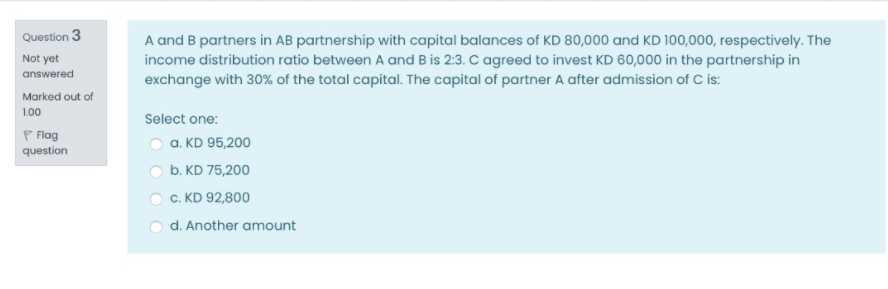

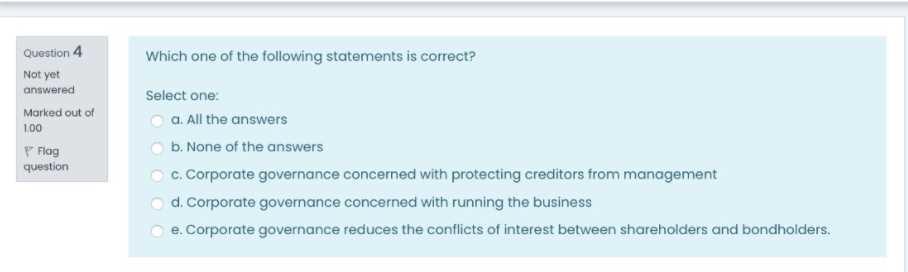

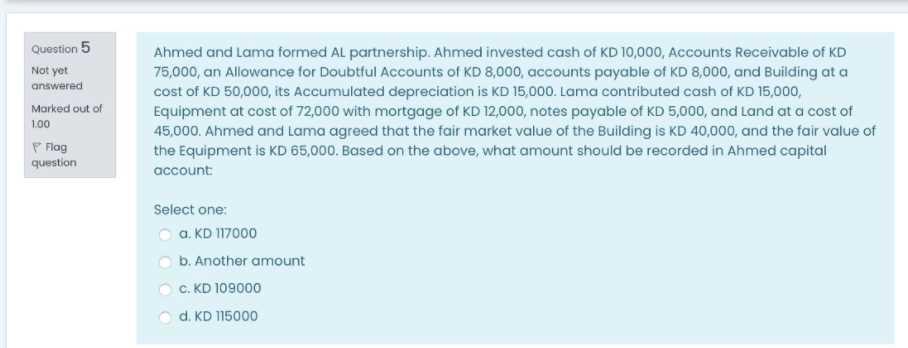

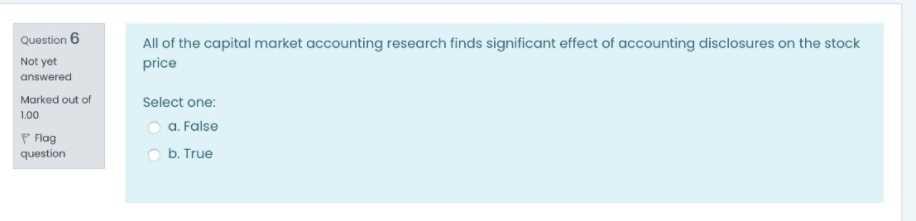

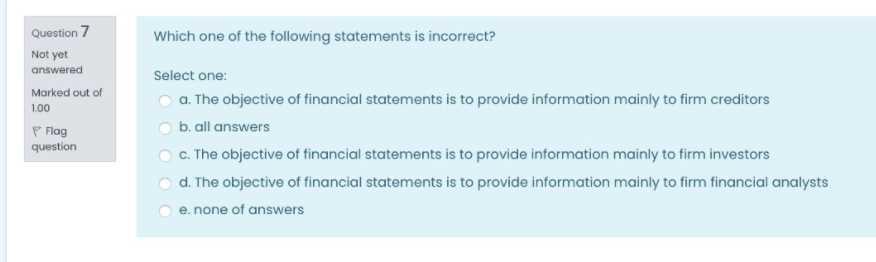

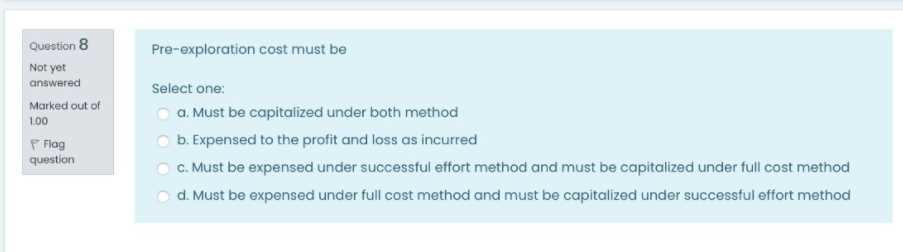

Question 2 Not yet answered Marked out of 4.00 Flag question Assume that ABC Company is liquidated when its ledger shows the following assets, liabilities, and owners equity accounts. Assets Liabilities & Equity Cash 20,000 A/P 20,000 A/R 50,000 Tax pay 30,000 Allowance for D.F. A (10,000) 40,000 Long-term loan 50,000 Inventory 30,000 Total liabilities 100,000 Buildings 150,000 Capital - A 50,000 Acc Dep-building (50,000) 100,000 Capital - B 80,000 Equipment 80,000 Capital - 70,000 Acc. Dep-equipment (30,000) 50,000 Total capital 200,000 Goodwill 60,000 Total 300,000 Total Equity & 300,000 liability Other information: 70% of the account receivables were collected in cash. Other noncash assets were sold for $200,000 Income distribution ratios between partners are 3:43. Required: 1) Calculate the total gain or loss from realization 2) Calculate capital of partners after distribution of gain or loss from realization 7 A BIR T . Question 1 Not yet answered If total exploration cost for one of the oil holes was $100,000,000 and the estimated quantity that can be extracted was 5,000,000 barrels of oil. Total production cost for that year was $10,000,000 to extract 1,000,000 barrels of oil. Based on this, depletion cost per barrel is: Marked out of 1.00 Select one: P Flag question a. $20 per barrel b. Another amount c. $10 per barrel d. $15 per barrel e $30 per barrel Question 3 Not yet answered A and B partners in AB partnership with capital balances of KD 80,000 and KD 100,000, respectively. The income distribution ratio between A and B is 2:3. C agreed to invest KD 60,000 in the partnership in exchange with 30% of the total capital. The capital of partner A after admission of Cis. Marked out of 100 Select one: Flag question a, KD 95,200 b.KD 75,200 C. KD 92,800 d. Another amount Question 4 Which one of the following statements is correct? Not