Answered step by step

Verified Expert Solution

Question

1 Approved Answer

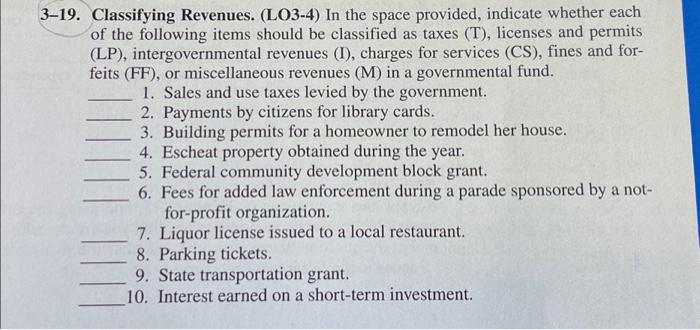

3-19. Classifying Revenues. (LO3-4) In the space provided, indicate whether each of the following items should be classified as taxes (T), licenses and permits (LP),

3-19. Classifying Revenues. (LO3-4) In the space provided, indicate whether each of the following items should be classified as taxes (T), licenses and permits (LP), intergovernmental revenues (I), charges for services (CS), fines and for- feits (FF), or miscellaneous revenues (M) in a governmental fund. 1. Sales and use taxes levied by the government. 2. Payments by citizens for library cards. 3. Building permits for a homeowner to remodel her house. 4. Escheat property obtained during the year. 5. Federal community development block grant. 6. Fees for added law enforcement during a parade sponsored by a not- for-profit organization. 7. Liquor license issued to a local restaurant. 8. Parking tickets. 9. State transportation grant. 10. Interest earned on a short-term investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started