Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3,000 1000 35K 3,500 3,500 1,00 a. Caleulate each project's payback period, net present value (NPV), internal rate of return (IRR), and modified internal rate

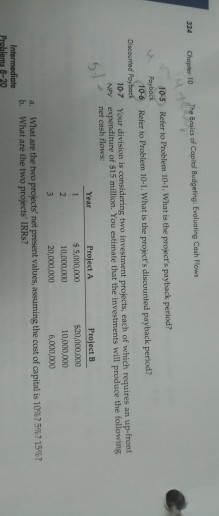

3,000 1000 35K 3,500 3,500 1,00 a. Caleulate each project's payback period, net present value (NPV), internal rate of return (IRR), and modified internal rate of return (MIRR) b. Which project or projects should be accepted if they are independent C. Which project should be accepted if they are mutually exclusivel d. How might a change in the cost of capital produce a conflict between the NPV and IRR rankings of these two projects? Would this conflict exist If were 57 Hint Pot the NPV profiles.) e. Why does the conflict exist? Problems Easy Problems Answers to odd-numbered problems appear in Appendix A. 1-7 10-1 A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for NPV 7 years, and a cost of capital of 115. What is the project's NPV? (Hint: Begin by constructing a time line.) 10-2 TRR Refer to Problem 10-1. What is the project's IRR? 10-3 MRR Refer to Problem 10-1. What is the project's MIRR? 10-4 Profitability Index Refer to Problem 10-1. What is the project's Pl? 32 Chapter 10 The basics of Capitol Budgeting: Evaluatie Cash Flows 105 Refer to Problem 10-1. What is the project's payback period? Payback 10-6 Refer to Problem 10-1. What is the project's discounted payback period? Discounted Payback 10-7 Your division is considering two investment projects, each of which requires an up-front NPV expenditure or $15 million. You estimate that the investments will produce the following het cash flows Year Project A Project B $5,000,000 $20,000,000 10,000,000 10,000,000 20,000,000 6,000,000 a. What are the two projects' net present values, assuming the cost of capital is 1047552 1592 b. What are the two projects' IRRs? Intermediate Problema 8-20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started