Question

3/10/22, 1:55 PM Payment Date Apr 2022 May 2022 Jun 2022 Jul 2022 Aug 2022 Sep 2022 Oct 2022 Nov 2022 Dec 2022 Jan 2023

3/10/22, 1:55 PM

Payment Date

Apr 2022 May 2022 Jun 2022 Jul 2022 Aug 2022 Sep 2022 Oct 2022 Nov 2022 Dec 2022 Jan 2023 Feb 2023 Mar 2023 Apr 2023 May 2023 Jun 2023 Jul 2023 Aug 2023 Sep 2023 Oct 2023 Nov 2023 Dec 2023 Jan 2024 Feb 2024 Mar 2024 Apr 2024 May 2024 Jun 2024 Jul 2024 Aug 2024 Sep 2024 Oct 2024 Nov 2024 Dec 2024 Jan 2025 Feb 2025 Mar 2025 Apr 2025 May 2025 Jun 2025 Jul 2025 Aug 2025 Sep 2025 Oct 2025

Payment Principal

$10,363.84 $6,613.84 $10,363.84 $6,638.64 $10,363.84 $6,663.54 $10,363.84 $6,688.53 $10,363.84 $6,713.61 $10,363.84 $6,738.78 $10,363.84 $6,764.05 $10,363.84 $6,789.42 $10,363.84 $6,814.88 $10,363.84 $6,840.44 $10,363.84 $6,866.09 $10,363.84 $6,891.84 $10,363.84 $6,917.68 $10,363.84 $6,943.62 $10,363.84 $6,969.66 $10,363.84 $6,995.80 $10,363.84 $7,022.03 $10,363.84 $7,048.36 $10,363.84 $7,074.79 $10,363.84 $7,101.32 $10,363.84 $7,127.95 $10,363.84 $7,154.68 $10,363.84 $7,181.51 $10,363.84 $7,208.44 $10,363.84 $7,235.48 $10,363.84 $7,262.61 $10,363.84 $7,289.84 $10,363.84 $7,317.18 $10,363.84 $7,344.62 $10,363.84 $7,372.16 $10,363.84 $7,399.81 $10,363.84 $7,427.56 $10,363.84 $7,455.41 $10,363.84 $7,483.37 $10,363.84 $7,511.43 $10,363.84 $7,539.60 $10,363.84 $7,567.87 $10,363.84 $7,596.25 $10,363.84 $7,624.74 $10,363.84 $7,653.33 $10,363.84 $7,682.03 $10,363.84 $7,710.84 $10,363.84 $7,739.75

Interest

$3,750.00 $3,725.20 $3,700.30 $3,675.31 $3,650.23 $3,625.06 $3,599.79 $3,574.42 $3,548.96 $3,523.41 $3,497.75 $3,472.01 $3,446.16 $3,420.22 $3,394.18 $3,368.05 $3,341.81 $3,315.48 $3,289.05 $3,262.52 $3,235.89 $3,209.16 $3,182.33 $3,155.40 $3,128.36 $3,101.23 $3,074.00 $3,046.66 $3,019.22 $2,991.68 $2,964.03 $2,936.28 $2,908.43 $2,880.47 $2,852.41 $2,824.24 $2,795.97 $2,767.59 $2,739.10 $2,710.51 $2,681.81 $2,653.00 $2,624.09

Total Interest

$3,750.00 $7,475.20 $11,175.50 $14,850.82 $18,501.05 $22,126.11 $25,725.89 $29,300.31 $32,849.27 $36,372.68 $39,870.43 $43,342.44 $46,788.60 $50,208.82 $53,603.00 $56,971.05 $60,312.86 $63,628.34 $66,917.38 $70,179.90 $73,415.79 $76,624.94 $79,807.27 $82,962.67 $86,091.03 $89,192.26 $92,266.26 $95,312.92 $98,332.14 $101,323.82 $104,287.85 $107,224.13 $110,132.56 $113,013.03 $115,865.44 $118,689.68 $121,485.65 $124,253.24 $126,992.34 $129,702.85 $132,384.66 $135,037.66 $137,661.75

Balance

$993,386.16 $986,747.52 $980,083.98 $973,395.45 $966,681.84 $959,943.06 $953,179.01 $946,389.59 $939,574.71 $932,734.27 $925,868.18 $918,976.35 $912,058.67 $905,115.05 $898,145.39 $891,149.59 $884,127.56 $877,079.20 $870,004.41 $862,903.08 $855,775.13 $848,620.44 $841,438.93 $834,230.48 $826,995.01 $819,732.40 $812,442.55 $805,125.37 $797,780.75 $790,408.59 $783,008.78 $775,581.22 $768,125.81 $760,642.44 $753,131.01 $745,591.41 $738,023.54 $730,427.29 $722,802.55 $715,149.22 $707,467.18 $699,756.35 $692,016.59

