Answered step by step

Verified Expert Solution

Question

1 Approved Answer

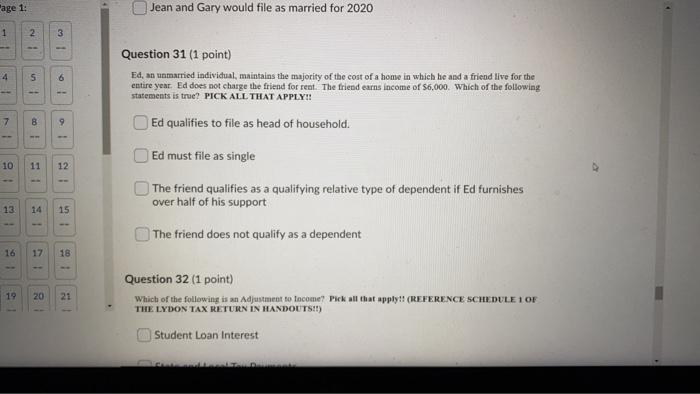

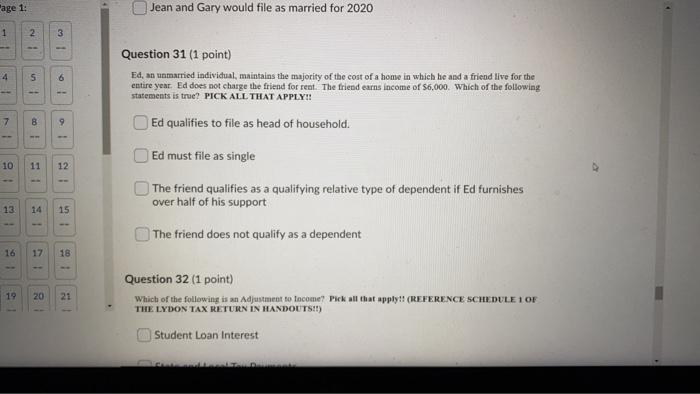

31 age 1: Jean and Gary would file as married for 2020 1 2 3 4 S 6 Question 31 (1 point) Ed, an unmarried

31

"age 1: Jean and Gary would file as married for 2020 1 2 3 4 S 6 Question 31 (1 point) Ed, an unmarried individual, maintains the majority of the cost of a home in which he and a friend live for the entire yeat. Ed does not charge the friend for rent. The friend earns income of $6,000. Which of the following statements is true? PICK ALL THAT APPLY!! 1 7 9 Ed qualifies to file as head of household. Ed must file as single 10 11 12 The friend qualifies as a qualifying relative type of dependent if Ed furnishes over half of his support 13 15 I The friend does not qualify as a dependent 16 17 18 19 20 Question 32 (1 point) Which of the following is an Adjustment to focome? Pick all that apply!! (REFERENCE SCHEDULE 1 OF THE LYDON TAX RETURN IN HANDOUTS!!) 21 Student Loan Interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started