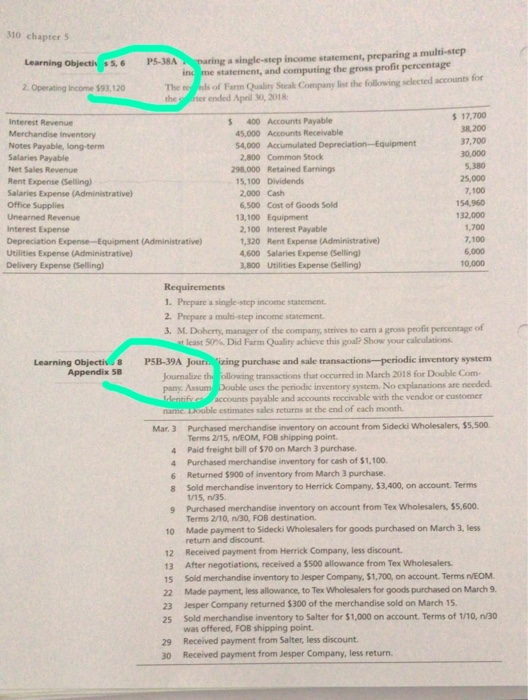

310 chapter 5 a single-step income statement, preparing a multi-step statement, and computing the gross profit percentage Learning Objectis s5,6 P5-38A 2. Operating Income $93,120 of Farm Qualiry Steak Company list the follonwing sclected accounts for the s her ended April 30, 2018 17,700 38,200 37,700 30,000 5,380 25,000 7,100 154,960 132,000 1,700 7,100 6,000 10,000 5 400 Accounts Payable Interest Revenue Merchandse inventory Notes Payable, long-term Salaries Payable Net Sales Revenue Rent Expense (Selling) Salaries Expense (Administrative) Office Supplies Unearned Revenue Interest Expense 45,000 Accounts Receivable 54,000 Accumulated Depreciation-Equipment 2,800 Common Stock 298,000 Retained Earnings 15,100 Dividends 2,000 Cash 6,500 Cost of Goods Sold 13,100 Equipment 2,100 Interest Payable 1,320 Rent Expense (Administrative) 4,600 Salaries Expense (Selling) 3,800 Utilities Expense (Selling) Utilities Expense (Administrative) Delivery Expense (Selling) 1. Prepare a single-step income statement 2. Prepare a mali-step income statement 3. M.Dohety, manager of the company, strives to earn a gross profit percentage of least 5on% Did Farm Quality achieve this goal? Show your calculations 8 P5B-39A purchase and sale transactions-periodic inventory system Journaline the following transactions thut occurred in March 2018 for Double Com- pany. Assum dentif accounts payable and accounts reccivable with the vendor or customer name Double estimates sales returns at the end of each month uses the periodic inventory system. No explanations are needed. Mar. 3 Purchased merchandise inventory on account from Sidecki Wholesalers, $5,500 Terms 2/15, rVEOM, FOB shipping point 4 Paid freight bill of $70 on March 3 purchase. Purchased merchandise inventory for cash of $1,100 4 6 Returned $900 of inventory from March 3 purchase. Sold merchandise inventory to Herrick Company, $3,400, on account. Terms 8 1/15, n/35 9 Purchased merchandise inventory on account from Tex Wholesalers, $5,600. Terms 2/10, n/30, FOB destination. 10 Made payment to Sidecki Wholesalers for goods purchased on March 3, less 12 Received payment from Herrick Company, less discount 13 After negotiations, received a 5500 allowance from Tex Wholesalers 15 Sold merchandise inventory to Jesper Company, $1,700, on account. Terms nVEOM 22 Made payment, less allowance, to Tex Wholesalers for goods purchased on March 9 23 Jesper Company returned $300 of the merchandise sold on March 15 25 Sold merchandise inventory to Salter for $1,000 on account. Terms of 1/10, n/30 return and discount was offered, FOB shipping point 29 Received payment from Salter, less discount. 30 Received payment from Jesper Company, less return