1/3

3/10/22, 1:55 PM

Payment Date

Nov 2025 Dec 2025 Jan 2026 Feb 2026 Mar 2026 Apr 2026 May 2026 Jun 2026 Jul 2026 Aug 2026 Sep 2026 Oct 2026 Nov 2026 Dec 2026 Jan 2027 Feb 2027 Mar 2027 Apr 2027 May 2027 Jun 2027 Jul 2027 Aug 2027 Sep 2027 Oct 2027 Nov 2027 Dec 2027 Jan 2028 Feb 2028 Mar 2028 Apr 2028 May 2028 Jun 2028 Jul 2028 Aug 2028 Sep 2028 Oct 2028 Nov 2028 Dec 2028 Jan 2029 Feb 2029 Mar 2029 Apr 2029 May 2029

Payment Principal

$10,363.84 $7,768.78 $10,363.84 $7,797.91 $10,363.84 $7,827.15 $10,363.84 $7,856.51 $10,363.84 $7,885.97 $10,363.84 $7,915.54 $10,363.84 $7,945.22 $10,363.84 $7,975.02 $10,363.84 $8,004.92 $10,363.84 $8,034.94 $10,363.84 $8,065.07 $10,363.84 $8,095.32 $10,363.84 $8,125.67 $10,363.84 $8,156.15 $10,363.84 $8,186.73 $10,363.84 $8,217.43 $10,363.84 $8,248.25 $10,363.84 $8,279.18 $10,363.84 $8,310.23 $10,363.84 $8,341.39 $10,363.84 $8,372.67 $10,363.84 $8,404.07 $10,363.84 $8,435.58 $10,363.84 $8,467.22 $10,363.84 $8,498.97 $10,363.84 $8,530.84 $10,363.84 $8,562.83 $10,363.84 $8,594.94 $10,363.84 $8,627.17 $10,363.84 $8,659.52 $10,363.84 $8,692.00 $10,363.84 $8,724.59 $10,363.84 $8,757.31 $10,363.84 $8,790.15 $10,363.84 $8,823.11 $10,363.84 $8,856.20 $10,363.84 $8,889.41 $10,363.84 $8,922.74 $10,363.84 $8,956.20 $10,363.84 $8,989.79 $10,363.84 $9,023.50 $10,363.84 $9,057.34 $10,363.84 $9,091.30

Interest

$2,595.06 $2,565.93 $2,536.69 $2,507.34 $2,477.87 $2,448.30 $2,418.62 $2,388.82 $2,358.92 $2,328.90 $2,298.77 $2,268.52 $2,238.17 $2,207.69 $2,177.11 $2,146.41 $2,115.59 $2,084.66 $2,053.62 $2,022.45 $1,991.17 $1,959.77 $1,928.26 $1,896.63 $1,864.87 $1,833.00 $1,801.01 $1,768.90 $1,736.67 $1,704.32 $1,671.85 $1,639.25 $1,606.53 $1,573.69 $1,540.73 $1,507.64 $1,474.43 $1,441.10 $1,407.64 $1,374.05 $1,340.34 $1,306.50 $1,272.54

Total Interest

$140,256.81 $142,822.74 $145,359.43 $147,866.76 $150,344.64 $152,792.94 $155,211.55 $157,600.38 $159,959.29 $162,288.19 $164,586.96 $166,855.48 $169,093.65 $171,301.34 $173,478.45 $175,624.86 $177,740.46 $179,825.12 $181,878.73 $183,901.19 $185,892.36 $187,852.13 $189,780.39 $191,677.02 $193,541.89 $195,374.89 $197,175.91 $198,944.81 $200,681.48 $202,385.80 $204,057.64 $205,696.89 $207,303.42 $208,877.12 $210,417.85 $211,925.49 $213,399.92 $214,841.02 $216,248.66 $217,622.71 $218,963.05 $220,269.55 $221,542.09

Balance

$684,247.81 $676,449.90 $668,622.75 $660,766.24 $652,880.27 $644,964.73 $637,019.51 $629,044.49 $621,039.57 $613,004.63 $604,939.55 $596,844.24 $588,718.56 $580,562.41 $572,375.68 $564,158.25 $555,910.00 $547,630.82 $539,320.60 $530,979.21 $522,606.54 $514,202.48 $505,766.89 $497,299.68 $488,800.71 $480,269.87 $471,707.04 $463,112.10 $454,484.93 $445,825.41 $437,133.42 $428,408.83 $419,651.52 $410,861.37 $402,038.26 $393,182.06 $384,292.65 $375,369.91 $366,413.71 $357,423.92 $348,400.42 $339,343.08 $330,251.77

2/3

3/10/22, 1:55 PM

Payment Date

Jun 2029 Jul 2029 Aug 2029 Sep 2029 Oct 2029 Nov 2029 Dec 2029 Jan 2030 Feb 2030 Mar 2030 Apr 2030 May 2030 Jun 2030 Jul 2030 Aug 2030 Sep 2030 Oct 2030 Nov 2030 Dec 2030 Jan 2031 Feb 2031 Mar 2031 Apr 2031 May 2031 Jun 2031 Jul 2031 Aug 2031 Sep 2031 Oct 2031 Nov 2031 Dec 2031 Jan 2032 Feb 2032 Mar 2032

