Answered step by step

Verified Expert Solution

Question

1 Approved Answer

31) (10 points) Casper's is analyzing a proposed expansion project that is much riskier than the firm's current operations. Thus, the project will be assigned

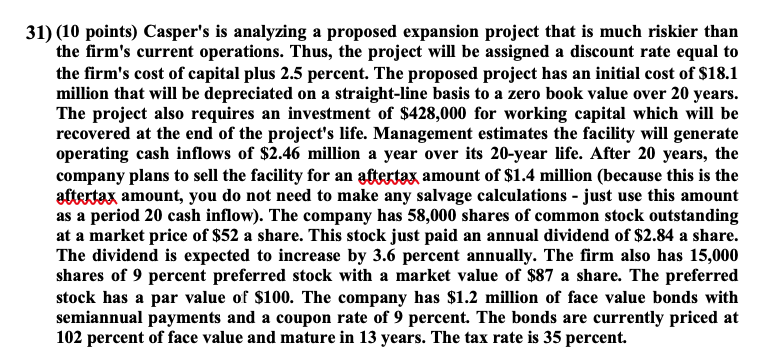

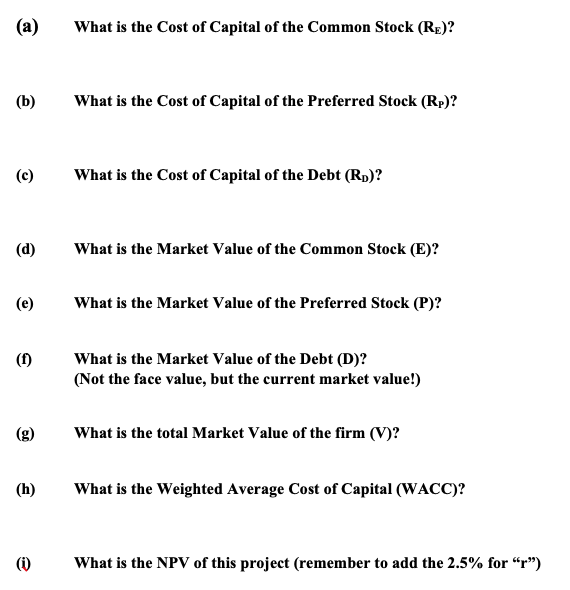

31) (10 points) Casper's is analyzing a proposed expansion project that is much riskier than the firm's current operations. Thus, the project will be assigned a discount rate equal to the firm's cost of capital plus 2.5 percent. The proposed project has an initial cost of $18.1 million that will be depreciated on a straight-line basis to a zero book value over 20 years. The project also requires an investment of $428,000 for working capital which will be recovered at the end of the project's life. Management estimates the facility will generate operating cash inflows of $2.46 million a year over its 20-year life. After 20 years, the company plans to sell the facility for an aftertax amount of $1.4 million (because this is the aftertax amount, you do not need to make any salvage calculations - just use this amount as a period 20 cash inflow). The company has 58,000 shares of common stock outstanding at a market price of $52 a share. This stock just paid an annual dividend of $2.84 a share. The dividend is expected to increase by 3.6 percent annually. The firm also has 15,000 shares of 9 percent preferred stock with a market value of $87 a share. The preferred stock has a par value of $100. The company has $1.2 million of face value bonds with semiannual payments and a coupon rate of 9 percent. The bonds are currently priced at 102 percent of face value and mature in 13 years. The tax rate is 35 percent. (a) What is the Cost of Capital of the Common Stock (Re)? (b) What is the Cost of Capital of the Preferred Stock (Rp)? (c) What is the Cost of Capital of the Debt (Rp)? What is the Market Value of the Common Stock (E)? (e) What is the Market Value of the Preferred Stock (P)? What is the Market Value of the Debt (D)? (Not the face value, but the current market value!) What is the total Market Value of the firm (V)? (h) What is the Weighted Average Cost of Capital (WACC)? (0) What is the NPV of this project (remember to add the 2.5% for "r") 31) (10 points) Casper's is analyzing a proposed expansion project that is much riskier than the firm's current operations. Thus, the project will be assigned a discount rate equal to the firm's cost of capital plus 2.5 percent. The proposed project has an initial cost of $18.1 million that will be depreciated on a straight-line basis to a zero book value over 20 years. The project also requires an investment of $428,000 for working capital which will be recovered at the end of the project's life. Management estimates the facility will generate operating cash inflows of $2.46 million a year over its 20-year life. After 20 years, the company plans to sell the facility for an aftertax amount of $1.4 million (because this is the aftertax amount, you do not need to make any salvage calculations - just use this amount as a period 20 cash inflow). The company has 58,000 shares of common stock outstanding at a market price of $52 a share. This stock just paid an annual dividend of $2.84 a share. The dividend is expected to increase by 3.6 percent annually. The firm also has 15,000 shares of 9 percent preferred stock with a market value of $87 a share. The preferred stock has a par value of $100. The company has $1.2 million of face value bonds with semiannual payments and a coupon rate of 9 percent. The bonds are currently priced at 102 percent of face value and mature in 13 years. The tax rate is 35 percent. (a) What is the Cost of Capital of the Common Stock (Re)? (b) What is the Cost of Capital of the Preferred Stock (Rp)? (c) What is the Cost of Capital of the Debt (Rp)? What is the Market Value of the Common Stock (E)? (e) What is the Market Value of the Preferred Stock (P)? What is the Market Value of the Debt (D)? (Not the face value, but the current market value!) What is the total Market Value of the firm (V)? (h) What is the Weighted Average Cost of Capital (WACC)? (0) What is the NPV of this project (remember to add the 2.5% for "r")

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started