Question

31. Jackson Company engaged in the following investment transactions during the current year. Feb. 17 Purchased 580 shares of Medical Company common stock for $15

31. Jackson Company engaged in the following investment transactions during the current year.

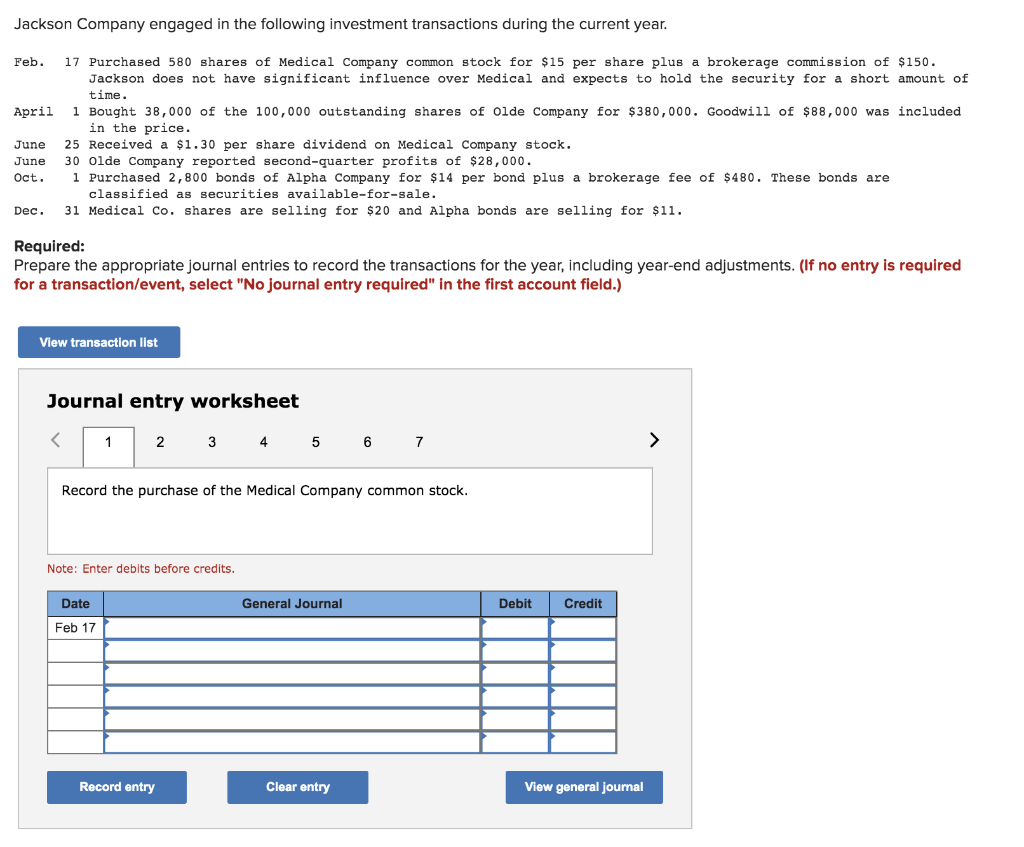

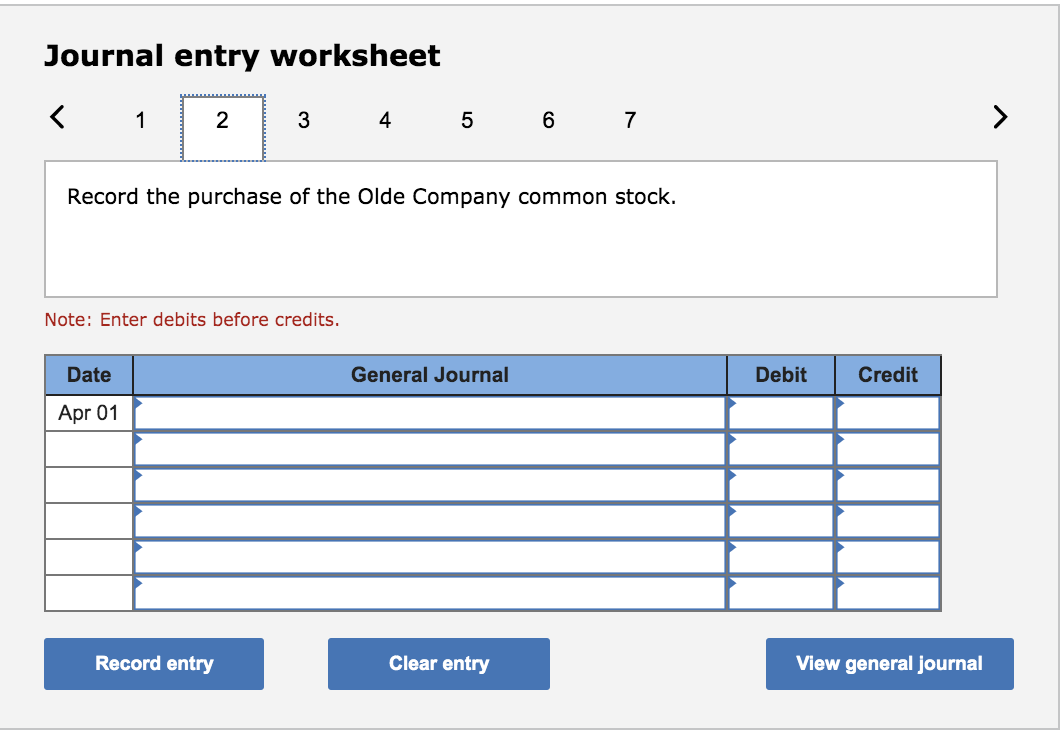

