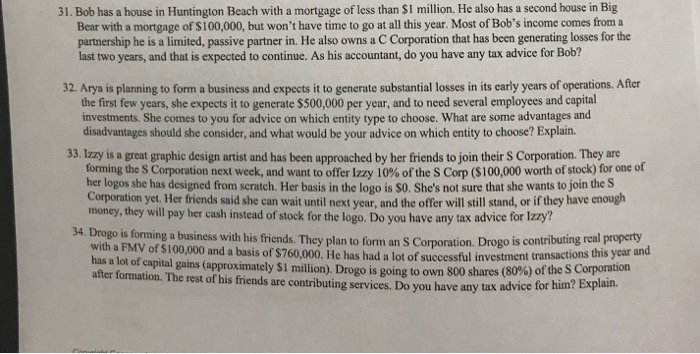

31. Bob has a house in Huntington Beach with a mortgage of less than $1 million. He also has a second house in Big Bear with a mortgage of $100,000, but won't have time to go at all this year. Most of Bob's income comes from a partnership he is a limited, passive partner in. He also owns a C Corporation that has been generating losses for the last two years, and that is expected to continue. As his accountant, do you have any tax advice for Bob? 32. Arya is planning to form a business and expects it to generate substantial losses in its early years of operations. After the first few years, she expects it to generate $500,000 per year, and to need several employees and capital investments. She comes to you for advice on which entity type to choose. What are some advantages and disadvantages should she consider, and what would be your advice on which entity to choose? Explam. 35. Izzy is a great graphic design artist and has been approached by her friends to join their S Corporation. They are forming the S Corporation next week, and want to offer Izzy 10% of the S Corp ($100,000 worth of stock) for one or her logos she has designed from scratch. Her basis in the logo is SO She's not sure that she wants to join the Corporation yet. Her friends said she can wait until next year and the offer will still stand, or if they have enough money, they will pay her cash instead of stock for the logo. Do you have any tax advice for 2 54. Drogo is forming a business with his friends. They plan to form an $ Corporation. Drogo is conc with a FMV of $100,000 and a basis of S760.000. He has had a lot of successful investment transactio n to form an S Corporation. Drogo is contributing real property e has a lot of capital gains (approximately $1 million) Drogo is going to own 800 shares (80%) of me a lot of successful investment transactions this year and after formation. The rest of his friends are contributing services. Do you have any tax advice for him rogo is going to own 800 shares (80%) of the S Corporation