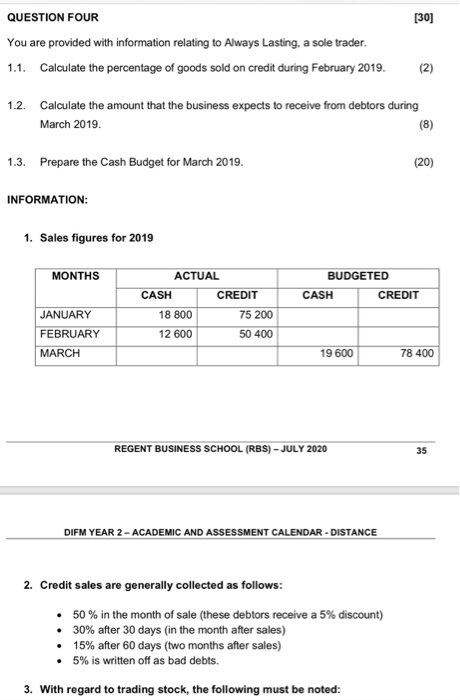

[30] QUESTION FOUR You are provided with information relating to Always Lasting, a sole trader. 1.1. Calculate the percentage of goods sold on credit during February 2019. 1.2. Calculate the amount that the business expects to receive from debtors during March 2019. (8) 1.3. Prepare the Cash Budget for March 2019. (20) INFORMATION: 1. Sales figures for 2019 MONTHS BUDGETED CASH CREDIT ACTUAL CASH CREDIT 18 800 75 200 12 600 50 400 JANUARY FEBRUARY MARCH 19 600 78 400 REGENT BUSINESS SCHOOL (RBS) - JULY 2020 35 DIFM YEAR 2 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE 2. Credit sales are generally collected as follows: 50 % in the month of sale (these debtors receive a 5% discount) 30% after 30 days (in the month after sales) 15% after 60 days (two months after sales) 5% is written off as bad debts. 3. With regard to trading stock, the following must be noted: The business maintains a mark-up percentage of 40% on sales and a fixed base stock level. (stock sold in a month is replaced in that month) All purchases of stock are made on credit Creditors are paid in the month after the purchase of the stock. 4. Interest on fixed deposit amounts to R4 800 per year. This is received in two equal instalments on 1 March 2019 and 1 September 2019 5. Operating expenses amount to R18 000 per month and is paid by cheque. 6. Salaries is R24 000 per month. During March 2019, the four shop assistants will also receive their production bonuses of 80% of their monthly salary. 7. The total rent income for the previous financial year was R36 000. The rent is expected to increase by 15% on 1 March 2019 8. The owner agreed that his drawings per month should exceed R2 000. This must comprise R1 500 cash and R500 worth of trading stock. 9. Renovations to the office and reception area were done during December 2018. New office equipment including computers were purchased on 1 January 2019 for R96 000. These are being paid off in 12 equal monthly instalments. Depreciation on equipment amounts to R7 800 (including the new equipment). 10. Bank charges average R500 per month. 11. R2 000 per month is allocated for maintenance of buildings. 12. Mr. Always decided that, during March 2019, he will increase his capital contribution by R40 000 cash and by R17 000 worth of equipment. 13. The bank balance reflected an overdraft of R6 000 on 28 February 2019 REGENT BUSINESS SCHOOL (RBS) - JULY 2020 36 DIFM YEAR 2 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE 14. The bookkeeper supplied the following actual amounts for February 2019 1 000 Rent income Drawings Bank charges Maintenance of buildings 3210 525 3780