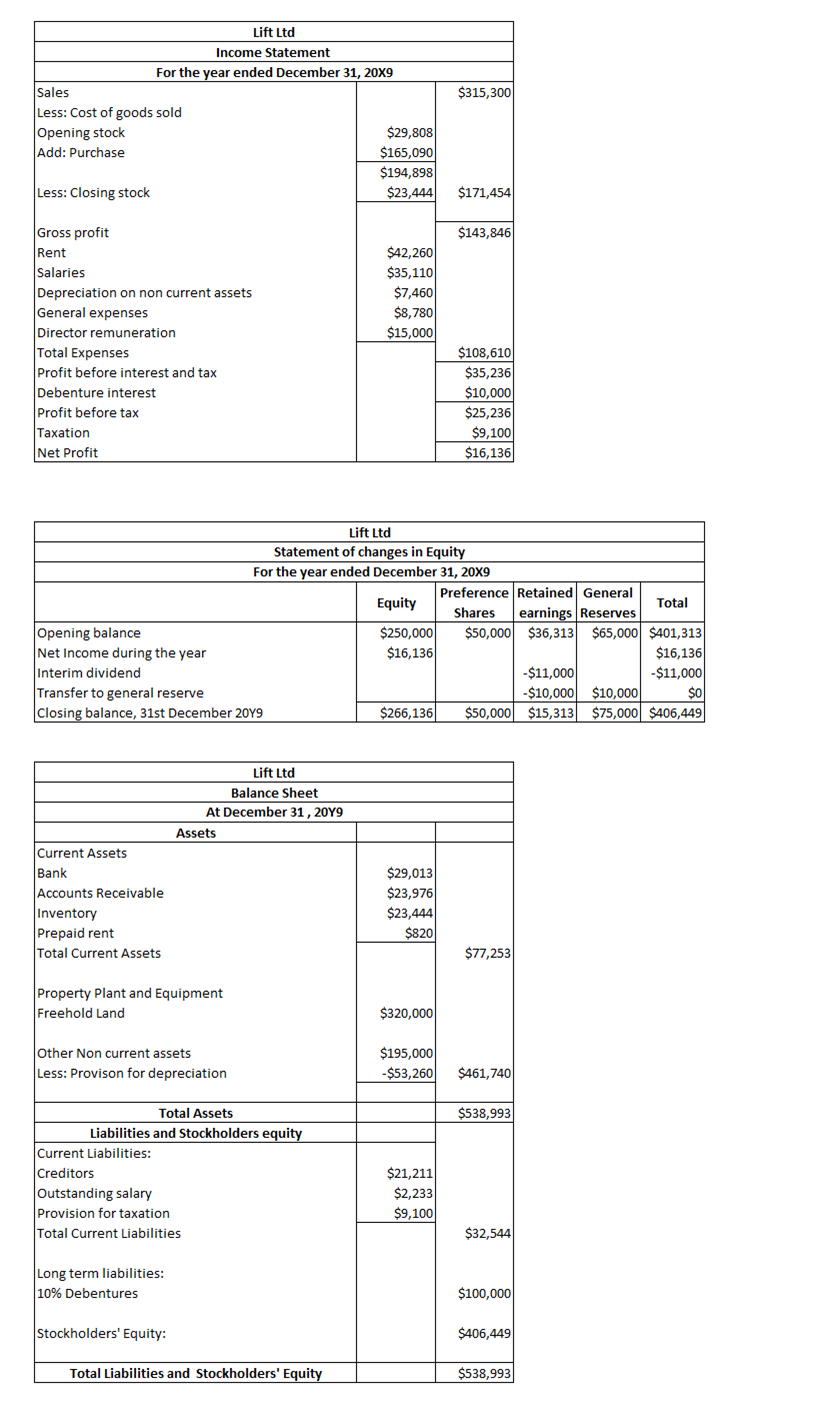

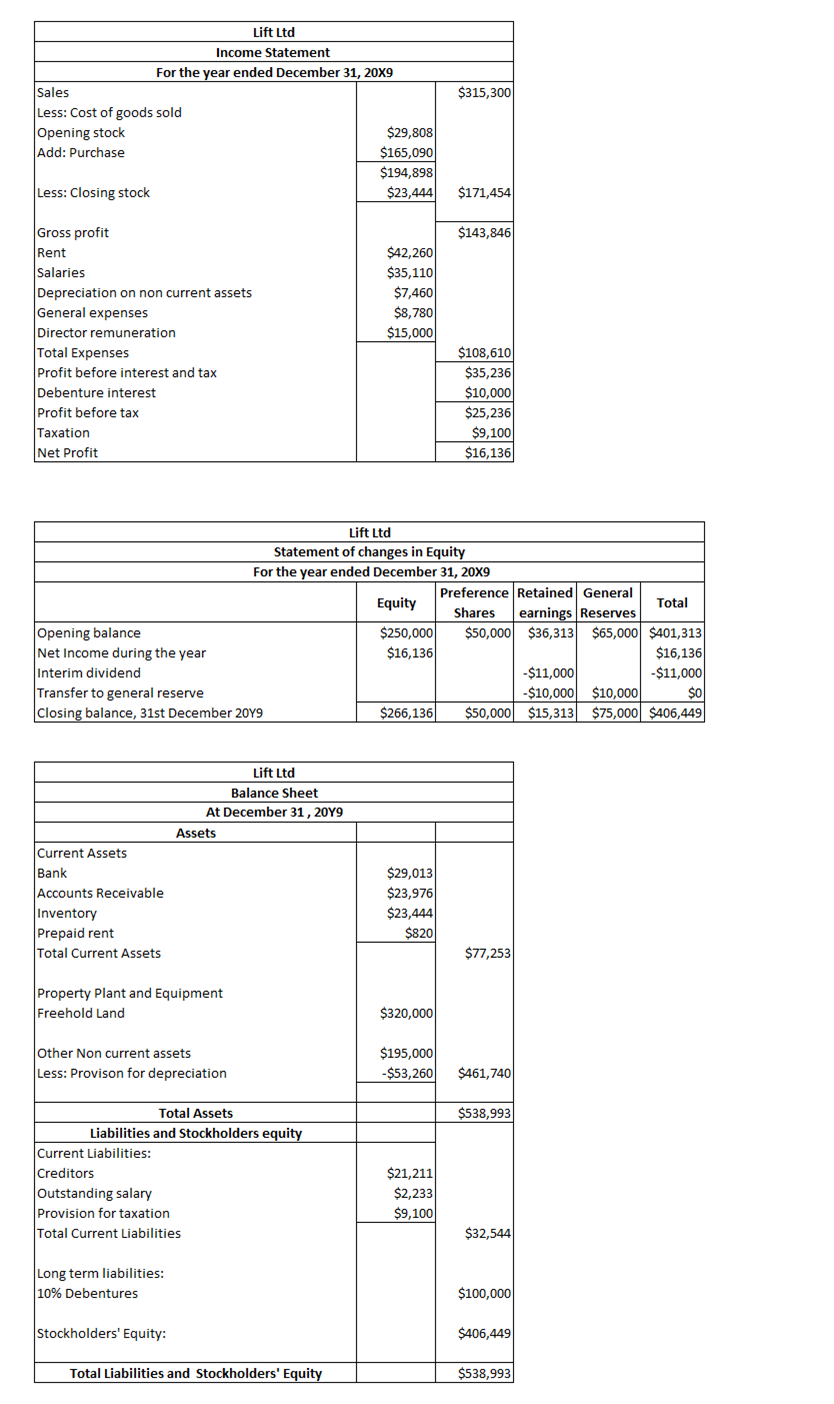

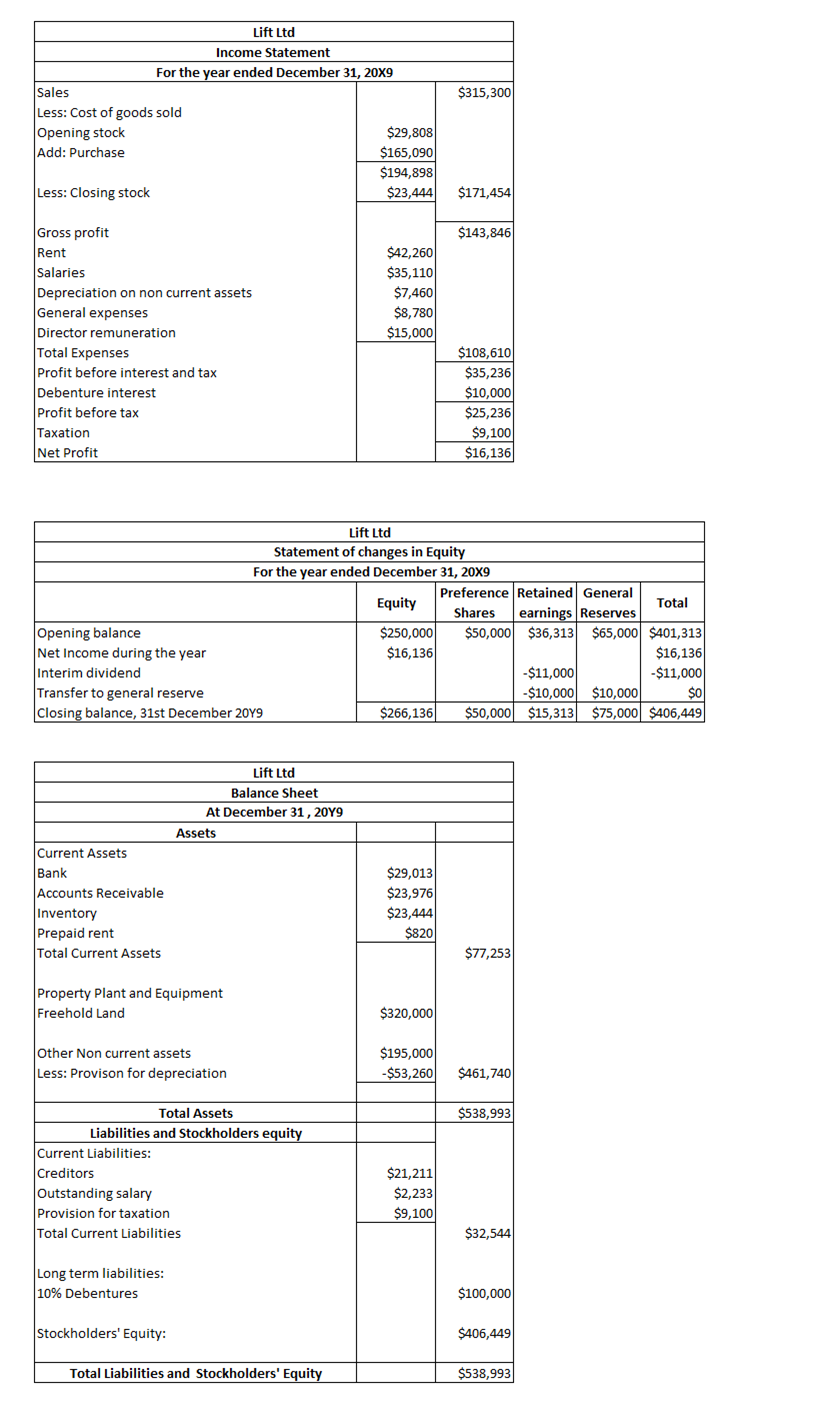

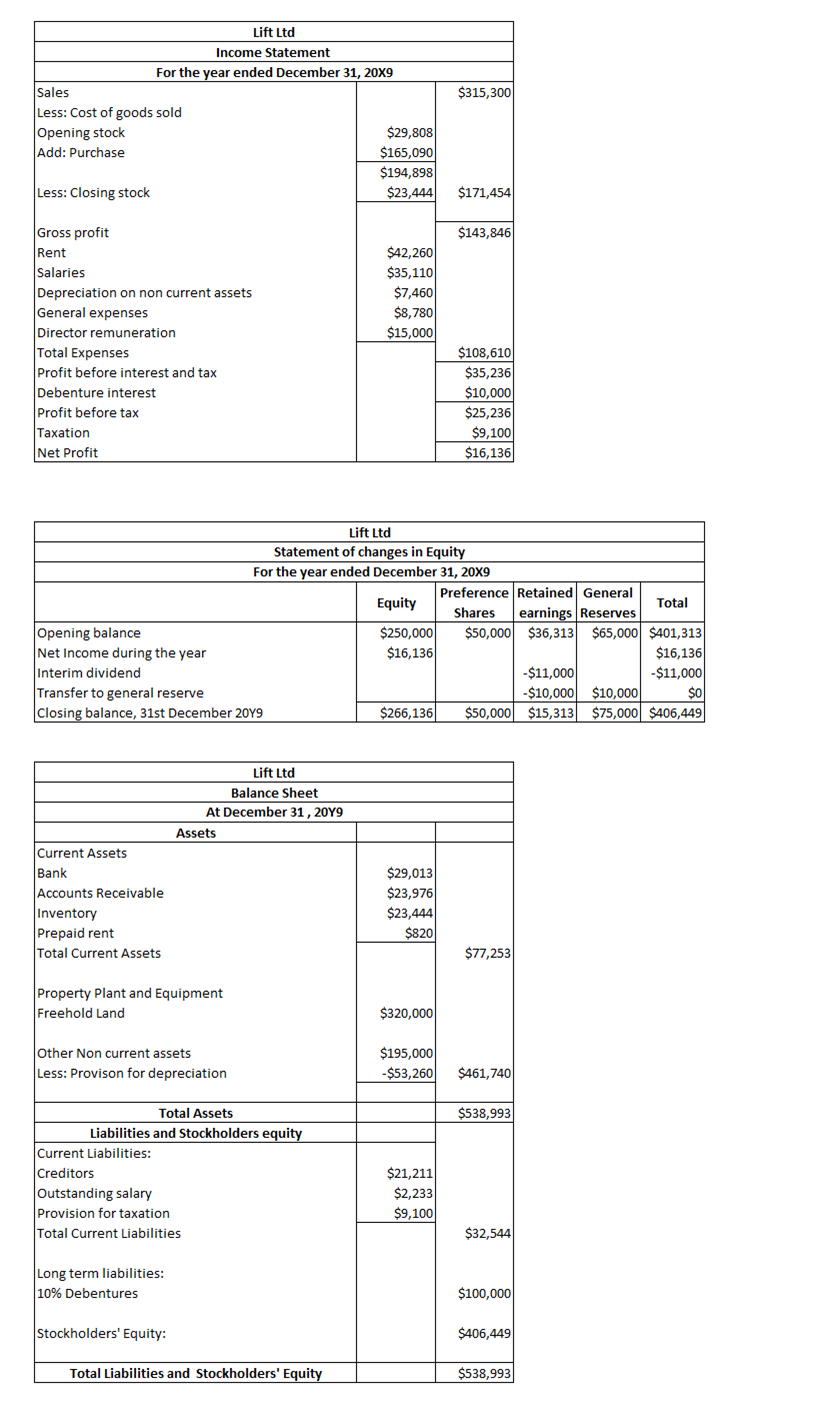

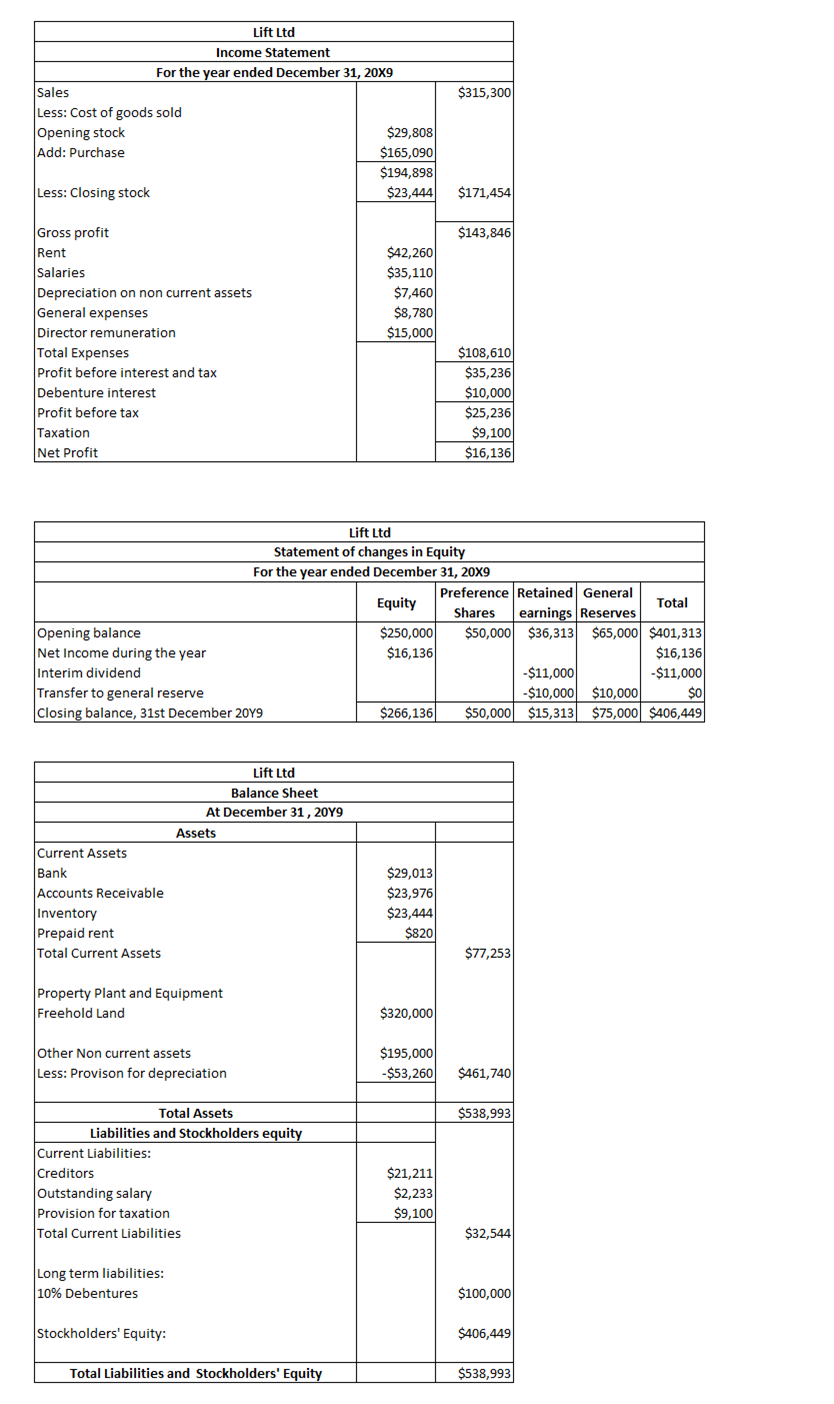

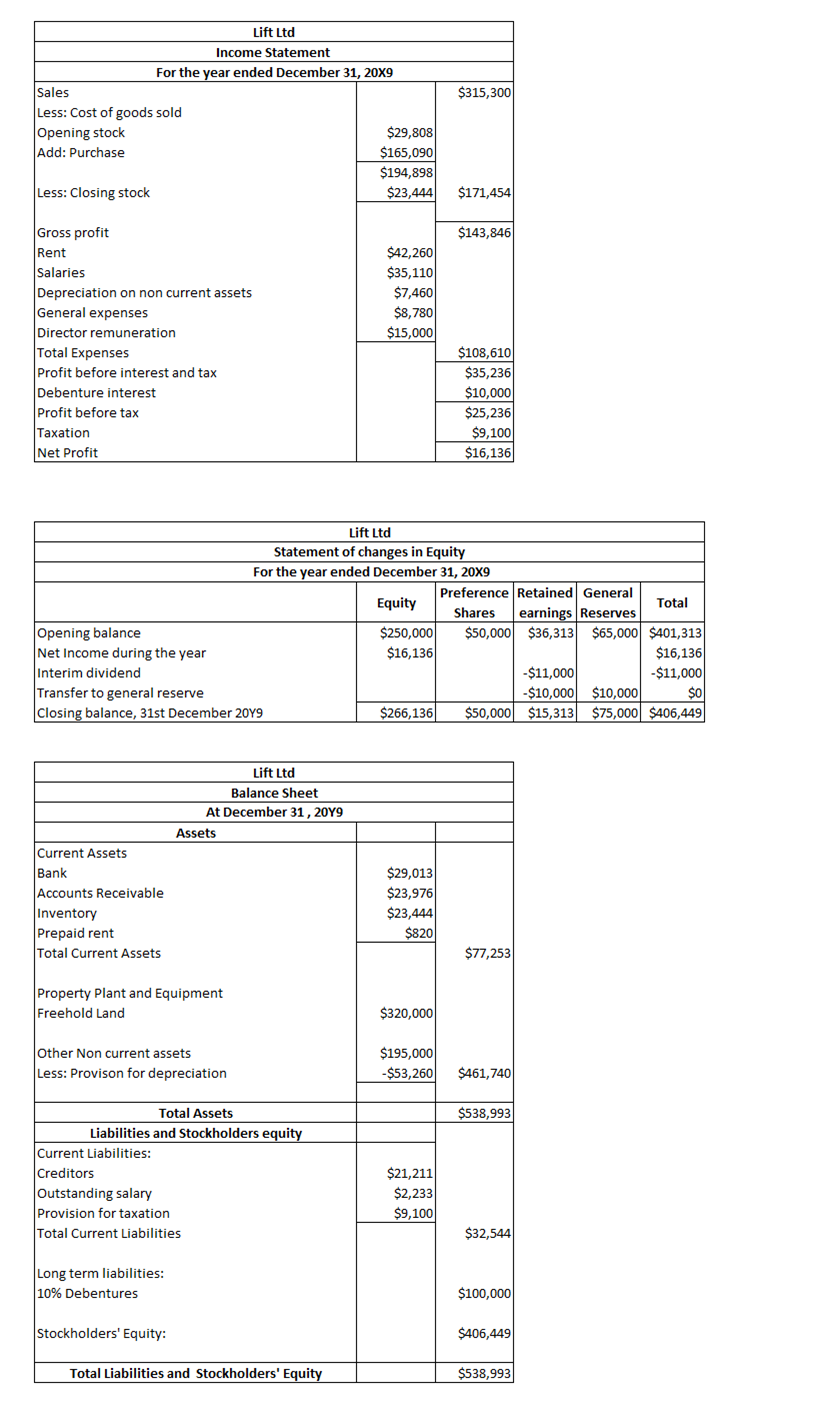

$315,300 Lift Ltd Income Statement For the year ended December 31, 20X9 Sales Less: Cost of goods sold Opening stock $29,808 Add: Purchase $165,090 $194,898 Less: Closing stock $23,444 $171,454 $143,846 $42,260 $35,110 $7,460 $8,780 $15,000 Gross profit Rent Salaries Depreciation on non current assets General expenses Director remuneration Total Expenses Profit before interest and tax Debenture interest Profit before tax Taxation Net Profit $108,610 $35, 236 $10,000 $25,236 $9,100 $16,136 Lift Ltd Statement of changes in Equity For the year ended December 31, 20X9 Preference Retained General Equity Total Shares earnings Reserves Opening balance $250,000 $50,000 $36,313 $65,000 $401,313 Net Income during the year $16,136 $16,136 Interim dividend $11,000 -$11,000 Transfer to general reserve $10,000 $10,000 Closing balance, 31st December 2049 | $266,136 $50,000 $15,313 $75,000 $406,449 Lift Ltd Balance Sheet At