Answered step by step

Verified Expert Solution

Question

1 Approved Answer

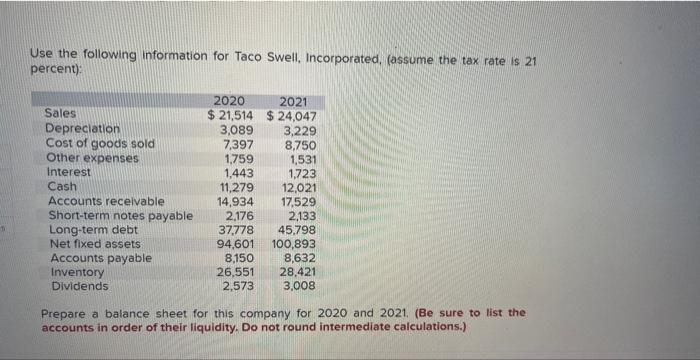

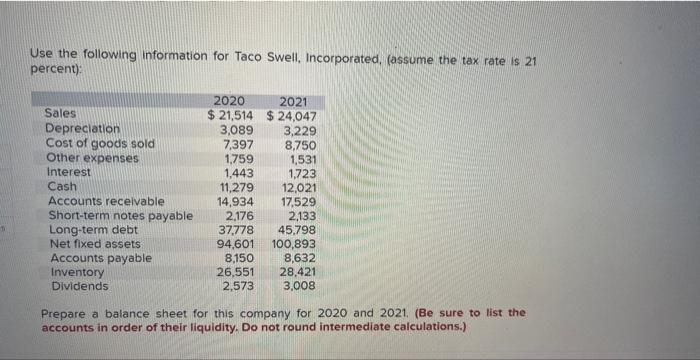

30 Use the following information for Taco Swell, Incorporated, (assume the tax rate is 21 percent): Prepare a balance sheet for this company for 2020

30

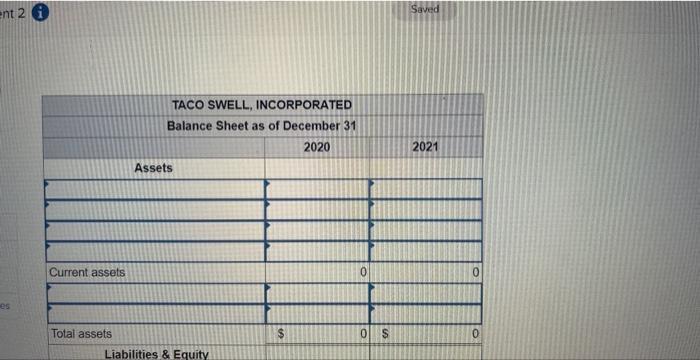

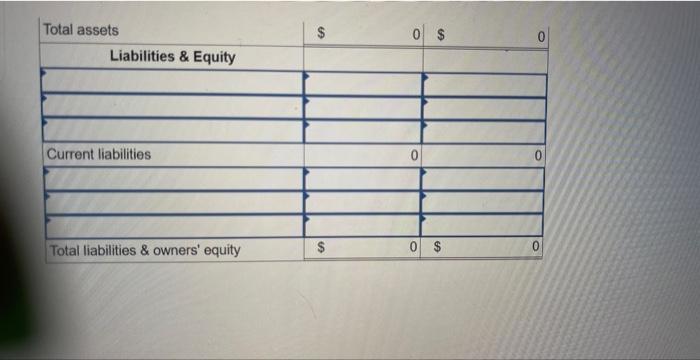

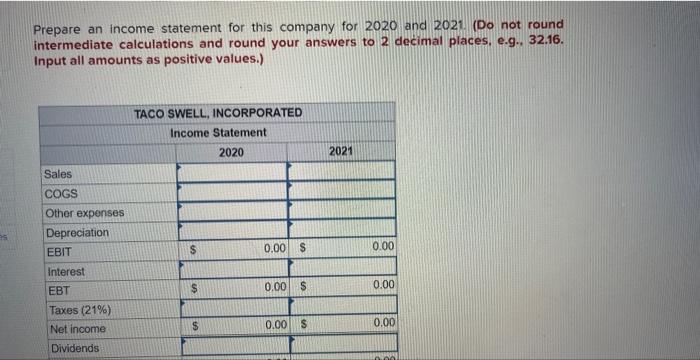

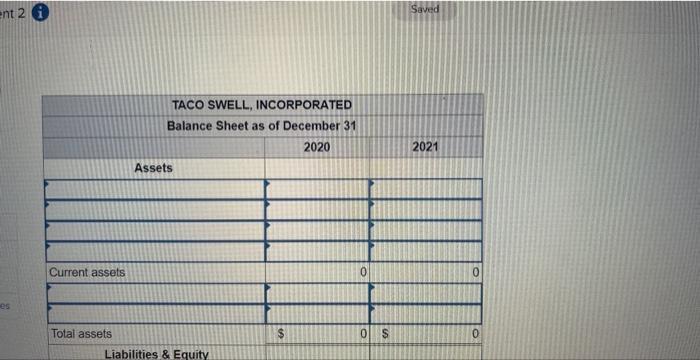

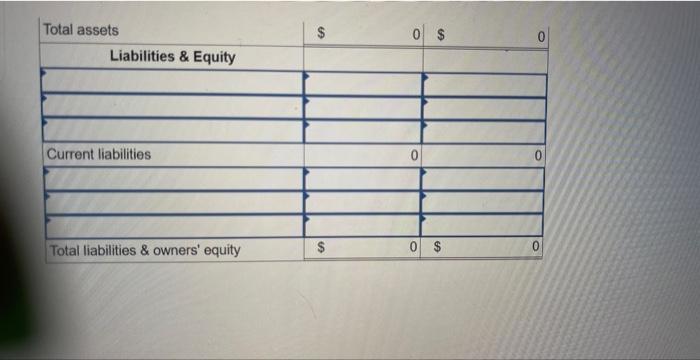

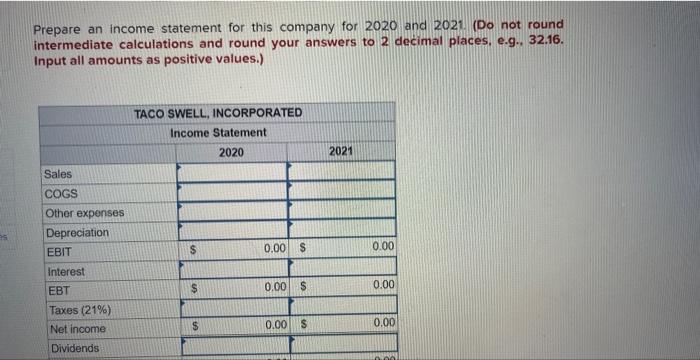

Use the following information for Taco Swell, Incorporated, (assume the tax rate is 21 percent): Prepare a balance sheet for this company for 2020 and 2021. (Be sure to list the accounts in order of their liquidity. Do not round intermediate calculations.) Prepare an income statement for this company for 2020 and 2021 . (Do not round intermediate calculations and round your answers to 2 decimal places, e.g.. 32.16. Input all amounts as positive values.) Additions to RE \begin{tabular}{|l|l|} \hline 0.00 & 0.00 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started