Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.1 Prepare the debtors' collection schedule for April and May 2017 3.2 Prepare the cash budget for April and May 2017 Question 3 starts from

3.1 Prepare the debtors' collection schedule for April and May 2017

3.2 Prepare the cash budget for April and May 2017

Question 3 starts from the first photo and continues to the second photo. Work out answers for questions 3.1 and 3.2 on the second photo

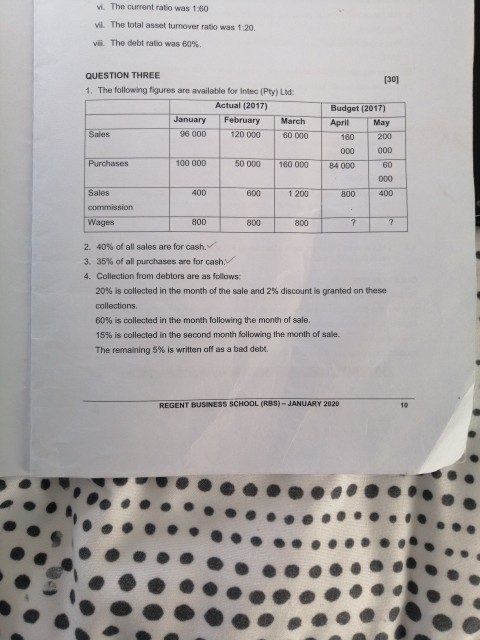

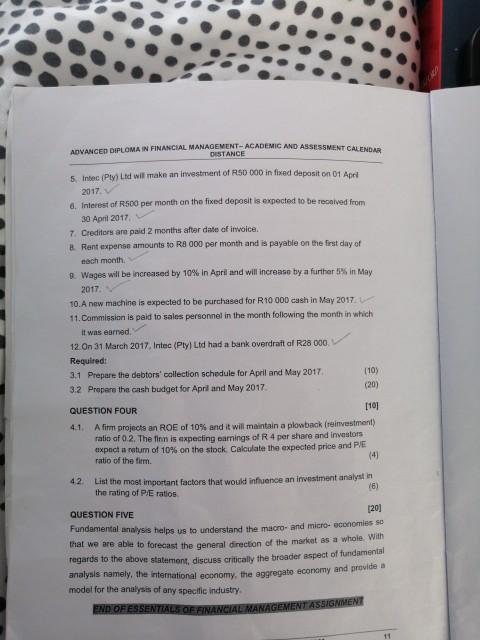

vi. The current ratio was 1:60 Vl. The total asset turnover ratio was 1:20 vil. The debt ratio was 60% (30 QUESTION THREE 1. The following figures are available for Intec (Pty) Lid: Actual (2017) January February March Sales 96 000 120 000 60 000 Budget (2017) April May 160 200 000 000 84 000 60 000 800 400 Purchases 100 000 50 000 160 000 Sales 400 600 1 200 commission Wages 800 800 800 ? ? 2. 40% of all sales are for cash 3. 35% of all purchases are for cash. 4. Collection from debtors are as follows: 20% is collected in the month of the sale and 2% discount is granted on these collections. 60% is collected in the month following the month of sale. 15% is collected in the second month following the month of sale. The remaining 5% is written off as a bad debt. REGENT BUSINESS SCHOOL (RBS) - JANUARY 2020 10 ADVANCED DIPLOMA IN FINANCIAL MANAGEMENT ACADEMIC AND ASSESSMENT CALENDAR 5. Intec (Pty) Ltd will make an investment of R50 000 in fixed deposit on 01 April 2017. 8. Interest of R500 per month on the fixed deposit is expected to be received from 30 April 2017 7. Creditors are paid 2 months after date of invoice. 8. Rent expense amounts to R8 000 per month and is payable on the first day of each month 9. Wages will be increased by 10% in April and will increase by a further 5% in May 2017 10.A new machine is expected to be purchased for R10 000 cash in May 2017 11. Commission is paid to sales personnel in the month following the month in which it was earned 12.On 31 March 2017 Intec (Ply) Ltd had a bank overdraft of R28 000 Required: 3.1 Prepare the debtors' collection schedule for April and May 2017 (10) 3.2 Prepare the cash budget for April and May 2017 (20) [101 QUESTION FOUR 4.1. A firm projects an ROE of 10% and it will maintain a plowback (reinvestment) ratio of 0.2. The firm is expecting earnings of R 4 per share and investors expect a return of 10% on the stock. Calculate the expected price and PIE ratio of the firm 42 List the most important factors that would influence an investment analyst in the rating of P/E ratios. (6) QUESTION FIVE [20] Fundamental analysis helps us to understand the macro- and micro-economies so that we are able to forecast the general direction of the market as a whole. With regards to the above statement, discuss critically the broader aspect of fundamental analysis namely, the international economy, the aggregate economy and provide model for the analysis of any specific industry. END OF ESSENTIALS OF FINANCIAL MANAGEMENT ASSIGNMENTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started