Answered step by step

Verified Expert Solution

Question

1 Approved Answer

31. S= Previous year's sales A= Total assets E= Total equity g= Projected growth in sales PM= Profit margin b= Retention (plowback) ratio Assuming all

31.

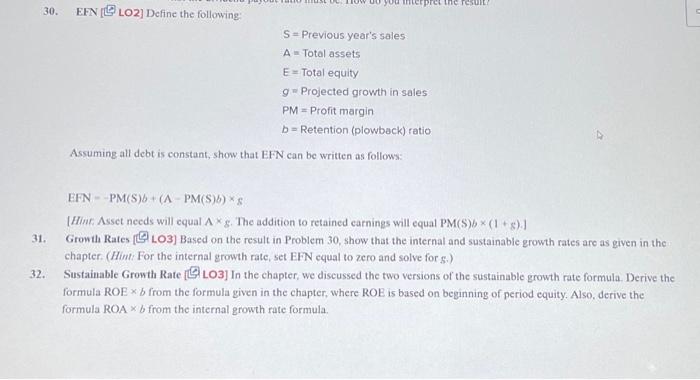

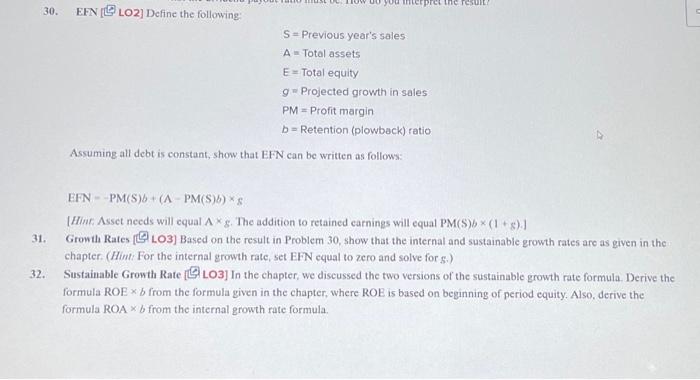

S= Previous year's sales A= Total assets E= Total equity g= Projected growth in sales PM= Profit margin b= Retention (plowback) ratio Assuming all debt is constant, show that EFN can be written as follows: EFN=PM(S)b+(APM(S)b)s [Hine, Asset needs will equal Ag. The addition to retained carnings will equal PM(S)b(1+8) ] 31. Growth Rates [ LO3] Based on the result in Problem 30, show that the internal and sustainable growth rates are as given in the chapter. (Hint: For the internal growth rate, set EFN equal to zero and solve for s.) 32. Sustainable Growth Rate [ LO3] In the chapter, we discussed the two versions of the sustainable growth rate formula. Derive the formula ROE b from the formula given in the chapter, where ROE is based on beginning of period equity. Also, derive the formula ROAb from the internal growth rate formula. S= Previous year's sales A= Total assets E= Total equity g= Projected growth in sales PM= Profit margin b= Retention (plowback) ratio Assuming all debt is constant, show that EFN can be written as follows: EFN=PM(S)b+(APM(S)b)s [Hine, Asset needs will equal Ag. The addition to retained carnings will equal PM(S)b(1+8) ] 31. Growth Rates [ LO3] Based on the result in Problem 30, show that the internal and sustainable growth rates are as given in the chapter. (Hint: For the internal growth rate, set EFN equal to zero and solve for s.) 32. Sustainable Growth Rate [ LO3] In the chapter, we discussed the two versions of the sustainable growth rate formula. Derive the formula ROE b from the formula given in the chapter, where ROE is based on beginning of period equity. Also, derive the formula ROAb from the internal growth rate formula

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started