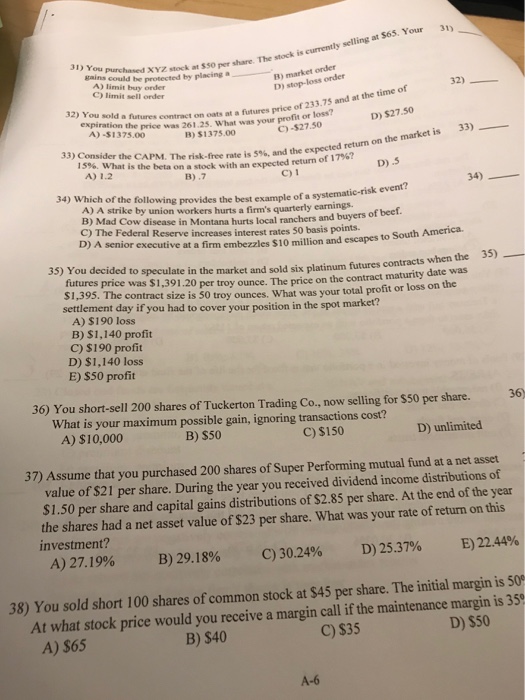

31 31) You gains at S$0 per share. The stock is currently selling at S65. Your could be protected by placing a_ A) limit buy order order -B) market C) limit sell order D) stop-loss order 32) of 233.75 and at the time of D) $27.50 32) You sold a futures contract on oats at a futures pri expiration the price was 261.25. What was your profit or loss A) -51375.00 C)-$27.50 B)51375.00 33) 33) Consider the CAPM. The risk- free rate is 5%, and the expected return on the market is 15%. What is the beta on a stock with an expected return of D) .5 B).7 C) 1 34) Which of the following provides the best example of a systematic-risk event? A) A strike by union workers hurts a firm's quarterly earnings.f beef. B) Mad Cow disease in Montana hur C) The Federal Reserve increases interest rates ts local ranchers 50 basis points. D) A senior executive at a firm embezzles $10 million and escapes to South America. 35) You decided to speculate in the market and sold six platinum futures futures price was $1,391.20 per $1,395The settlement day if you had to cover your position in the spot mark troy ounce. The price on the contract maturity date was e contract size is 50 troy ounces. What was your total profit or loss on the et? A) $190 loss B) $1,140 profit c) $190 profit D) $1,140 loss E) S50 profit 36) You short-sell 200 shares of Tuckerton Trading Co., now selling for $50 per share. 36) What is your maximum possible gain, ignoring transactions cost? A) $10,000 B) $50 C) $150 D) unlimited 37) Assume that you purchased 200 shares of Super Performing mutual fund at a net asset value of $21 per share. During the year you received dividend income distributions of $1.50 per share and capital gains distributions of $2.85 per share. At the end of the year the shares had a net asset value of $23 per share. What was your rate of return on this investment? A)27.19% B)29. I 8% C)30.24% D)25.37% E) 22.44% 38) You sold short 100 shares of common stock at $45 per share. The initial margin is 50 At what stock price would you receive a margin call if the maintenance margin is 35 A) S65 B) $40 C) $35 D) $50 A-6