Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.1. What is the difference between Minimum Attractive Rate of Return (MARR) and Internal Rate of Return (IRR)? And how can they be used

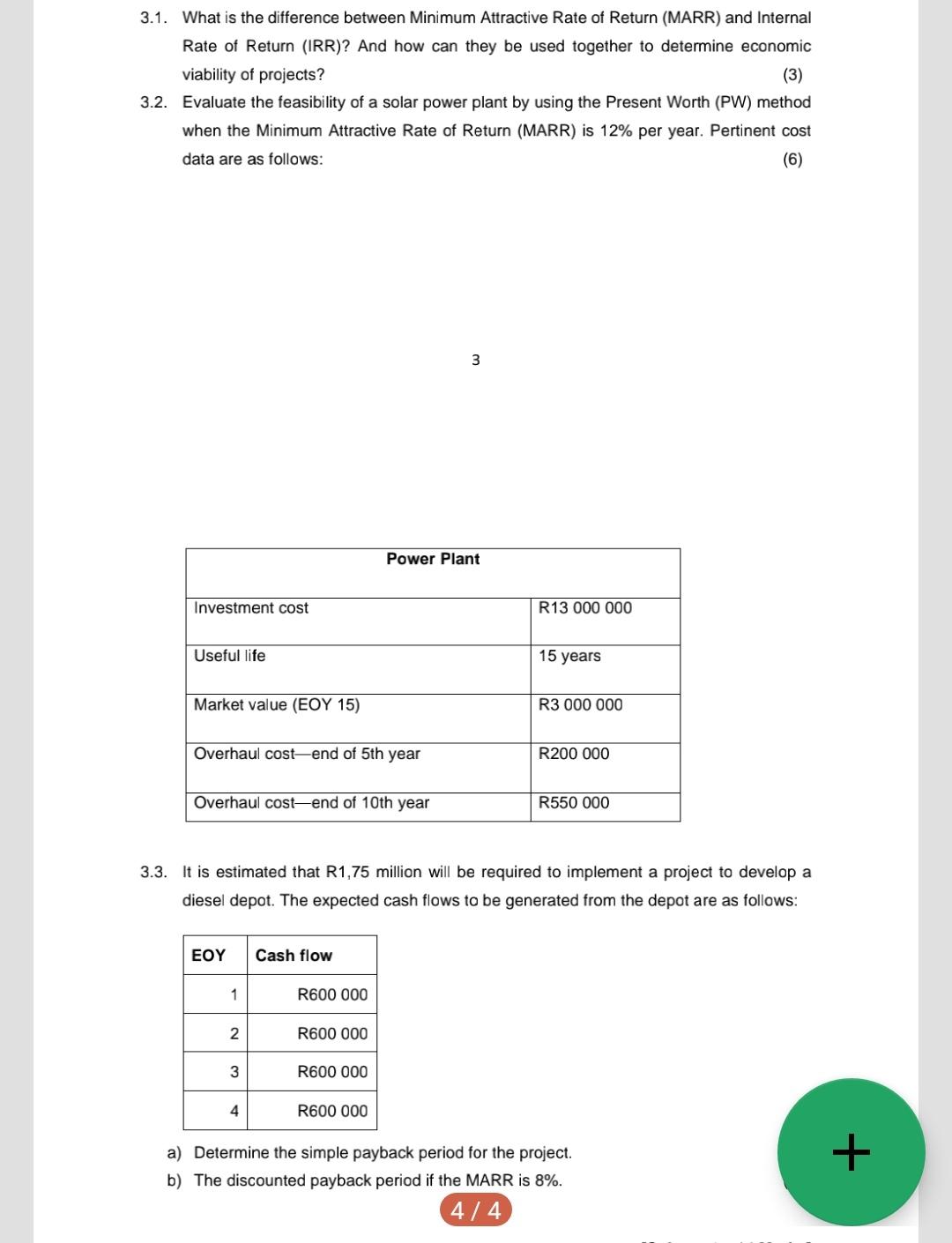

3.1. What is the difference between Minimum Attractive Rate of Return (MARR) and Internal Rate of Return (IRR)? And how can they be used together to determine economic viability of projects? (3) 3.2. Evaluate the feasibility of a solar power plant by using the Present Worth (PW) method when the Minimum Attractive Rate of Return (MARR) is 12% per year. Pertinent cost data are as follows: (6) 3 Power Plant Investment cost R13 000 000 Useful life 15 years Market value (EOY 15) R3 000 000 Overhaul cost-end of 5th year R200 000 Overhaul cost-end of 10th year R550 000 3.3. It is estimated that R1,75 million will be required to implement a project to develop a diesel depot. The expected cash flows to be generated from the depot are as follows: Cash flow 1 R600 000 2 R600 000 3 R600 000 4 R600 000 a) Determine the simple payback period for the project. + b) The discounted payback period if the MARR is 8%. 4/4

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

31 The MARR is the minimum acceptable rate of return that a company will accept on a new investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started