Payment Principal

$10,363.84 $9,125.40 $10,363.84 $9,159.62 $10,363.84 $9,193.97 $10,363.84 $9,228.44 $10,363.84 $9,263.05 $10,363.84 $9,297.79 $10,363.84 $9,332.65 $10,363.84 $9,367.65 $10,363.84 $9,402.78 $10,363.84 $9,438.04 $10,363.84 $9,473.43 $10,363.84 $9,508.96 $10,363.84 $9,544.62 $10,363.84 $9,580.41 $10,363.84 $9,616.33 $10,363.84 $9,652.40 $10,363.84 $9,688.59 $10,363.84 $9,724.92 $10,363.84 $9,761.39 $10,363.84 $9,798.00 $10,363.84 $9,834.74 $10,363.84 $9,871.62 $10,363.84 $9,908.64 $10,363.84 $9,945.80 $10,363.84 $9,983.09 $10,363.84 $10,020.53 $10,363.84 $10,058.11 $10,363.84 $10,095.83 $10,363.84 $10,133.68 $10,363.84 $10,171.69 $10,363.84 $10,209.83 $10,363.84 $10,248.12 $10,363.84 $10,286.55 $10,363.84 $10,325.12

Interest Total Interest

$1,238.44 $222,780.53 $1,204.22 $223,984.76 $1,169.88 $225,154.63 $1,135.40 $226,290.03 $1,100.79 $227,390.82 $1,066.05 $228,456.88 $1,031.19 $229,488.06 $996.19 $230,484.25 $961.06 $231,445.32 $925.80 $232,371.12 $890.41 $233,261.53 $854.88 $234,116.41 $819.23 $234,935.64 $783.43 $235,719.07 $747.51 $236,466.57 $711.44 $237,178.02 $675.25 $237,853.27 $638.92 $238,492.18 $602.45 $239,094.63 $565.84 $239,660.47 $529.10 $240,189.57 $492.22 $240,681.79 $455.20 $241,137.00 $418.04 $241,555.04 $380.75 $241,935.79 $343.31 $242,279.10 $305.73 $242,584.83 $268.02 $242,852.85 $230.16 $243,083.00 $192.15 $243,275.16 $154.01 $243,429.17 $115.72 $243,544.89 $77.29 $243,622.19 $38.72 $243,660.91

Balance

$321,126.38 $311,966.76 $302,772.79 $293,544.35 $284,281.30 $274,983.52 $265,650.86 $256,283.21 $246,880.43 $237,442.39 $227,968.96 $218,460.01 $208,915.39 $199,334.98 $189,718.65 $180,066.25 $170,377.66 $160,652.73 $150,891.34 $141,093.34 $131,258.60 $121,386.98 $111,478.34 $101,532.54 $91,549.45 $81,528.92 $71,470.81 $61,374.99 $51,241.30 $41,069.62 $30,859.79 $20,611.67 $10,325.12 $0.00

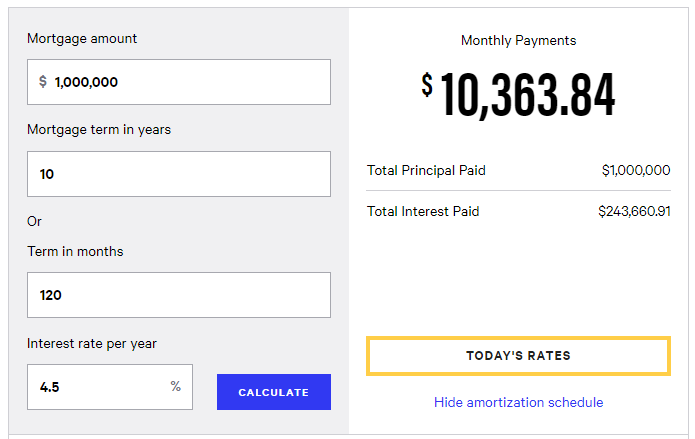

Please review the amortization table provided in the course resources and the screenshot below. To be clear, you are not using Excel to construct a new amortization schedule. You should use the screenshot below along with the already constructed amortization table in the course resources for this week. Please answer the following questions:

What is the dollar amount, interest rate and term of the contemplated loan?

How much interest is paid over the life of the loan?

How much in total will be paid over the life of the loan?

On the amortization table, the monthly payment is the same. When you analyze the April 2022 payment (principal and interest components), and compare to March 2032, what do you observe? What is different and why?

If the loan was paid in full in March 2027 (after the March 2027 scheduled payment is made), what would the total interest paid be and how much savings would occur by paying off before the maturity date?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started