Answered step by step

Verified Expert Solution

Question

1 Approved Answer

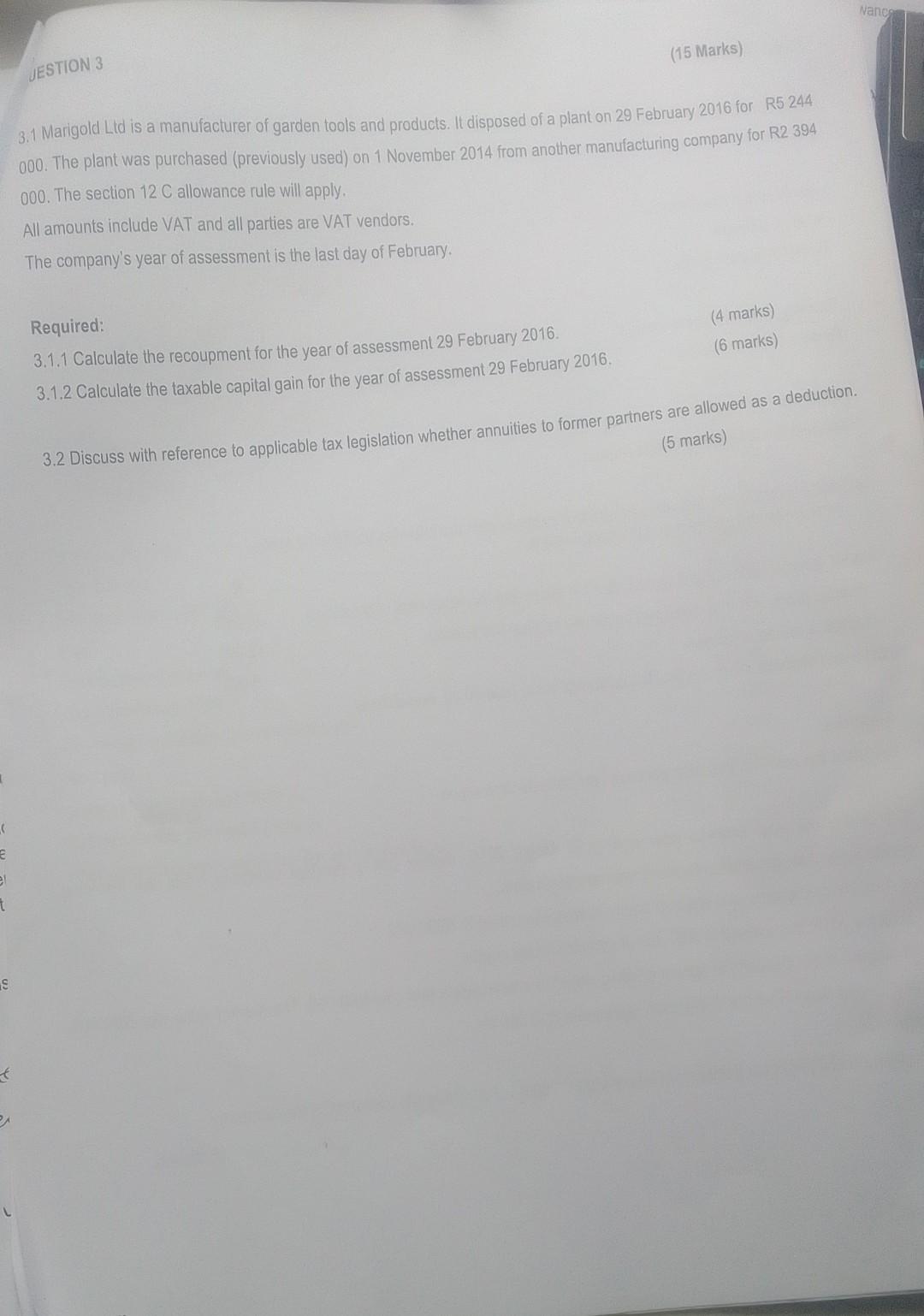

3.1 Marigold Ltd is a manufacturer of garden tools and products. It disposed of a plant on 29 February 2016 for R5244 000. The plant

3.1 Marigold Ltd is a manufacturer of garden tools and products. It disposed of a plant on 29 February 2016 for R5244 000. The plant was purchased (previously used) on 1 November 2014 from another manufacturing company for R2 394 000. The section 12C allowance rule will apply. All amounts include VAT and all parties are VAT vendors. The company's year of assessment is the last day of February. Required: 3.1.1 Calculate the recoupment for the year of assessment 29 February 2016. (4 marks) 3.1.2 Calculate the taxable capital gain for the year of assessment 29 February 2016. (6 marks) 3.2 Discuss with reference to applicable tax legislation whether annuities to former partners are allowed as a deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started