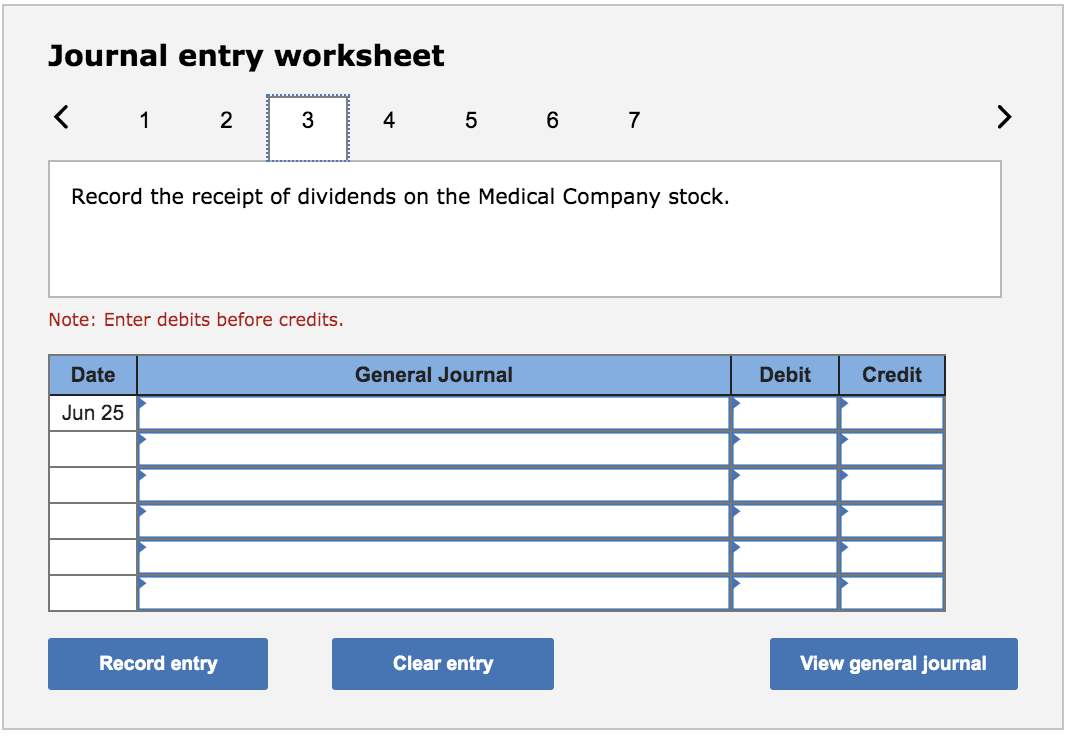

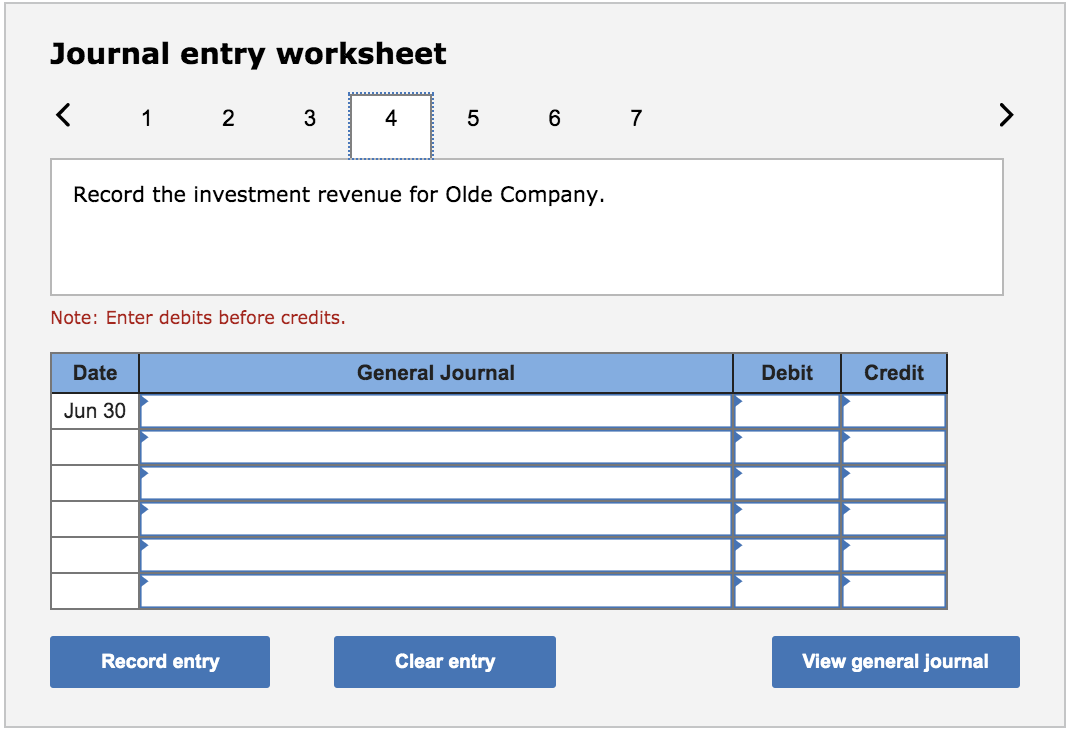

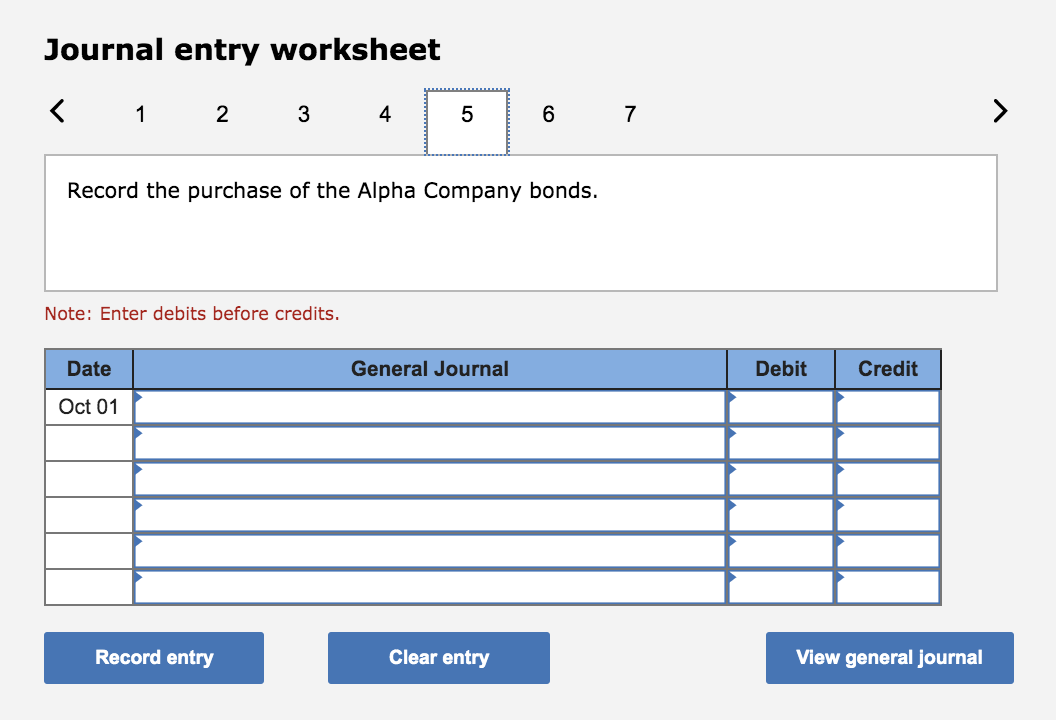

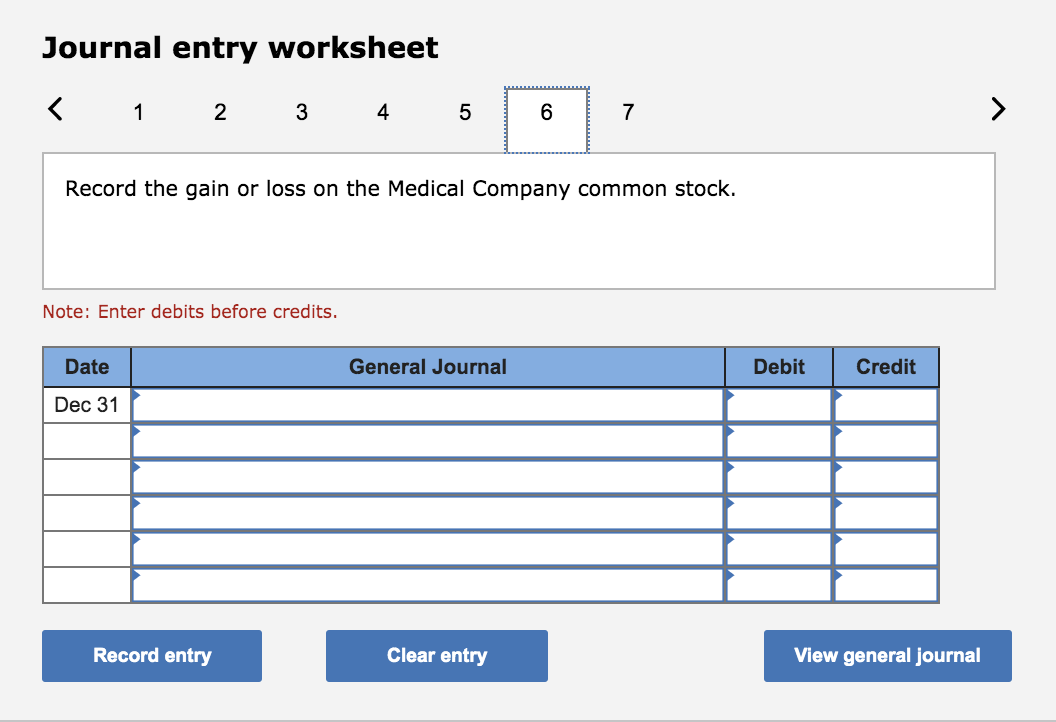

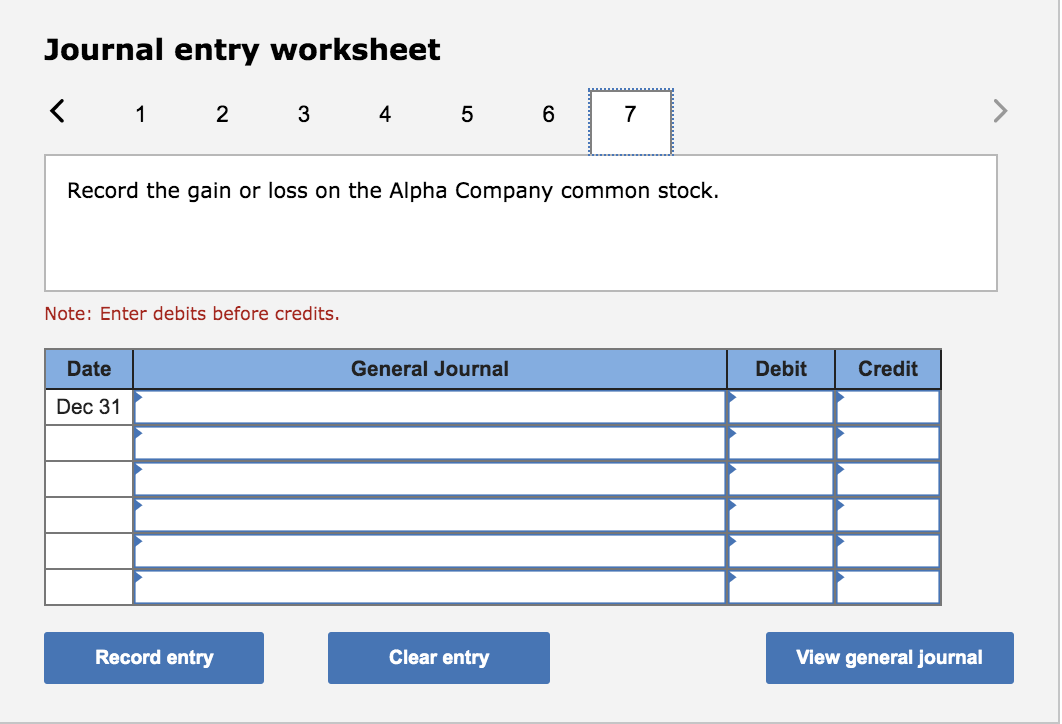

Feb. 17 Purchased 580 shares of Medical Company common stock for $15 per share plus a brokerage commission of $150. Jackson does not have significant influence over Medical and expects to hold the security for a short amount of time. April 1 Bought 38,000 of the 100,000 outstanding shares of Olde Company for $380,000. Goodwill of $88,000 was included in the price. June 25 Received a $1.30 per share dividend on Medical Company stock. June 30 Olde Company reported second-quarter profits of $28,000. Oct. 1 Purchased 2,800 bonds of Alpha Company for $14 per bond plus a brokerage fee of $480. These bonds are classified as securities available-for-sale. Dec. 31 Medical Co. shares are selling for $20 and Alpha bonds are selling for $11. Required: Prepare the appropriate journal entries to record the transactions for the year, including year-end adjustments. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started