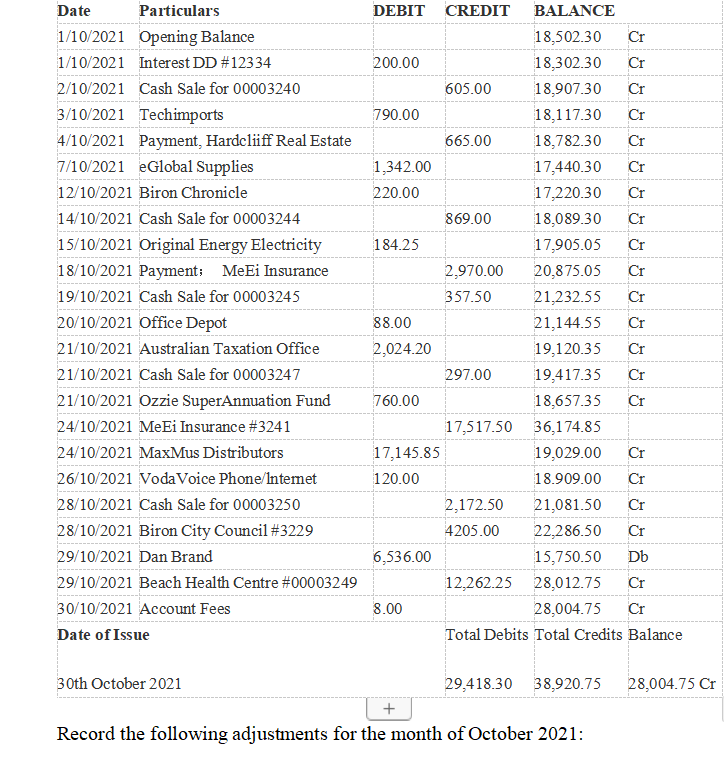

Question

30/10/2021 Record $88 (inc. GST) credit sale for repairs completed to VHS for Geoff Hardcliff but not invoiced as #00003252. 30/10/2021 Record monthly depreciation amount

| 30/10/2021 | Record $88 (inc. GST) credit sale for repairs completed to VHS for Geoff Hardcliff but not invoiced as #00003252. |

| 30/10/2021 | Record monthly depreciation amount of $250 for Fixtures & Fittings in the Journal Entry |

| 30/10/2021 | Record monthly depreciation amount of $115 for Office Equipment in the Journal Entry |

| 30/10/2021 | Record monthly rent expense of $2200 in the Journal Entry |

| 30/10/2021 | Record monthly insurance expense of $300 in the Journal Entry |

| 30/10/2021 | Unearned Revenue remains unearned |

| 30/10/2021 | Record accrued interest owing for the month of June of $66.70 in the Journal Entry |

| 30/10/2021 | Bad debts are calculated using the percentage of sales method and for the first year of trading Mike estimates they will be 0.25% of net sales in the Journal Entry |

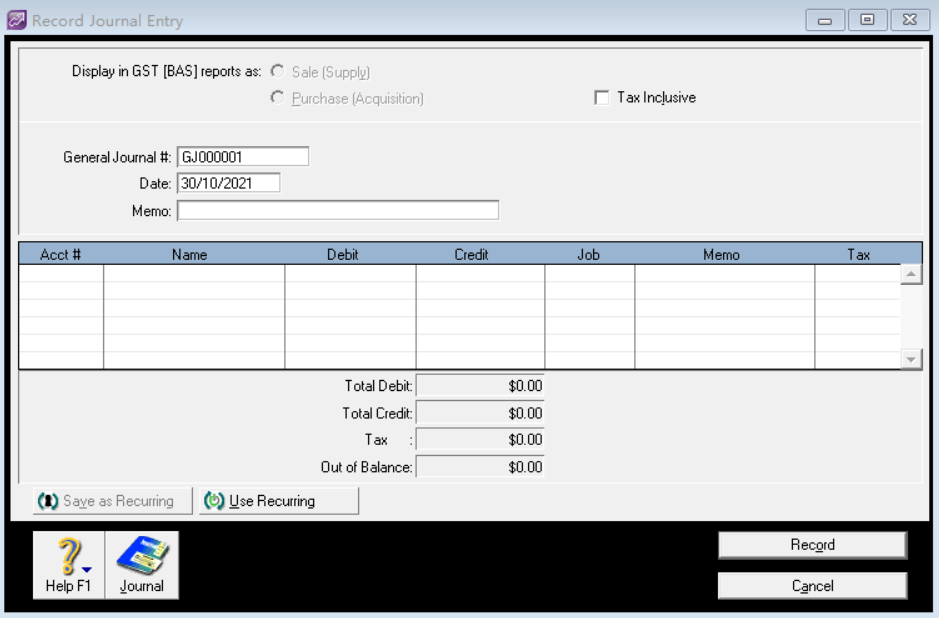

Record the appropriate adjustments in one journal entry.Please make a journal entry for October 30th.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started