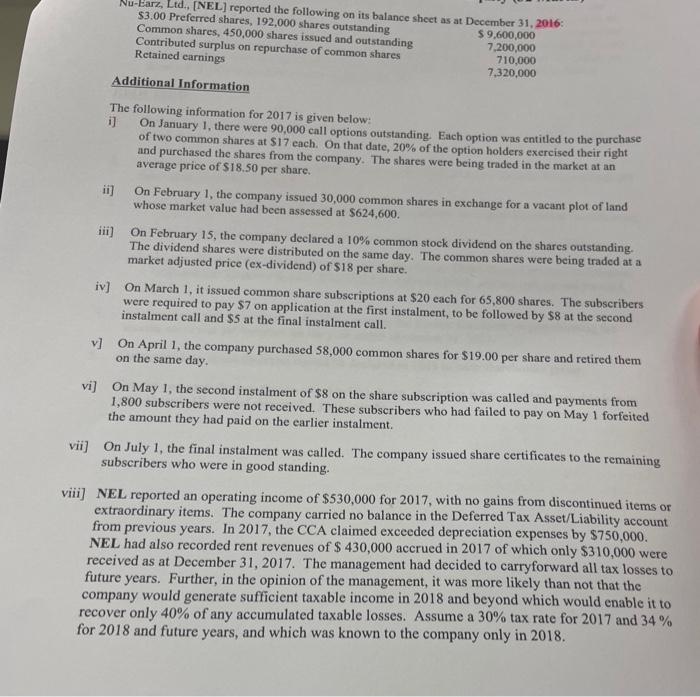

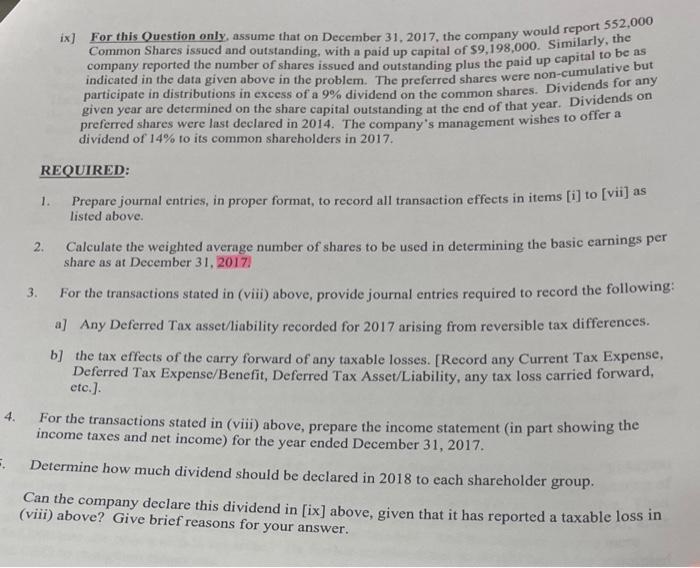

\\$3,00 Pref [ [ reported the following on its balance sheet as at December 31, 2016: Commonerred shares, 192,000 shares outstanding Contributed 450,000 shares issued and outstanding Retained earnings \\( \\$ 9,600,000 \\) \\( 7,200,000 \\) 710,000 \\( 7,320,000 \\) Additional Information The following information for 2017 is given below: i) On January 1, there were 90,000 call options outstanding. Each option was entitled to the purchase of two common shares at \\( \\$ 17 \\) each. On that date, \20 of the option holders exercised their right and purchased the shares from the company. The shares were being traded in the market at an average price of \\( \\$ 18.50 \\) per share. ii) On February 1, the company issued 30,000 common shares in exchange for a vacant plot of land whose market value had been assessed at \\( \\$ 624,600 \\). iii) On February 15, the company declared a \10 common stock dividend on the shares outstanding. The dividend shares were distributed on the same day. The common shares were being traded at a market adjusted price (ex-dividend) of \\( \\$ 18 \\) per share. iv] On March 1, it issued common share subscriptions at \\( \\$ 20 \\) each for 65,800 shares. The subscribers were required to pay \\( \\$ 7 \\) on application at the first instalment, to be followed by \\( \\$ 8 \\) at the second instalment call and \\( \\$ 5 \\) at the final instalment call. v] On April 1, the company purchased \\( \\$ 8,000 \\) common shares for \\( \\$ 19.00 \\) per share and retired them on the same day. vi] On May 1, the second instalment of \\( \\$ 8 \\) on the share subscription was called and payments from 1,800 subscribers were not received. These subscribers who had failed to pay on May 1 forfeited the amount they had paid on the earlier instalment. vii] On July 1, the final instalment was called. The company issued share certificates to the remaining subscribers who were in good standing. viii] NEL reported an operating income of \\( \\$ 530,000 \\) for 2017 , with no gains from discontinued items or extraordinary items. The company carried no balance in the Deferred Tax Asset/Liability account from previous years. In 2017, the CCA claimed exceeded depreciation expenses by \\( \\$ 750,000 \\). NEL had also recorded rent revenues of \\( \\$ 430,000 \\) accrued in 2017 of which only \\( \\$ 310,000 \\) were received as at December 31,2017 . The management had decided to carryforward all tax losses to future years. Further, in the opinion of the management, it was more likely than not that the company would generate sufficient taxable income in 2018 and beyond which would enable it to recover only \40 of any accumulated taxable losses. Assume a 30\\% tax rate for 2017 and \34 for 2018 and future years, and which was known to the company only in 2018. ix] For this Question only, assume that on December 31, 2017, the company would report 552,000 Common Shares issued and outstanding, with a paid up capital of \\( \\$ 9,198,000 \\). Similarly, the company reported the number of shares issued and outstanding plus the paid up capital to be as indicated in the data given above in the problem. The preferred shares were non-cumulative but participate in distributions in excess of a \9 dividend on the common shares. Dividends for any given year are determined on the share capital outstanding at the end of that year. Dividends on preferred shares were last declared in 2014. The company's management wishes to offer a dividend of \14 to its common shareholders in 2017. REQUIRED: 1. Prepare journal entries, in proper format, to record all transaction effects in items [i] to [vii] as listed above. 2. Calculate the weighted average number of shares to be used in determining the basic earnings per share as at December 31, 2017. 3. For the transactions stated in (viii) above, provide journal entries required to record the following: a] Any Deferred Tax asset/liability recorded for 2017 arising from reversible tax differences. b] the tax effects of the carry forward of any taxable losses. [Record any Current Tax Expense, Deferred Tax Expense/Benefit, Deferred Tax Asset/Liability, any tax loss carried forward, etc.]. For the transactions stated in (viii) above, prepare the income statement (in part showing the income taxes and net income) for the year ended December 31, 2017. Determine how much dividend should be declared in 2018 to each shareholder group. Can the company declare this dividend in [ix] above, given that it has reported a taxable loss in (viii) above? Give brief reasons for your