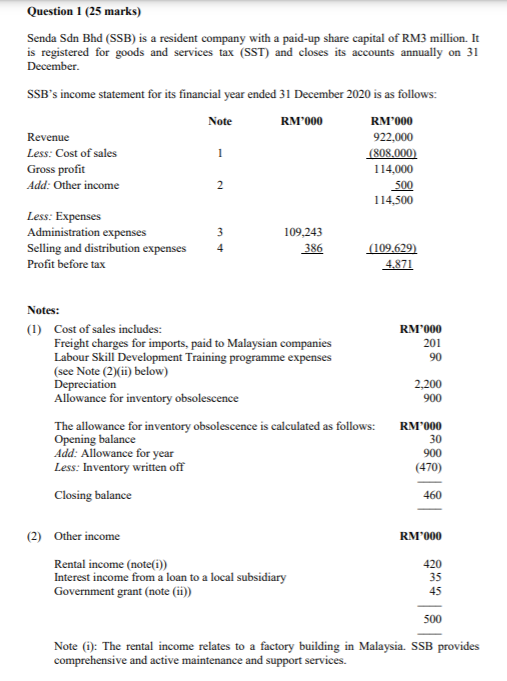

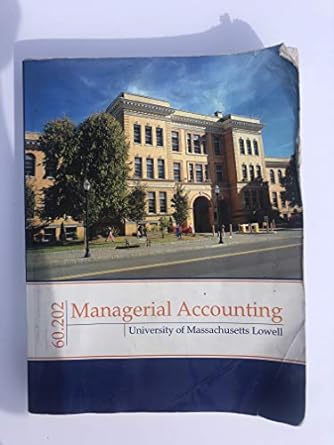

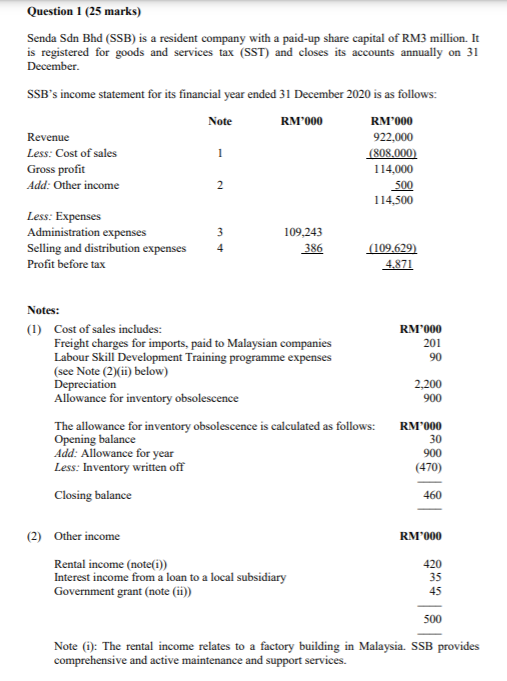

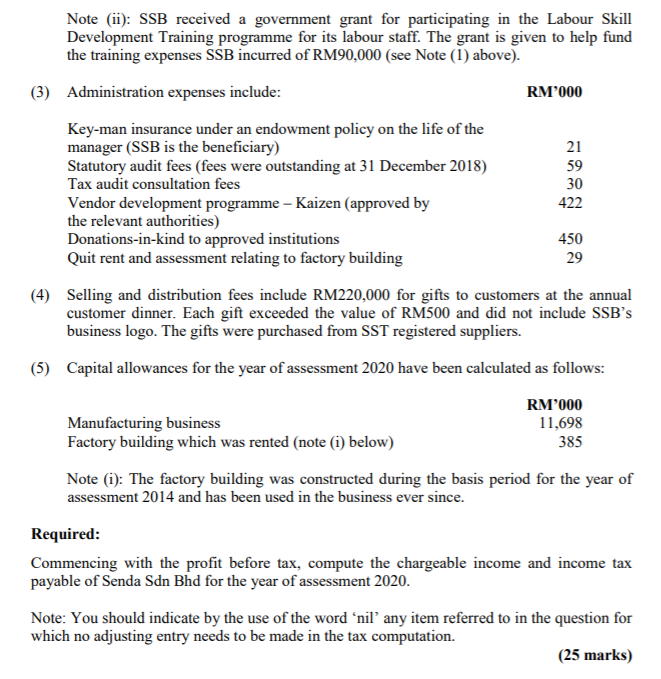

30 Note (ii): SSB received a government grant for participating in the Labour Skill Development Training programme for its labour staff. The grant is given to help fund the training expenses SSB incurred of RM90,000 (see Note (1) above). (3) Administration expenses include: RM'000 Key-man insurance under an endowment policy on the life of the manager (SSB is the beneficiary) 21 Statutory audit fees (fees were outstanding at 31 December 2018) 59 Tax audit consultation fees Vendor development programme - Kaizen (approved by 422 the relevant authorities) Donations-in-kind to approved institutions 450 Quit rent and assessment relating to factory building 29 (4) Selling and distribution fees include RM220,000 for gifts to customers at the annual customer dinner. Each gift exceeded the value of RM500 and did not include SSB's business logo. The gifts were purchased from SST registered suppliers. (5) Capital allowances for the year of assessment 2020 have been calculated as follows: Manufacturing business Factory building which was rented (note (1) below) RM'000 11,698 385 Note (i): The factory building was constructed during the basis period for the year of assessment 2014 and has been used in the business ever since. Required: Commencing with the profit before tax, compute the chargeable income and income tax payable of Senda Sdn Bhd for the year of assessment 2020. Note: You should indicate by the use of the word 'nil' any item referred to in the question for which no adjusting entry needs to be made in the tax computation. (25 marks) 30 Note (ii): SSB received a government grant for participating in the Labour Skill Development Training programme for its labour staff. The grant is given to help fund the training expenses SSB incurred of RM90,000 (see Note (1) above). (3) Administration expenses include: RM'000 Key-man insurance under an endowment policy on the life of the manager (SSB is the beneficiary) 21 Statutory audit fees (fees were outstanding at 31 December 2018) 59 Tax audit consultation fees Vendor development programme - Kaizen (approved by 422 the relevant authorities) Donations-in-kind to approved institutions 450 Quit rent and assessment relating to factory building 29 (4) Selling and distribution fees include RM220,000 for gifts to customers at the annual customer dinner. Each gift exceeded the value of RM500 and did not include SSB's business logo. The gifts were purchased from SST registered suppliers. (5) Capital allowances for the year of assessment 2020 have been calculated as follows: Manufacturing business Factory building which was rented (note (1) below) RM'000 11,698 385 Note (i): The factory building was constructed during the basis period for the year of assessment 2014 and has been used in the business ever since. Required: Commencing with the profit before tax, compute the chargeable income and income tax payable of Senda Sdn Bhd for the year of assessment 2020. Note: You should indicate by the use of the word 'nil' any item referred to in the question for which no adjusting entry needs to be made in the tax computation. (25 marks)