Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[(30,000 - 0) * 5/20 - 10,00] * (.34) = 1,700 Can you please help me understand where the 5/20 part comes from in this

[(30,000 - 0) * 5/20 - 10,00] * (.34) = 1,700

Can you please help me understand where the 5/20 part comes from in this equation. Thanks!

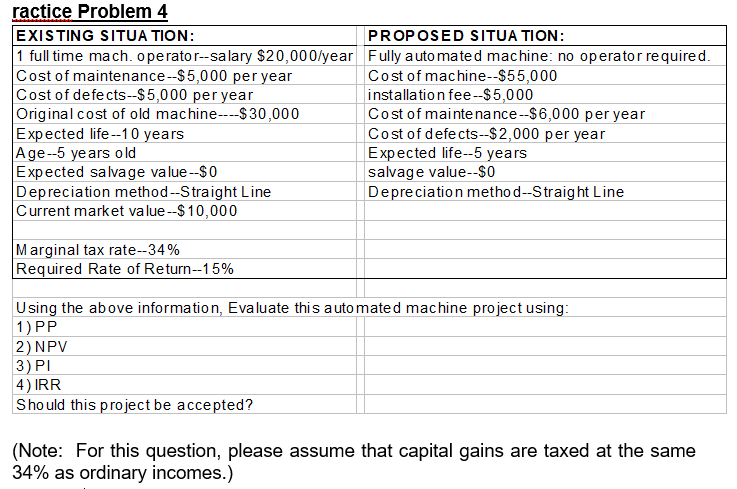

ractice Problem 4 EXISTING SITUATION: PROPOSED SITUATION: 1 full time mach. operator--salary $20,000/year Fully automated machine: no operator required. Cost of maintenance--$5,000 per year Cost of machine--$55,000 Cost of defects-$5,000 per year installation fee-$5,000 Original cost of old machine----$30,000 Cost of maintenance--$6,000 per year Expected life--10 years Cost of defects--$2,000 per year Age--5 years old Expected life--5 years Expected salvage value--$0 salvage value--SO Depreciation method --Straight Line Depreciation method--Straight Line Current market value--$10,000 Marginal tax rate-34% Required Rate of Return--15% Using the above information, Evaluate this automated machine project using: 1) PP 2) NPV 3)PI 4) IRR Should this project be accepted? (Note: For this question, please assume that capital gains are taxed at the same 34% as ordinary incomes.) ractice Problem 4 EXISTING SITUATION: PROPOSED SITUATION: 1 full time mach. operator--salary $20,000/year Fully automated machine: no operator required. Cost of maintenance--$5,000 per year Cost of machine--$55,000 Cost of defects-$5,000 per year installation fee-$5,000 Original cost of old machine----$30,000 Cost of maintenance--$6,000 per year Expected life--10 years Cost of defects--$2,000 per year Age--5 years old Expected life--5 years Expected salvage value--$0 salvage value--SO Depreciation method --Straight Line Depreciation method--Straight Line Current market value--$10,000 Marginal tax rate-34% Required Rate of Return--15% Using the above information, Evaluate this automated machine project using: 1) PP 2) NPV 3)PI 4) IRR Should this project be accepted? (Note: For this question, please assume that capital gains are taxed at the same 34% as ordinary incomes.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started