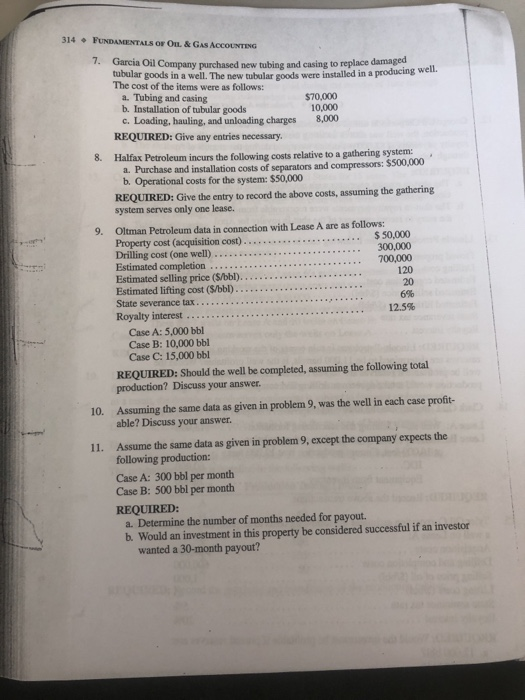

314FuNDAMENTALS oF OL.& GAS ACCOUNTENG 7. Garcia Oil Company purchased new tubing and casing to replace damaged tubular goods in a well. The new tubular goods were installed in a producing we well. a. Tubing and casing b. Installation of tubular goods c. Loading, hauling, and unloading charges $70,000 10,000 8,000 REQUIRED: Give any entries necessary 8. Halfax Petroleum incurs the following costs relative to a gathering system: a. Purchase and installation costs of separators and compressors: $ 500,000 b. Operational costs for the system: $50,000 REQUIRED: Give the entry to record the above costs, assuming the gathering system serves only one lease. Oltman Petroleum data in connection with Lease A are as follows: Drilling cost (one well) 9. .. 300,000 Estimated completion 120 20 6% 12.5% (Sobl State severance tax. Royalty interest Case A: 5,000 bbl Case B: 10,000 bbl Case C: 15,000 bbl REQUIRED: Should the well be completed, assuming the following total production? Discuss your answer Assuming the same data as given in problem 9, was the well in each case profit- able? Discuss your answer Assume the same data as given in problem 9, except the company expects the following production: Case A: 300 bbl per month Case B: 500 bbl per month REQUIRED: 10. 11. a. Determine the number of months needed for payout. b. Would an investment in this property be considered successful if an investor wanted a 30-month payout? 314FuNDAMENTALS oF OL.& GAS ACCOUNTENG 7. Garcia Oil Company purchased new tubing and casing to replace damaged tubular goods in a well. The new tubular goods were installed in a producing we well. a. Tubing and casing b. Installation of tubular goods c. Loading, hauling, and unloading charges $70,000 10,000 8,000 REQUIRED: Give any entries necessary 8. Halfax Petroleum incurs the following costs relative to a gathering system: a. Purchase and installation costs of separators and compressors: $ 500,000 b. Operational costs for the system: $50,000 REQUIRED: Give the entry to record the above costs, assuming the gathering system serves only one lease. Oltman Petroleum data in connection with Lease A are as follows: Drilling cost (one well) 9. .. 300,000 Estimated completion 120 20 6% 12.5% (Sobl State severance tax. Royalty interest Case A: 5,000 bbl Case B: 10,000 bbl Case C: 15,000 bbl REQUIRED: Should the well be completed, assuming the following total production? Discuss your answer Assuming the same data as given in problem 9, was the well in each case profit- able? Discuss your answer Assume the same data as given in problem 9, except the company expects the following production: Case A: 300 bbl per month Case B: 500 bbl per month REQUIRED: 10. 11. a. Determine the number of months needed for payout. b. Would an investment in this property be considered successful if an investor wanted a 30-month payout