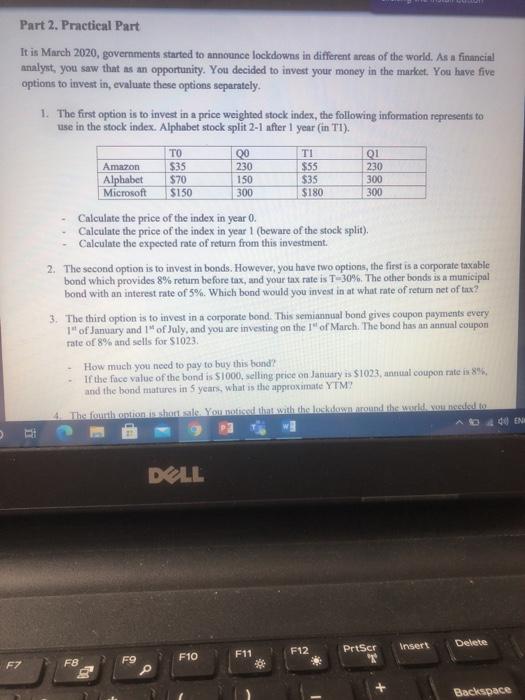

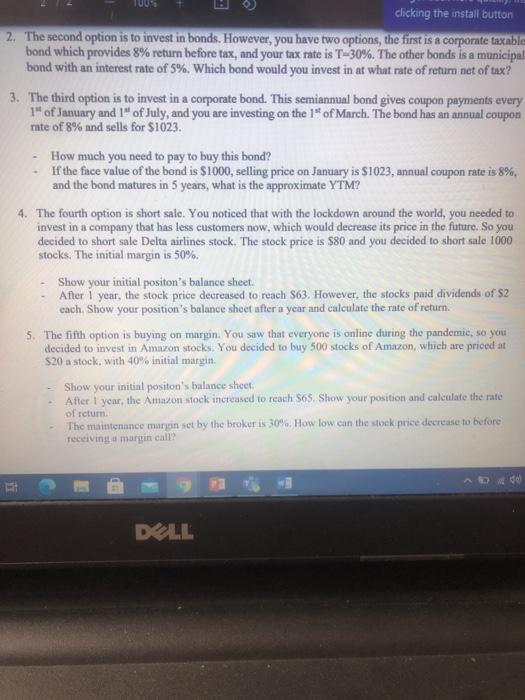

300 Part 2. Practical Part It is March 2020, governments started to announce lockdowns in different areas of the world. As a financial analyst, you saw that is an opportunity. You decided to invest your money in the market. You have five options to invest in, evalute these options separately. 1. The first option is to invest in a price weighted stock index, the following information represents to use in the stock index. Alphabet stock split 2-1 after 1 year (in TI). 00 TI 01 Amazon $35 230 $55 230 Alphabet $70 150 $35 300 Microsoft $150 300 $180 Calculate the price of the index in year 0 Calculate the price of the index in year 1 (beware of the stock split), - Calculate the expected rate of return from this investment 2. The second option is to invest in bonds. However, you have two options, the first is a corporate taxable bond which provides 8% return before tax, and your tax rate is T-30%. The other bonds is a municipal bond with an interest rate of 5%. Which bond would you invest in at what rate of return net of tax? 3. The third option is to invest in a corporate bond. This semiannual bond gives coupon payments every 1" of January and Iof July, and you are investing on the l" of March. The bond has an annual coupon rate of 8% and sells for $1023. How much you need to pay to buy this bond? If the face value of the bond is 1000, selling price on January is $1023, annual coupon rate is 896, and the bond matures in 5 years, what is the approximate YTM? Thanhtonishes You all with the laskesmand the needle 0400 EN DELL Delete F12 Priser Insert F11 F10 F9 FZ F8 Backspace clicking the install button 2. The second option is to invest in bonds. However, you have two options, the first is a corporate taxable bond which provides 8% return before tax, and your tax rate is T-30%. The other bonds is a municipal bond with an interest rate of 5%. Which bond would you invest in at what rate of return net of tax? 3. The third option is to invest in a corporate bond. This semiannual bond gives coupon payments every 1" of January and 1 of July, and you are investing on the 1" of March. The bond has an annual coupon rate of 8% and sells for $1023. - How much you need to pay to buy this bond? - If the face value of the bond is $1000, selling price on January is $1023, annual coupon rate is 8%, and the bond matures in 5 years, what is the approximate YTM? 4. The fourth option is short sale. You noticed that with the lockdown around the world, you needed to invest in a company that has less customers now, which would decrease its price in the future. So you decided to short sale Delta airlines stock. The stock price is $80 and you decided to short sale 1000 stocks. The initial margin is 50%. Show your initial positon's balance sheet. After 1 year, the stock price decreased to reach S63. However, the stocks paid dividends of S2 cach. Show your position's balance sheet after a year and calculate the rate of return. 5. The fifth option is buying on margin. You saw that everyone is online during the pandemic, so you decided to invest in Amazon stocks. You decided to buy 500 stocks of Amazon, which are priced at $20 a stock. with 40% initial margin - Show your initial positon's balance sheet After 1 year, the Amazon stock increased to reach S65. Show your position and calculate the rate of retum The maintenance margin set by the broker is 30%. How low can the stock price decrease to before Teceiving a margin call? DALL