Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(30 Points) Buffett's Alpha: Go to Moodle and download and read the paper Buffet's Alpha by Frazzini, Kabiller, and Ped- ersen. (hint: the following questions

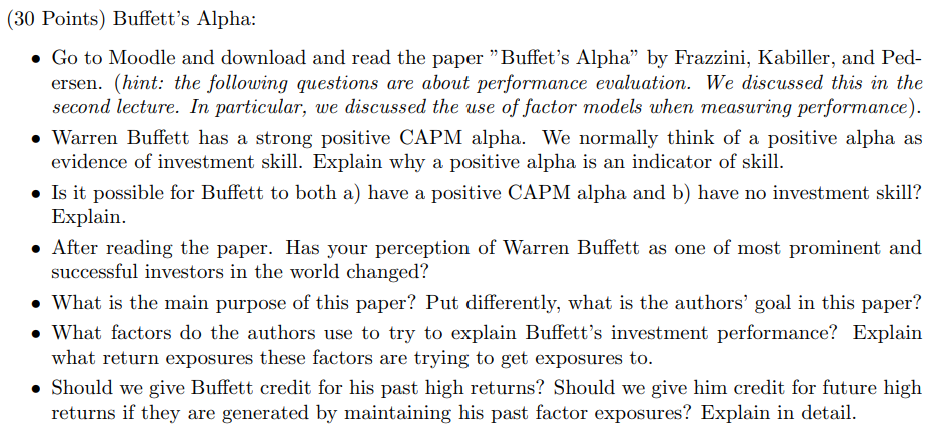

(30 Points) Buffett's Alpha: Go to Moodle and download and read the paper "Buffet's Alpha" by Frazzini, Kabiller, and Ped- ersen. (hint: the following questions are about performance evaluation. We discussed this in the second lecture. In particular, we discussed the use of factor models when measuring performance). Warren Buffett has a strong positive CAPM alpha. We normally think of a positive alpha as evidence of investment skill. Explain why a positive alpha is an indicator of skill. Is it possible for Buffett to both a) have a positive CAPM alpha and b) have no investment skill? Explain. After reading the paper. Has your perception of Warren Buffett as one of most prominent and successful investors in the world changed? What is the main purpose of this paper? Put differently, what is the authors' goal in this paper? What factors do the authors use to try to explain Buffett's investment performance? Explain what return exposures these factors are trying to get exposures to. Should we give Buffett credit for his past high returns? Should we give him credit for future high returns if they are generated by maintaining his past factor exposures? Explain in detail. (30 Points) Buffett's Alpha: Go to Moodle and download and read the paper "Buffet's Alpha" by Frazzini, Kabiller, and Ped- ersen. (hint: the following questions are about performance evaluation. We discussed this in the second lecture. In particular, we discussed the use of factor models when measuring performance). Warren Buffett has a strong positive CAPM alpha. We normally think of a positive alpha as evidence of investment skill. Explain why a positive alpha is an indicator of skill. Is it possible for Buffett to both a) have a positive CAPM alpha and b) have no investment skill? Explain. After reading the paper. Has your perception of Warren Buffett as one of most prominent and successful investors in the world changed? What is the main purpose of this paper? Put differently, what is the authors' goal in this paper? What factors do the authors use to try to explain Buffett's investment performance? Explain what return exposures these factors are trying to get exposures to. Should we give Buffett credit for his past high returns? Should we give him credit for future high returns if they are generated by maintaining his past factor exposures? Explain in detail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started