Answered step by step

Verified Expert Solution

Question

1 Approved Answer

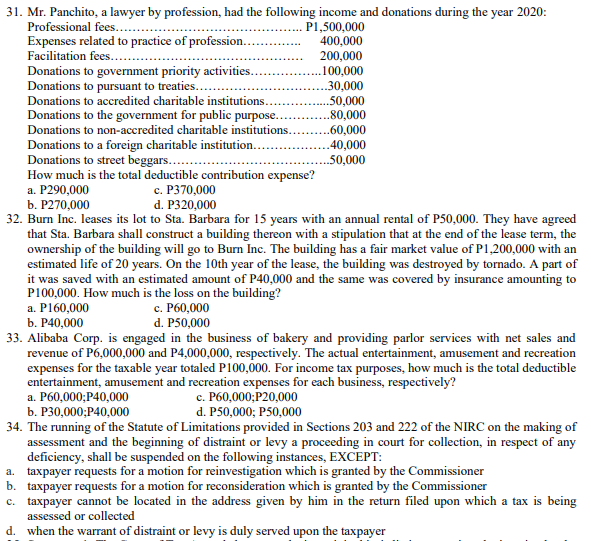

31. Mr. Panchito, a lawyer by profession, had the following income and donations during the year 2020: P1,500,000 400,000 200,000 .100,000 .30,000 .50,000 ..80,000

31. Mr. Panchito, a lawyer by profession, had the following income and donations during the year 2020: P1,500,000 400,000 200,000 .100,000 .30,000 .50,000 ..80,000 Professional fees...... Expenses related to practice of profession. Facilitation fees... Donations to government priority activities.. Donations to pursuant to treaties.. Donations to accredited charitable institutions. Donations to the government for public purpose... Donations to non-accredited charitable institutions.. Donations to a foreign charitable institution.. Donations to street beggars..... How much is the total deductible contribution expense? a. P290,000 c. P370,000 b. P270,000 d. P320,000 32. Burn Inc. leases its lot to Sta. Barbara for 15 years with an annual rental of P50,000. They have agreed that Sta. Barbara shall construct a building thereon with a stipulation that at the end of the lease term, the ownership of the building will go to Burn Inc. The building has a fair market value of P1,200,000 with an estimated life of 20 years. On the 10th year of the lease, the building was destroyed by tornado. A part of it was saved with an estimated amount of P40,000 and the same was covered by insurance amounting to P100,000. How much is the loss on the building? c. P60,000 d. P50,000 a. P160,000 b. P40,000 ..60,000 ..40,000 ..50,000 33. Alibaba Corp. is engaged in the business of bakery and providing parlor services with net sales and revenue of P6,000,000 and P4,000,000, respectively. The actual entertainment, amusement and recreation expenses for the taxable year totaled P100,000. For income tax purposes, how much is the total deductible entertainment, amusement and recreation expenses for each business, respectively? a. P60,000;P40,000 b. P30,000;P40,000 c. P60,000;P20,000 d. P50,000; P50,000 34. The running of the Statute of Limitations provided in Sections 203 and 222 of the NIRC on the making of assessment and the beginning of distraint or levy a proceeding in court for collection, in respect of any deficiency, shall be suspended on the following instances, EXCEPT: a. taxpayer requests for a motion for reinvestigation which is granted by the Commissioner b. taxpayer requests for a motion for reconsideration which is granted by the Commissioner c. taxpayer cannot be located in the address given by him in the return filed upon which a tax is being assessed or collected d. when the warrant of distraint or levy is duly served upon the taxpayer

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

31 The total deductible contribution expense is P270000 Deductible contributions Donations to govern...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started