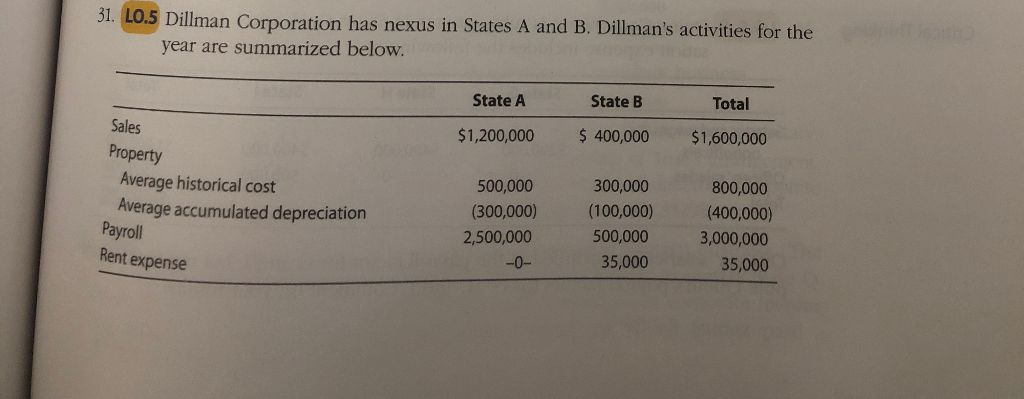

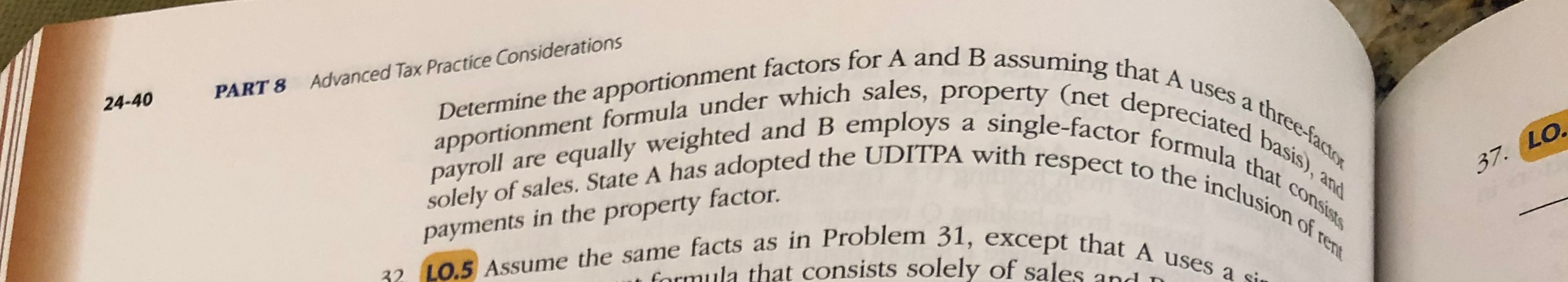

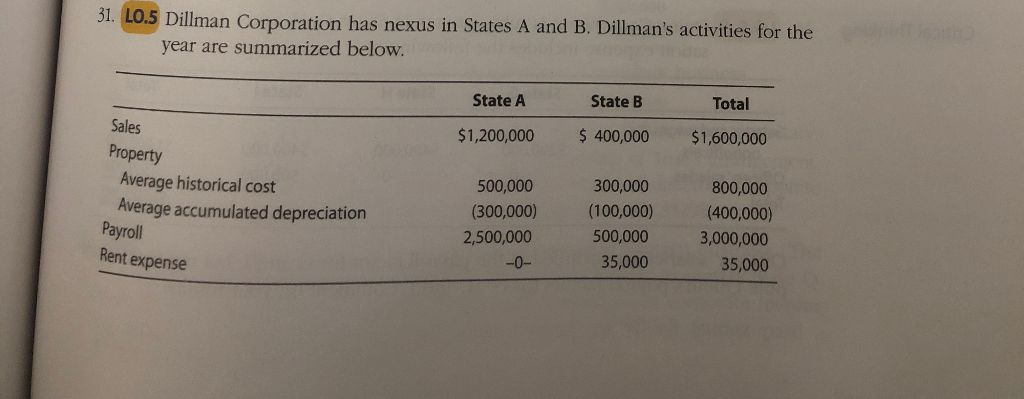

31. L0.5 Dillman Corporation has nexus in States A and B. Dillman's activities for the year are summarized below. State A State B Total Sales Property $1,200,000 $ 400,000 $1,600,000 Average historical cost Average accumulated depreciation Payroll 500,000 (300,000) 2,500,000 300,000 (100,000) 500,000 35,000 800,000 (400,000) 3,000,000 35,000 Rent expense -O- hat A uses a three-fa PART 8 Advanced Tax Practice Considerations 24-40 for A and B assuming that A r which sales, property (net de and B employs a single-factor UDITPA with respect to the (net depreciated bas efactor formula that hree factor ed basis), and in that consists o the inclusion of Determine the apportionment factors for A ar apportionment formula under which sale payroll are equally weighted and B emp solely of sales. State A has adopted the UDITP payments in the property factor. 37. LO. ision of rent cept that A uses a si 32 L0.5 Assume the same facts as in Problem 31 formula that consists solely of sales on 1 dctor oblem 31, except that both st Ust), and oth states employ a payroll. SUL DU 33. LO.5 Assume the same facts as in Problem 31. exe three-factor formula, under which sales are double factor in A is computed using historical cost; this facte the net depreciated basis. Neither A nor B includes re factor. are double-weighted. The this factor in B is compute includes rent payments in the .d. The property mputed using in the property as indicated below. This 34. LO.5 Roger Corporation operates in two states, as indica operations generated $400,000 of apportionable incom 31. L0.5 Dillman Corporation has nexus in States A and B. Dillman's activities for the year are summarized below. State A State B Total Sales Property $1,200,000 $ 400,000 $1,600,000 Average historical cost Average accumulated depreciation Payroll 500,000 (300,000) 2,500,000 300,000 (100,000) 500,000 35,000 800,000 (400,000) 3,000,000 35,000 Rent expense -O- hat A uses a three-fa PART 8 Advanced Tax Practice Considerations 24-40 for A and B assuming that A r which sales, property (net de and B employs a single-factor UDITPA with respect to the (net depreciated bas efactor formula that hree factor ed basis), and in that consists o the inclusion of Determine the apportionment factors for A ar apportionment formula under which sale payroll are equally weighted and B emp solely of sales. State A has adopted the UDITP payments in the property factor. 37. LO. ision of rent cept that A uses a si 32 L0.5 Assume the same facts as in Problem 31 formula that consists solely of sales on 1 dctor oblem 31, except that both st Ust), and oth states employ a payroll. SUL DU 33. LO.5 Assume the same facts as in Problem 31. exe three-factor formula, under which sales are double factor in A is computed using historical cost; this facte the net depreciated basis. Neither A nor B includes re factor. are double-weighted. The this factor in B is compute includes rent payments in the .d. The property mputed using in the property as indicated below. This 34. LO.5 Roger Corporation operates in two states, as indica operations generated $400,000 of apportionable incom