Answered step by step

Verified Expert Solution

Question

1 Approved Answer

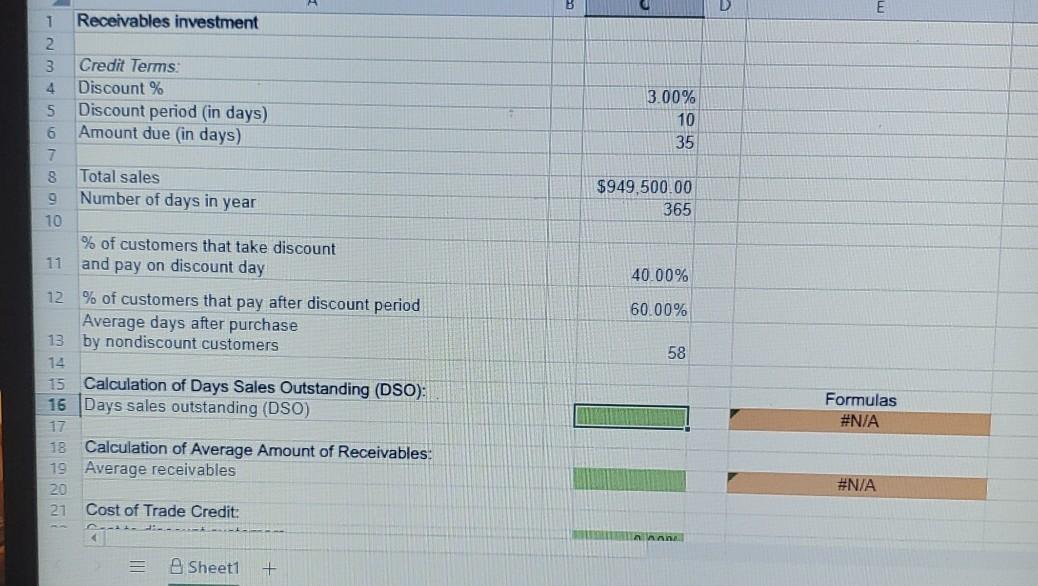

3.00% 10 35 $949,500.00 365 1 Receivables investment 2 3 Credit Terms. 4 Discount % S Discount period (in days) 6 Amount due (in days)

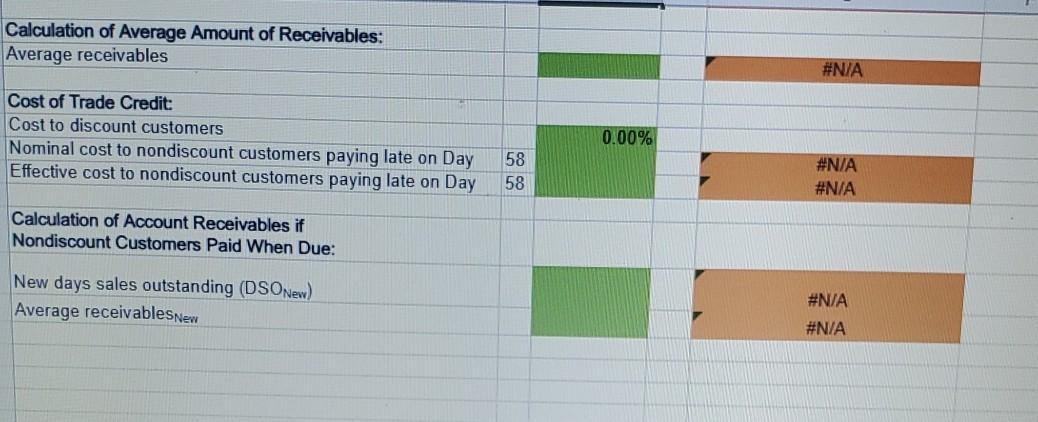

3.00% 10 35 $949,500.00 365 1 Receivables investment 2 3 Credit Terms. 4 Discount % S Discount period (in days) 6 Amount due (in days) 7 8 Total sales 9 Number of days in year 10 % of customers that take discount 11 and pay on discount day 12% of customers that pay after discount period Average days after purchase 13 by nondiscount customers 14 15 Calculation of Days Sales Outstanding (DSO): 16 Days sales outstanding (DSO) 17 18 Calculation of Average Amount of Receivables: 19 Average receivables 20 21 Cost of Trade Credit: 40.00% 60.00% 58 Formulas #N/A #N/A nana A Sheet1 + Calculation of Average Amount of Receivables: Average receivables #N/A Cost of Trade Credit: Cost to discount customers Nominal cost to nondiscount customers paying late on Day Effective cost to nondiscount customers paying late on Day 0.00% 58 58 #N/A #N/A Calculation of Account Receivables if Nondiscount Customers Paid When Due: New days sales outstanding (DSONew) Average receivablesNew #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started