Question

3.1 Company DEF wants to buy a machine that produces t-shirts. The selling price per t-shirt will be N$10. The cost of production will

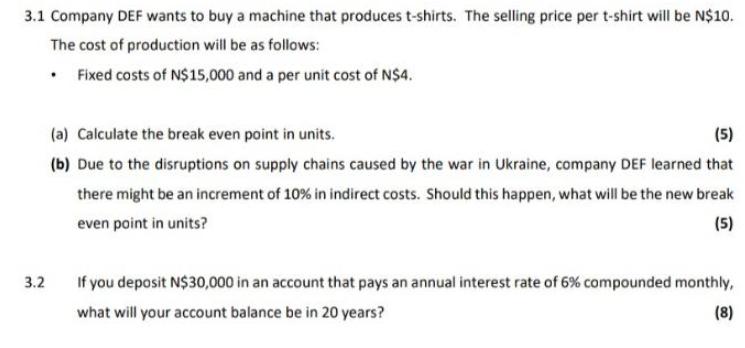

3.1 Company DEF wants to buy a machine that produces t-shirts. The selling price per t-shirt will be N$10. The cost of production will be as follows: Fixed costs of N$15,000 and a per unit cost of N$4. (a) Calculate the break even point in units. (5) (b) Due to the disruptions on supply chains caused by the war in Ukraine, company DEF learned that there might be an increment of 10% in indirect costs. Should this happen, what will be the new break even point in units? (5) 3.2 If you deposit N$30,000 in an account that pays an annual interest rate of 6% compounded monthly, what will your account balance be in 20 years? (8)

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

31 a Break even point in units 2500 Explanation Break even point in units Fixed cost Contrib...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics The Exploration & Analysis Of Data

Authors: Roxy Peck, Jay L. Devore

7th Edition

0840058012, 978-0840058010

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App