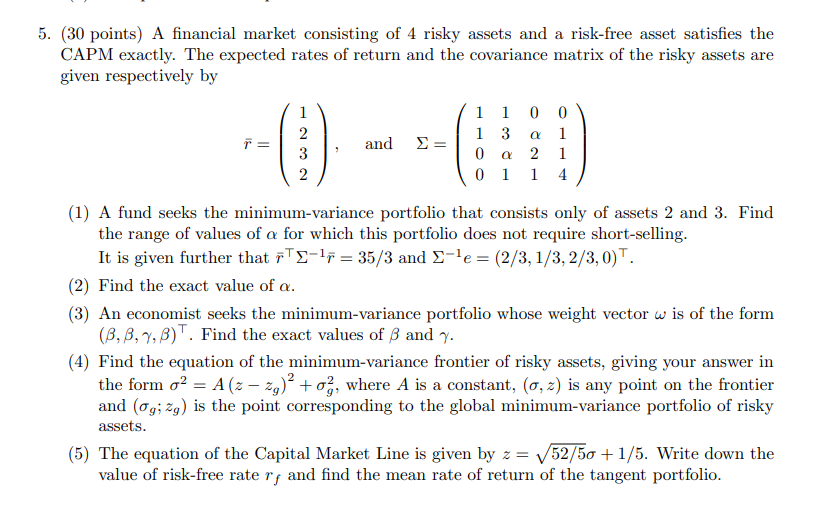

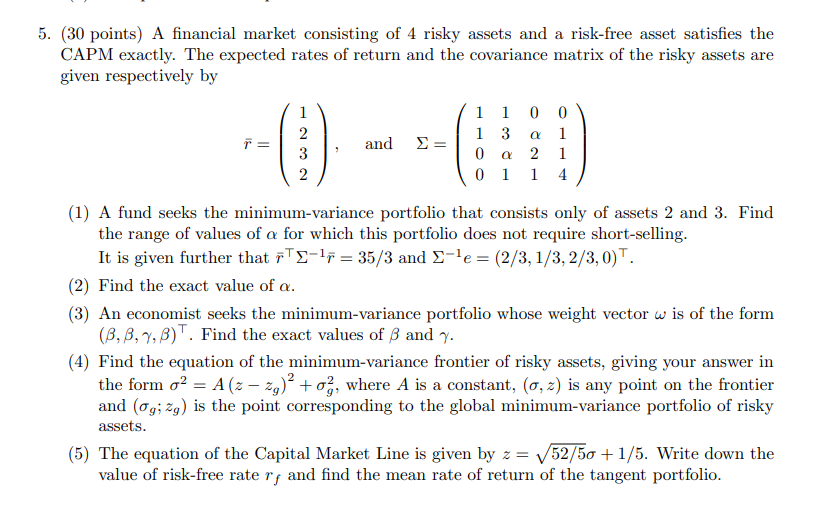

(30 points) A financial market consisting of 4 risky assets and a risk-free asset satisfies the CAPM exactly. The expected rates of return and the covariance matrix of the risky assets are given respectively by r=1232,and=11001310210114 (1) A fund seeks the minimum-variance portfolio that consists only of assets 2 and 3 . Find the range of values of for which this portfolio does not require short-selling. It is given further that r1r=35/3 and 1e=(2/3,1/3,2/3,0). (2) Find the exact value of . (3) An economist seeks the minimum-variance portfolio whose weight vector is of the form (,,,). Find the exact values of and . (4) Find the equation of the minimum-variance frontier of risky assets, giving your answer in the form 2=A(zzg)2+g2, where A is a constant, (,z) is any point on the frontier and (g;zg) is the point corresponding to the global minimum-variance portfolio of risky assets. (5) The equation of the Capital Market Line is given by z=52/5+1/5. Write down the value of risk-free rate rf and find the mean rate of return of the tangent portfolio. (30 points) A financial market consisting of 4 risky assets and a risk-free asset satisfies the CAPM exactly. The expected rates of return and the covariance matrix of the risky assets are given respectively by r=1232,and=11001310210114 (1) A fund seeks the minimum-variance portfolio that consists only of assets 2 and 3 . Find the range of values of for which this portfolio does not require short-selling. It is given further that r1r=35/3 and 1e=(2/3,1/3,2/3,0). (2) Find the exact value of . (3) An economist seeks the minimum-variance portfolio whose weight vector is of the form (,,,). Find the exact values of and . (4) Find the equation of the minimum-variance frontier of risky assets, giving your answer in the form 2=A(zzg)2+g2, where A is a constant, (,z) is any point on the frontier and (g;zg) is the point corresponding to the global minimum-variance portfolio of risky assets. (5) The equation of the Capital Market Line is given by z=52/5+1/5. Write down the value of risk-free rate rf and find the mean rate of return of the tangent portfolio