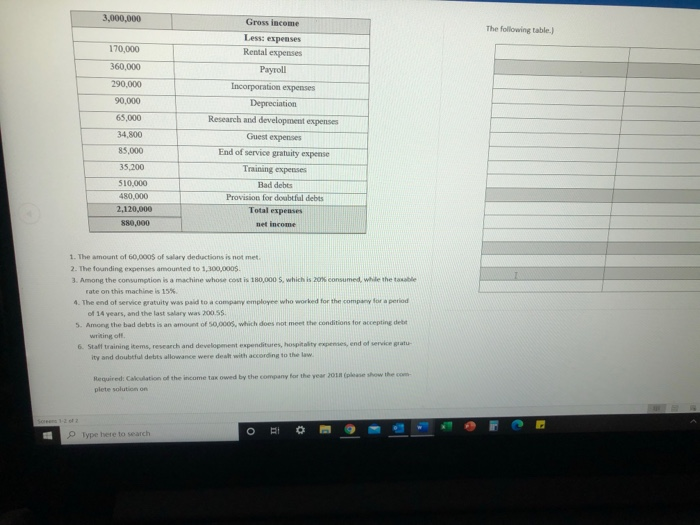

3,000,000 The following table.) 170,000 360.000 290.000 90,000 65,000 Gross income Less: expenses Rental expenses Payroll Incorporation expenses Depreciation Research and development expenses Guest expenses End of service gratuity expense Training expenses Bad debts Provision for doubtfuldebts Total expenses net income 34.800 85,000 35.200 510,000 480,000 2,120,000 880,000 1. The amount of 60.0005 of salary deductions is not met 2. The founding expenses amounted to 1,300,000$ 3. Among the consumption is a machine whose cost is 180,000 $, which is 20% consumed while the table rate on this machine is 15% 4. The end of service gratuity was paid to a company employee who worked for the company for a period of 14 years, and the last salary was 200.55. 5. Among the bad debits is an amount of 50.000s, which does not meet the conditions for accepting dett writing of 6. Staff training items, research and development expenditures, hospitality expenses, end of service ity and doubtfuldebts allowance were deal with according to the law Required Calculation of the income tax owed by the company for the year 2018 (please show the com plete solution O Type here to search 3,000,000 The following table.) 170,000 360.000 290.000 90,000 65,000 Gross income Less: expenses Rental expenses Payroll Incorporation expenses Depreciation Research and development expenses Guest expenses End of service gratuity expense Training expenses Bad debts Provision for doubtfuldebts Total expenses net income 34.800 85,000 35.200 510,000 480,000 2,120,000 880,000 1. The amount of 60.0005 of salary deductions is not met 2. The founding expenses amounted to 1,300,000$ 3. Among the consumption is a machine whose cost is 180,000 $, which is 20% consumed while the table rate on this machine is 15% 4. The end of service gratuity was paid to a company employee who worked for the company for a period of 14 years, and the last salary was 200.55. 5. Among the bad debits is an amount of 50.000s, which does not meet the conditions for accepting dett writing of 6. Staff training items, research and development expenditures, hospitality expenses, end of service ity and doubtfuldebts allowance were deal with according to the law Required Calculation of the income tax owed by the company for the year 2018 (please show the com plete solution O Type here to search