Answered step by step

Verified Expert Solution

Question

1 Approved Answer

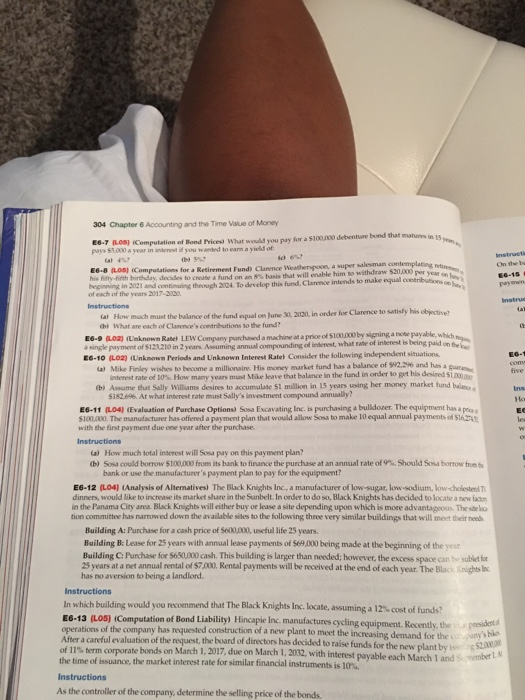

304 Chapter 6 Accounting and the Time Value of Money E6-7 (LOS) (Computation of Bond Prices What would you pay for a $100,000 debenture

304 Chapter 6 Accounting and the Time Value of Money E6-7 (LOS) (Computation of Bond Prices What would you pay for a $100,000 debenture bond that matures in 15 yea pays $5,000 a year in interest if you wanted to earn a yield of (b) 5% 560 E6-8 (LOS) (Computations for a Retirement Fund) Clarence Weatherspoon, a super salesman contemplating retim his fifty-fifth birthday, decides to create a fund on an 8% basis that will enable him to with equal per year on J beginning in 2021 and continuing through 2024. To develop this fund, Clarence intends to make equal contributions on of each of the years 2017-2020 Instructions (a) How much must the balance of the fund equal on June 30, 2020, in order for Clarence to satisfy his objective? (b) What are each of Clarence's contributions to the fund? E6-9 (L02) (Unknown Rate) LEW Company purchased a machine at a price of $100,000 by signing a note payable, which a single payment of $123,210 in 2 years. Assuming annual compounding of interest, what rate of interest is being paid on the E6-10 (L02) (Unknown Periods and Unknown Interest Rate) Consider the following independent situations. (a) Mike Finley wishes to become a millionaire. His money market fund has a balance of $92,296 and has a guara interest rate of 10% How many years must Mike leave that balance in the fund in order to get his desired $1.000 (b) Assume that Sally Williams desires to accumulate $1 million in 15 years using her money market fund balanc $182,696. At what interest rate must Sally's investment compound annually? E6-11 (L04) (Evaluation of Purchase Options) Sosa Excavating Inc. is purchasing a bulldozer. The equipment has a pr $100,000. The manufacturer has offered a payment plan that would allow Sosa to make 10 equal annual payments of $16,24 with the first payment due one year after the purchase. Instructions (a) How much total interest will Sosa pay on this payment plan? (b) Sosa could borrow $100,000 from its bank to finance the purchase at an annual rate of 9%. Should Sosa borrow from the bank or use the manufacturer's payment plan to pay for the equipment? E6-12 (L04) (Analysis of Alternatives) The Black Knights Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol T dinners, would like to increase its market share in the Sunbelt. In order to do so, Black Knights has decided to locate a new facin in the Panama City area. Black Knights will either buy or lease a site depending upon which is more advantageous. The site loo tion committee has narrowed down the available sites to the following three very similar buildings that will meet their needs Building A: Purchase for a cash price of $600,000, useful life 25 years. Building B: Lease for 25 years with annual lease payments of $69,000 being made at the beginning of the year Building C: Purchase for $650,000 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $7,000. Rental payments will be received at the end of each year. The Black Knights Inc has no aversion to being a landlord. Instructions Instructi On the ba E6-15 paymen Instruc (ak (b EG-1 come five Ins Ho EC lea w on In which building would you recommend that The Black Knights Inc. locate, assuming a 12% cost of funds? E6-13 (L05) (Computation of Bond Liability) Hincapie Inc. manufactures cycling equipment. Recently, the operations of the company has requested construction of a new plant to meet the increasing demand for the cpany's bike After a careful evaluation of the request, the board of directors has decided to raise funds for the new plant by is of 11% term corporate bonds on March 1, 2017, due on March 1, 2032, with interest payable each March 1 and Sember L the time of issuance, the market interest rate for similar financial instruments is 10% president $2.000 Instructions As the controller of the company, determine the selling price of the bonds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question Overview E69 L02 The question asks how much Sosa should borrow to buy a bulldozer costing 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started