Answered step by step

Verified Expert Solution

Question

1 Approved Answer

30. Which of the following is not properly classified as property, plant, and equipment? a. Building used as a factory. b. Land used in

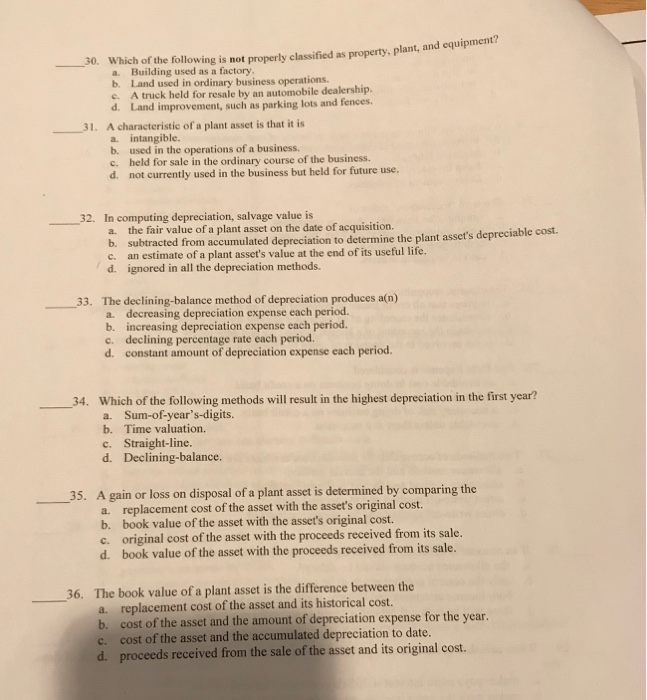

30. Which of the following is not properly classified as property, plant, and equipment? a. Building used as a factory. b. Land used in ordinary business operations. c. A truck held for resale by an automobile dealership. d. Land improvement, such as parking lots and fences. 31. A characteristic of a plant asset is that it is a. intangible. b. used in the operations of a business. c. held for sale in the ordinary course of the business. d. not currently used in the business but held for future use, 32. In computing depreciation, salvage value is a. the fair value of a plant asset on the date of acquisition. b. subtracted from accumulated depreciation to determine the plant asset's depreciable cost. c. an estimate of a plant asset's value at the end of its useful life. d. ignored in all the depreciation methods. 33. The declining-balance method of depreciation produces a(n) a. decreasing depreciation expense each period. b. increasing depreciation expense each period. c. declining percentage rate each period. d. constant amount of depreciation expense each period. 34. Which of the following methods will result in the highest depreciation in the first year? a. Sum-of-year's-digits. b. Time valuation. c. Straight-line. d. Declining-balance. 35. A gain or loss on disposal of a plant asset is determined by comparing the a. replacement cost of the asset with the asset's original cost. b. book value of the asset with the asset's original cost. c. original cost of the asset with the proceeds received from its sale. d. book value of the asset with the proceeds received from its sale. 36. The book value of a plant asset is the difference between the a. replacement cost of the asset and its historical cost. b. cost of the asset and the amount of depreciation expense for the year. c. cost of the asset and the accumulated depreciation to date. d. proceeds received from the sale of the asset and its original cost.

Step by Step Solution

★★★★★

3.57 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

30 Answer c A truck held for resale by an automobile dealership Explanation A truck held for resale ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started