Answered step by step

Verified Expert Solution

Question

1 Approved Answer

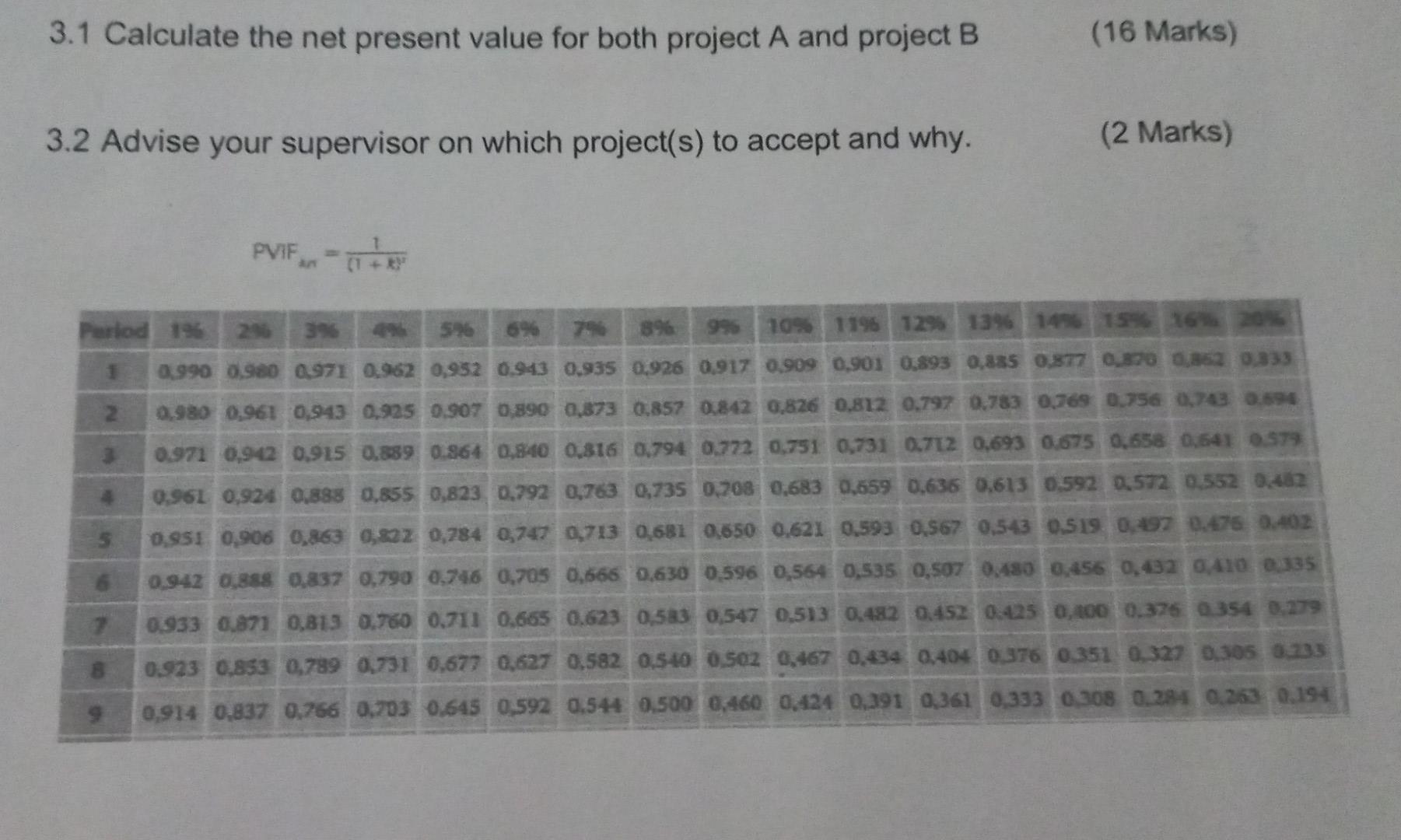

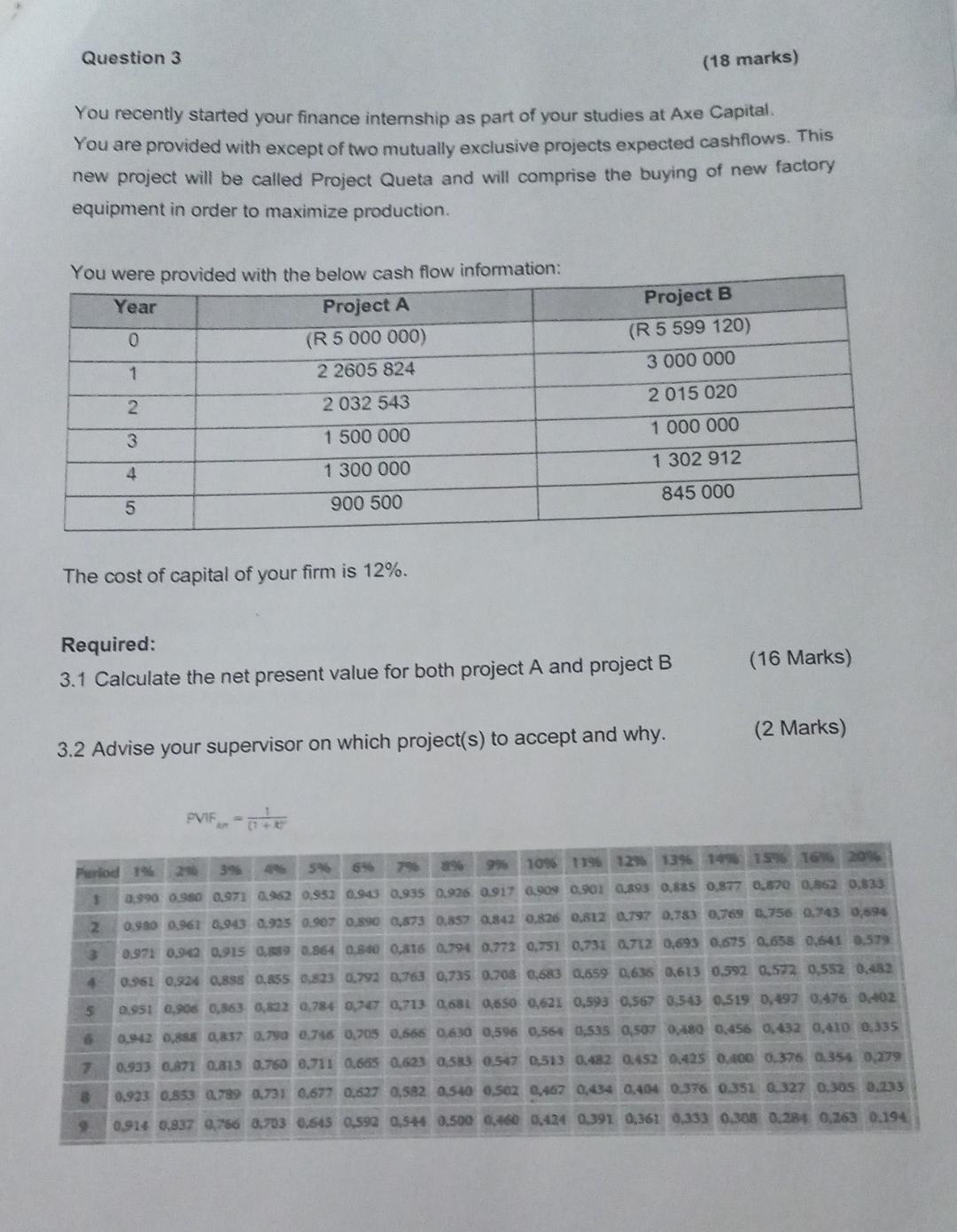

3.1 Calculate the net present value for both project A and project B 3.2 Advise your supervisor on which project(s) to accept and why. PVIFAn=(1+k)21

3.1 Calculate the net present value for both project A and project B 3.2 Advise your supervisor on which project(s) to accept and why. PVIFAn=(1+k)21 Question 3 (18 marks) You recently started your finance internship as part of your studies at Axe Capital. You are provided with except of two mutually exclusive projects expected cashflows. This new project will be called Project Queta and will comprise the buying of new factory equipment in order to maximize production. You were provided with the below cash flow information: The cost of capital of your firm is 12%. Required: 3.1 Calculate the net present value for both project A and project B (16 Marks) 3.2 Advise your supervisor on which project(s) to accept and why. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started