December 31, 2049 Assets Current Assets Bank Accounts Receivable Inventory Prepaid rent Total Current Assets $29,013 $23,976 $23,444 $820 $77,253 Property Plant and Equipment Freehold Land $320,000 Other Non current assets Less: Provison for depreciation $195,000 - $53,260 $461,740 $538,993 Total Assets Liabilities and Stockholders equity Current Liabilities: Creditors Outstanding salary Provision for taxation Total Current Liabilities $21,211 $2,233 $9,100 $32,544 Long term liabilities: 10% Debentures $100,000 Stockholders' Equity: $406,449 Total Liabilities and Stockholders' Equity $538,993 $315,300 Lift Ltd Income Statement For the year ended December 31, 20X9 Sales Less: Cost of goods sold Opening stock $29,808 Add: Purchase $165,090 $194,898 Less: Closing stock $23,444 $171,454 $143,846 $42,260 $35,110 $7,460 $8,780 $15,000 Gross profit Rent Salaries Depreciation on non current assets General expenses Director remuneration Total Expenses Profit before interest and tax Debenture interest Profit before tax Taxation Net Profit $108,610 $35, 236 $10,000 $25,236 $9,100 $16,136 Lift Ltd Statement of changes in Equity For the year ended December 31, 20X9 Preference Retained General Equity Total Shares earnings Reserves Opening balance $250,000 $50,000 $36,313 $65,000 $401,313 Net Income during the year $16,136 $16,136 Interim dividend $11,000 -$11,000 Transfer to general reserve $10,000 $10,000 Closing balance, 31st December 2049 | $266,136 $50,000 $15,313 $75,000 $406,449 Lift Ltd Balance Sheet At December 31, 2049 Assets Current Assets Bank Accounts Receivable Inventory Prepaid rent Total Current Assets $29,013 $23,976 $23,444 $820 $77,253 Property Plant and Equipment Freehold Land $320,000 Other Non current assets Less: Provison for depreciation $195,000 - $53,260 $461,740 $538,993 Total Assets Liabilities and Stockholders equity Current Liabilities: Creditors Outstanding salary Provision for taxation Total Current Liabilities $21,211 $2,233 $9,100 $32,544 Long term liabilities: 10% Debentures $100,000 Stockholders' Equity: $406,449 Total Liabilities and Stockholders' Equity $538,993 $315,300 Lift Ltd Income Statement For the year ended December 31, 20X9 Sales Less: Cost of goods sold Opening stock $29,808 Add: Purchase $165,090 $194,898 Less: Closing stock $23,444 $171,454 $143,846 $42,260 $35,110 $7,460 $8,780 $15,000 Gross profit Rent Salaries Depreciation on non current assets General expenses Director remuneration Total Expenses Profit before interest and tax Debenture interest Profit before tax Taxation Net Profit $108,610 $35, 236 $10,000 $25,236 $9,100 $16,136 Lift Ltd Statement of changes in Equity For the year ended December 31, 20X9 Preference Retained General Equity Total Shares earnings Reserves Opening balance $250,000 $50,000 $36,313 $65,000 $401,313 Net Income during the year $16,136 $16,136 Interim dividend $11,000 -$11,000 Transfer to general reserve $10,000 $10,000 Closing balance, 31st December 2049 | $266,136 $50,000 $15,313 $75,000 $406,449 Lift Ltd Balance Sheet At December 31, 2049 Assets Current Assets Bank Accounts Receivable Inventory Prepaid rent Total Current Assets $29,013 $23,976 $23,444 $820 $77,253 Property Plant and Equipment Freehold Land $320,000 Other Non current assets Less: Provison for depreciation $195,000 - $53,260 $461,740 $538,993 Total Assets Liabilities and Stockholders equity Current Liabilities: Creditors Outstanding salary Provision for taxation Total Current Liabilities $21,211 $2,233 $9,100 $32,544 Long term liabilities: 10% Debentures $100,000 Stockholders' Equity: $406,449 Total Liabilities and Stockholders' Equity $538,993 $315,300 Lift Ltd Income Statement For the year ended December 31, 20X9 Sales Less: Cost of goods sold Opening stock $29,808 Add: Purchase $165,090 $194,898 Less: Closing stock $23,444 $171,454 $143,846 $42,260 $35,110 $7,460 $8,780 $15,000 Gross profit Rent Salaries Depreciation on non current assets General expenses Director remuneration Total Expenses Profit before interest and tax Debenture interest Profit before tax Taxation Net Profit $108,610 $35, 236 $10,000 $25,236 $9,100 $16,136 Lift Ltd Statement of changes in Equity For the year ended December 31, 20X9 Preference Retained General Equity Total Shares earnings Reserves Opening balance $250,000 $50,000 $36,313 $65,000 $401,313 Net Income during the year $16,136 $16,136 Interim dividend $11,000 -$11,000 Transfer to general reserve $10,000 $10,000 Closing balance, 31st December 2049 | $266,136 $50,000 $15,313 $75,000 $406,449 Lift Ltd Balance Sheet At December 31, 2049 Assets Current Assets Bank Accounts Receivable Inventory Prepaid rent Total Current Assets $29,013 $23,976 $23,444 $820 $77,253 Property Plant and Equipment Freehold Land $320,000 Other Non current assets Less: Provison for depreciation $195,000 - $53,260 $461,740 $538,993 Total Assets Liabilities and Stockholders equity Current Liabilities: Creditors Outstanding salary Provision for taxation Total Current Liabilities $21,211 $2,233 $9,100 $32,544 Long term liabilities: 10% Debentures $100,000 Stockholders' Equity: $406,449 Total Liabilities and Stockholders' Equity $538,993 $315,300 Lift Ltd Income Statement For the year ended December 31, 20X9 Sales Less: Cost of goods sold Opening stock $29,808 Add: Purchase $165,090 $194,898 Less: Closing stock $23,444 $171,454 $143,846 $42,260 $35,110 $7,460 $8,780 $15,000 Gross profit Rent Salaries Depreciation on non current assets General expenses Director remuneration Total Expenses Profit before interest and tax Debenture interest Profit before tax Taxation Net Profit $108,610 $35, 236 $10,000 $25,236 $9,100 $16,136 Lift Ltd Statement of changes in Equity For the year ended December 31, 20X9 Preference Retained General Equity Total Shares earnings Reserves Opening balance $250,000 $50,000 $36,313 $65,000 $401,313 Net Income during the year $16,136 $16,136 Interim dividend $11,000 -$11,000 Transfer to general reserve $10,000 $10,000 Closing balance, 31st December 2049 | $266,136 $50,000 $15,313 $75,000 $406,449 Lift Ltd Balance Sheet At December 31, 2049 Assets Current Assets Bank Accounts Receivable Inventory Prepaid rent Total Current Assets $29,013 $23,976 $23,444 $820 $77,253 Property Plant and Equipment Freehold Land $320,000 Other Non current assets Less: Provison for depreciation $195,000 - $53,260 $461,740 $538,993 Total Assets Liabilities and Stockholders equity Current Liabilities: Creditors Outstanding salary Provision for taxation Total Current Liabilities $21,211 $2,233 $9,100 $32,544 Long term liabilities: 10% Debentures $100,000 Stockholders' Equity: $406,449 Total Liabilities and Stockholders' Equity $538,993 $315,300 Lift Ltd Income Statement For the year ended December 31, 20X9 Sales Less: Cost of goods sold Opening stock $29,808 Add: Purchase $165,090 $194,898 Less: Closing stock $23,444 $171,454 $143,846 $42,260 $35,110 $7,460 $8,780 $15,000 Gross profit Rent Salaries Depreciation on non current assets General expenses Director remuneration Total