Answered step by step

Verified Expert Solution

Question

1 Approved Answer

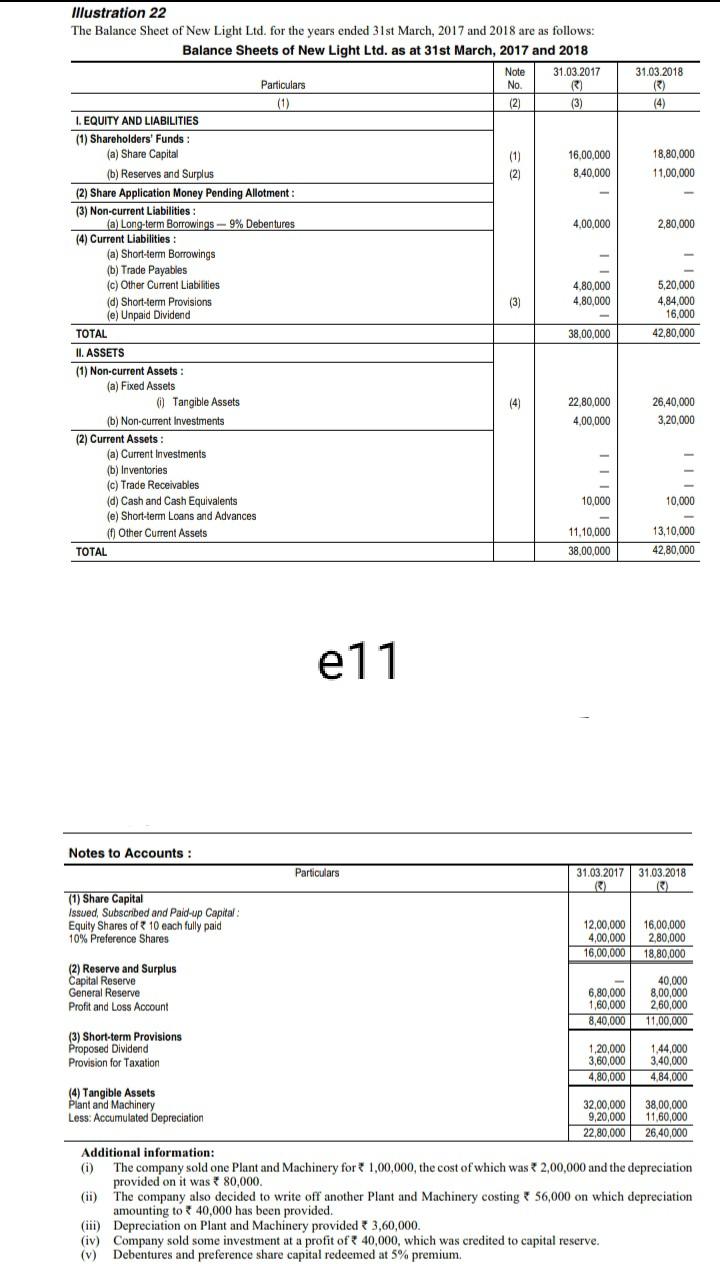

31.03.2018 (3) (4) ( 18,80,000 11,00,000 2,80,000 Illustration 22 The Balance Sheet of New Light Ltd. for the years ended 31st March, 2017 and 2018

31.03.2018 (3) (4) ( 18,80,000 11,00,000 2,80,000 Illustration 22 The Balance Sheet of New Light Ltd. for the years ended 31st March, 2017 and 2018 are as follows: Balance Sheets of New Light Ltd. as at 31st March, 2017 and 2018 Note 31.03.2017 Particulars No. R) (1) (2) (3) LEQUITY AND LIABILITIES (1) Shareholders' Funds: (a) Share Capital (1) 16,00,000 (b) Reserves and Surplus (2) 8,40,000 (2) Share Application Money Pending Allotment: (3) Non-current Liabilities: (a) Long-term Borrowings -9% Debentures 4,00,000 (4) Current Liabilities: (a) Short-term Borrowings (b) Trade Payables (c) Other Current Liabilities 4,80,000 (d) Short-term Provisions (3) 4,80,000 (e) Unpaid Dividend TOTAL 38,00,000 II. ASSETS (1) Non-current Assets (a) Fixed Assets () Tangible Assets (4) 22,80,000 (b) Non-current Investments 4,00,000 (2) Current Assets : (a) Current Investments (b) Inventories (c) Trade Receivables (d) Cash and Cash Equivalents 10,000 (e) Short-term Loans and Advances Other Current Assets 11.10,000 TOTAL 38,00,000 5,20,000 4,84,000 16,000 42,80,000 26,40,000 3,20,000 10,000 13,10,000 42,80,000 e11 Notes to Accounts: Particulars 31.03.2017 31.03.2018 (1) Share Capital Issued, Subscribed and Paid-up Capital Equity Shares of 10 each fully paid 12,00,000 16,00,000 10% Preference Shares 4,00,000 2,80,000 16,00,000 18,80,000 (2) Reserve and Surplus Capital Reserve 40,000 General Reserve 6,80,000 8,00,000 Profit and Loss Account 1,60,000 260,000 8,40,000 11,00,000 (3) Short-term Provisions Proposed Dividend 1,20,000 1,44,000 Provision for Taxation 3,60,000 3.40.000 4,80,000 4,84,000 (4) Tangible Assets Plant and Machinery 32,00,000 38,00,000 Less: Accumulated Depreciation 9,20,000 11.60,000 22,80,000 26,40,000 Additional information: (i) The company sold one plant and Machinery for 1,00,000, the cost of which was 2,00,000 and the depreciation provided on it was 80,000. (ii) The company also decided to write off another Plant and Machinery costing 56,000 on which depreciation amounting to 40,000 has been provided. (iii) Depreciation on Plant and Machinery provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started