yet answered Select one: Morked out of a. All the answers 100 b. None of the answers P Flag question C. Corporate governance concerned with protecting creditors from management d. Corporate governance concerned with running the business e. Corporate governance reduces the conflicts of Interest between shareholders and bondholders. Question 5 Not yet answered Morked out of 1.00 Ahmed and Lama formed AL partnership. Ahmed invested cash of KD 10,000, Accounts Receivable of KD 75,000, an Allowance for Doubtful Accounts of KD 8,000, accounts payable of KD 8,000, and Building at a cost of KD 50,000, its Accumulated depreciation is KD 15,000. Lama contributed cash of KD 15,000, Equipment at cost of 72,000 with mortgage of KD 12,000, notes payable of KD 5,000, and Land at a cost of 45,000. Ahmed and Lama agreed that the fair market value of the Building is KD 40,000, and the fair value of the Equipment is KD 65,000. Based on the above, what amount should be recorded in Ahmed capital account P Flag question Select one: a, KD 117000 b. Another amount C. KD 109000 d. KD 115000 Question 6 All of the capital market accounting research finds significant effect of accounting disclosures on the stock price Not yet answered Marked out of Select one: 1.00 a False Prag question b. True Question 7 Which one of the following statements is incorrect? Not yet answered Select one: Morked out of 1.00 a. The objective of financial statements is to provide information mainly to firm creditors b. all answers P Flag question c. The objective of financial statements is to provide information mainly to firm investors d. The objective of financial statements is to provide information mainly to firm financial analysts e none of answers Question 8 Pre-exploration cost must be Not yet answered Select one: Marked out of 100 a. Must be capitalized under both method b. Expensed to the profit and loss as incurred P Flag question C. Must be expensed under successful effort method and must be capitalized under full cost method d. Must be expensed under full cost method and must be capitalized under successful effort method