Expenses Profit before interest and tax Debenture interest Profit before tax Taxation Net Profit $108,610 $35, 236 $10,000 $25,236 $9,100 $16,136 Lift Ltd Statement of changes in Equity For the year ended December 31, 20X9 Preference Retained General Equity Total Shares earnings Reserves Opening balance $250,000 $50,000 $36,313 $65,000 $401,313 Net Income during the year $16,136 $16,136 Interim dividend $11,000 -$11,000 Transfer to general reserve $10,000 $10,000 Closing balance, 31st December 2049 | $266,136 $50,000 $15,313 $75,000 $406,449 Lift Ltd Balance Sheet At December 31, 2049 Assets Current Assets Bank Accounts Receivable Inventory Prepaid rent Total Current Assets $29,013 $23,976 $23,444 $820 $77,253 Property Plant and Equipment Freehold Land $320,000 Other Non current assets Less: Provison for depreciation $195,000 - $53,260 $461,740 $538,993 Total Assets Liabilities and Stockholders equity Current Liabilities: Creditors Outstanding salary Provision for taxation Total Current Liabilities $21,211 $2,233 $9,100 $32,544 Long term liabilities: 10% Debentures $100,000 Stockholders' Equity: $406,449 Total Liabilities and Stockholders' Equity $538,993