Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(30pt) 1) Suppose that you get a partially amortizing mortgage loan of $80.000. The mortgage is for 20 years and is made at 5 percent

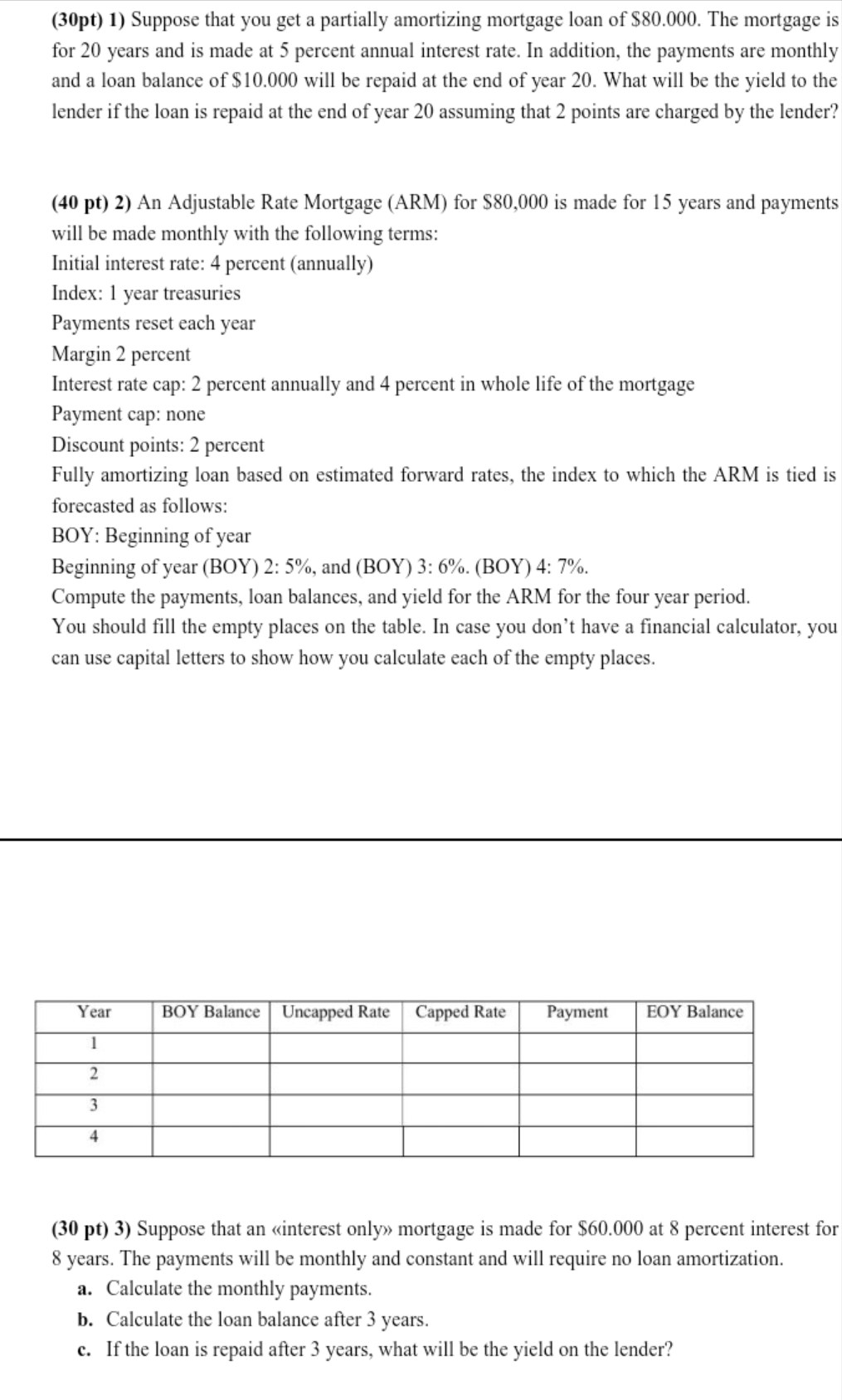

(30pt) 1) Suppose that you get a partially amortizing mortgage loan of $80.000. The mortgage is for 20 years and is made at 5 percent annual interest rate. In addition, the payments are monthly and a loan balance of $10.000 will be repaid at the end of year 20. What will be the yield to the lender if the loan is repaid at the end of year 20 assuming that 2 points are charged by the lender? (40 pt) 2) An Adjustable Rate Mortgage (ARM) for $80,000 is made for 15 years and payments will be made monthly with the following terms: Initial interest rate: 4 percent (annually) Index: 1 year treasuries Payments reset each year Margin 2 percent Interest rate cap: 2 percent annually and 4 percent in whole life of the mortgage Payment cap: none Discount points: 2 percent Fully amortizing loan based on estimated forward rates, the index to which the ARM is tied is forecasted as follows: BOY: Beginning of year Beginning of year (BOY) 2: 5%, and (BOY) 3: 6%. (BOY) 4: 7%. Compute the payments, loan balances, and yield for the ARM for the four year period. You should fill the empty places on the table. In case you don't have a financial calculator, you can use capital letters to show how you calculate each of the empty places. Year BOY Balance Uncapped Rate Capped Rate Payment EOY Balance 1 2 3 4 (30 pt) 3) Suppose that an interest only mortgage is made for $60.000 at 8 percent interest for 8 years. The payments will be monthly and constant and will require no loan amortization. a. Calculate the monthly payments. b. Calculate the loan balance after 3 years. c. If the loan is repaid after 3 years, what will be the yield on the lender

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started