Answered step by step

Verified Expert Solution

Question

1 Approved Answer

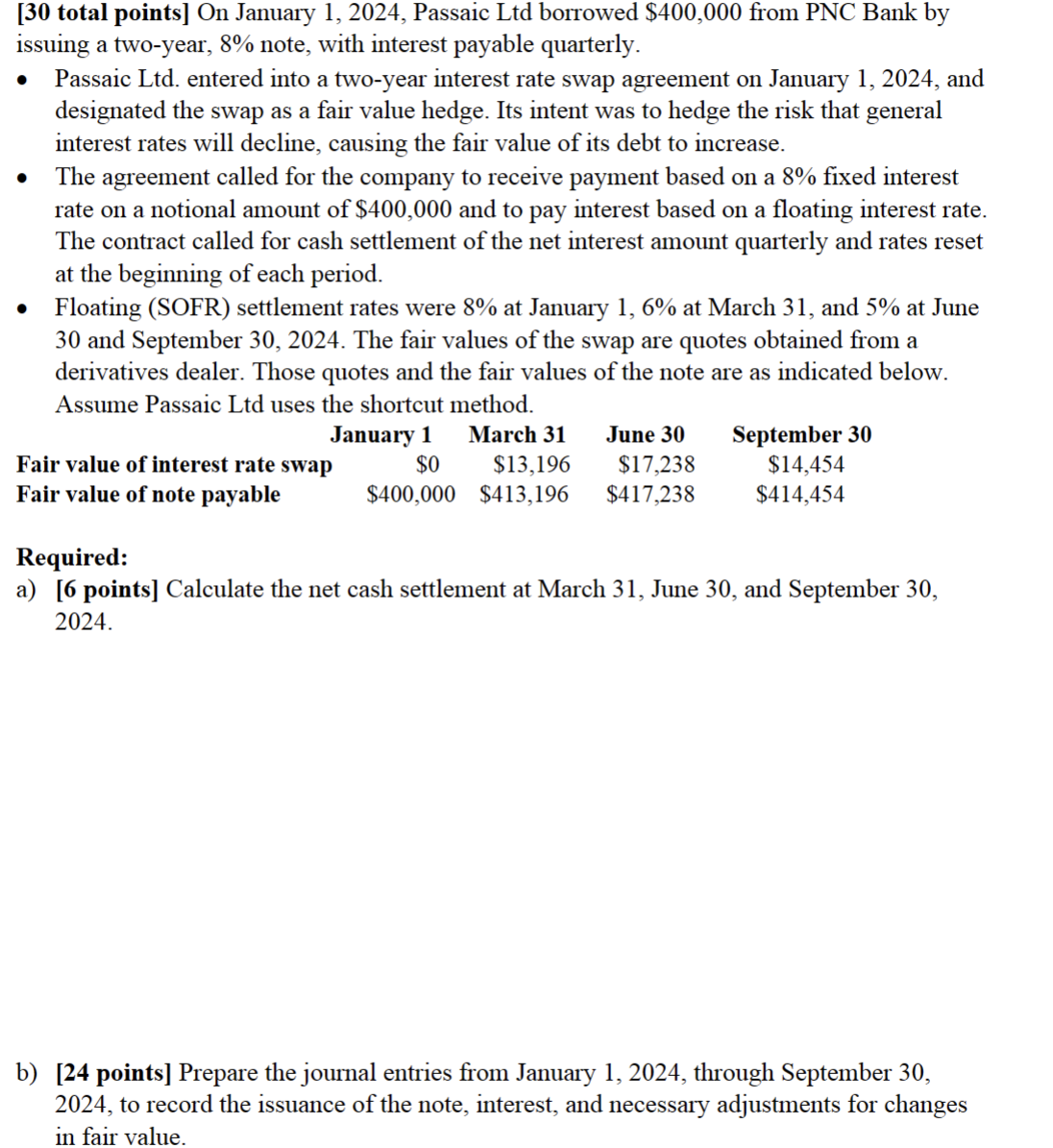

[30 total points] On January 1, 2024, Passaic Ltd borrowed $400,000 from PNC Bank by issuing a two-year, 8% note, with interest payable quarterly. -

[30 total points] On January 1, 2024, Passaic Ltd borrowed $400,000 from PNC Bank by issuing a two-year, 8% note, with interest payable quarterly. - Passaic Ltd. entered into a two-year interest rate swap agreement on January 1,2024, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. - The agreement called for the company to receive payment based on a 8% fixed interest rate on a notional amount of $400,000 and to pay interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly and rates reset at the beginning of each period. - Floating (SOFR) settlement rates were 8% at January 1,6% at March 31 , and 5% at June 30 and September 30,2024. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as indicated below. Assume Passaic Ltd uses the shortcut method. Required: a) [6 points] Calculate the net cash settlement at March 31, June 30, and September 30, 2024. b) [24 points] Prepare the journal entries from January 1, 2024, through September 30, 2024 , to record the issuance of the note, interest, and necessary adjustments for changes in fair value

[30 total points] On January 1, 2024, Passaic Ltd borrowed $400,000 from PNC Bank by issuing a two-year, 8% note, with interest payable quarterly. - Passaic Ltd. entered into a two-year interest rate swap agreement on January 1,2024, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. - The agreement called for the company to receive payment based on a 8% fixed interest rate on a notional amount of $400,000 and to pay interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly and rates reset at the beginning of each period. - Floating (SOFR) settlement rates were 8% at January 1,6% at March 31 , and 5% at June 30 and September 30,2024. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as indicated below. Assume Passaic Ltd uses the shortcut method. Required: a) [6 points] Calculate the net cash settlement at March 31, June 30, and September 30, 2024. b) [24 points] Prepare the journal entries from January 1, 2024, through September 30, 2024 , to record the issuance of the note, interest, and necessary adjustments for changes in fair value Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started