Answered step by step

Verified Expert Solution

Question

1 Approved Answer

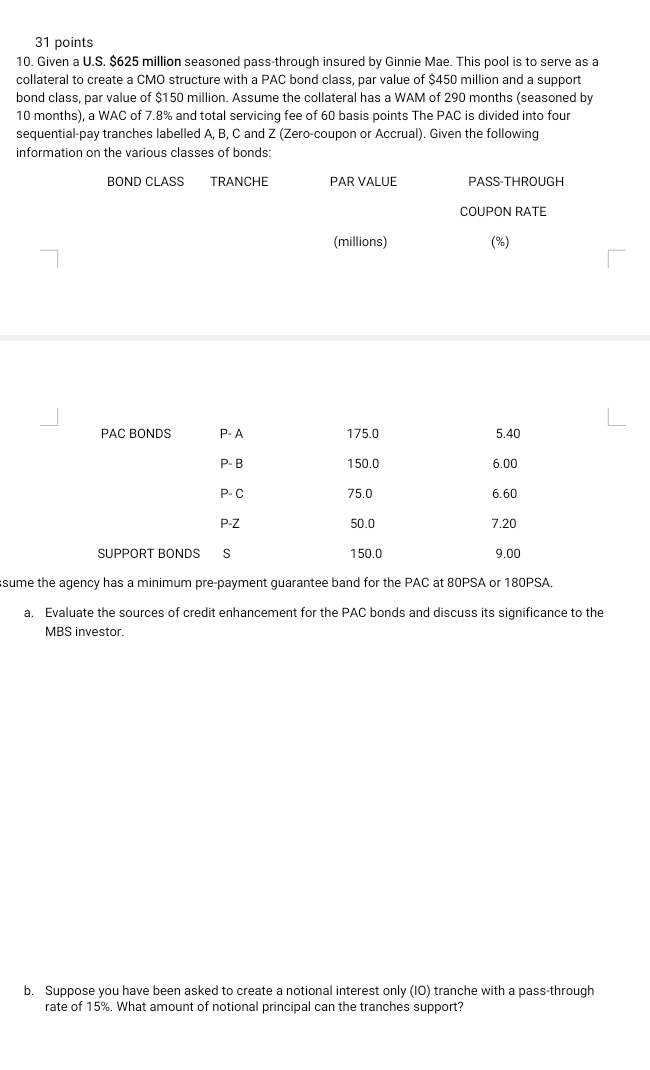

31 points 10. Given a U.S. $625 million seasoned pass-through insured by Ginnie Mae. This pool is to serve as a collateral to create a

31 points 10. Given a U.S. $625 million seasoned pass-through insured by Ginnie Mae. This pool is to serve as a collateral to create a CMO structure with a PAC bond class, par value of $450 million and a support bond class, par value of $150 million. Assume the collateral has a WAM of 290 months (seasoned by 10 months), a WAC of 7.8% and total servicing fee of 60 basis points The PAC is divided into four sequential-pay tranches labelled A, B, C and Z (Zero-coupon or Accrual). Given the following information on the various classes of bonds: BOND CLASS TRANCHE PAR VALUE PASS-THROUGH COUPON RATE (millions) PAC BONDS P-A 175.0 5.40 P-B 150.0 6.00 P-C 75.0 6.60 P-Z 50.0 7.20 SUPPORT BONDS S 150.0 9.00 sume the agency has a minimum pre-payment guarantee band for the PAC at 8OPSA or 180PSA. a. Evaluate the sources of credit enhancement for the PAC bonds and discuss its significance to the MBS investor. b. Suppose you have been asked to create a notional interest only (10) tranche with a pass-through rate of 15%. What amount of notional principal can the tranches support? 31 points 10. Given a U.S. $625 million seasoned pass-through insured by Ginnie Mae. This pool is to serve as a collateral to create a CMO structure with a PAC bond class, par value of $450 million and a support bond class, par value of $150 million. Assume the collateral has a WAM of 290 months (seasoned by 10 months), a WAC of 7.8% and total servicing fee of 60 basis points The PAC is divided into four sequential-pay tranches labelled A, B, C and Z (Zero-coupon or Accrual). Given the following information on the various classes of bonds: BOND CLASS TRANCHE PAR VALUE PASS-THROUGH COUPON RATE (millions) PAC BONDS P-A 175.0 5.40 P-B 150.0 6.00 P-C 75.0 6.60 P-Z 50.0 7.20 SUPPORT BONDS S 150.0 9.00 sume the agency has a minimum pre-payment guarantee band for the PAC at 8OPSA or 180PSA. a. Evaluate the sources of credit enhancement for the PAC bonds and discuss its significance to the MBS investor. b. Suppose you have been asked to create a notional interest only (10) tranche with a pass-through rate of 15%. What amount of notional principal can the tranches support

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started