Answered step by step

Verified Expert Solution

Question

1 Approved Answer

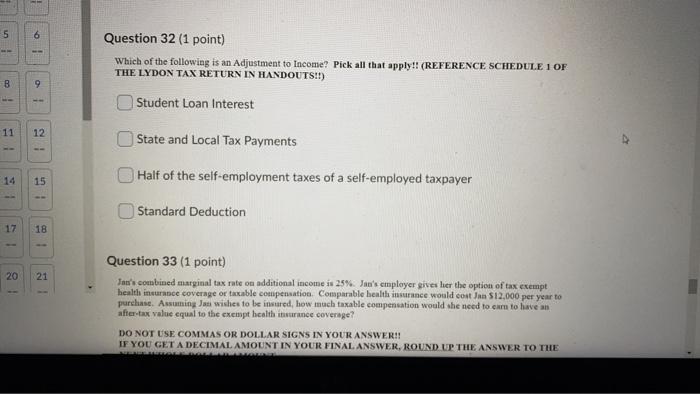

32 1 5 ! Question 32 (1 point) Which of the following is an Adjustment to Income? Pick all that apply!! (REFERENCE SCHEDULE 1 OF

32

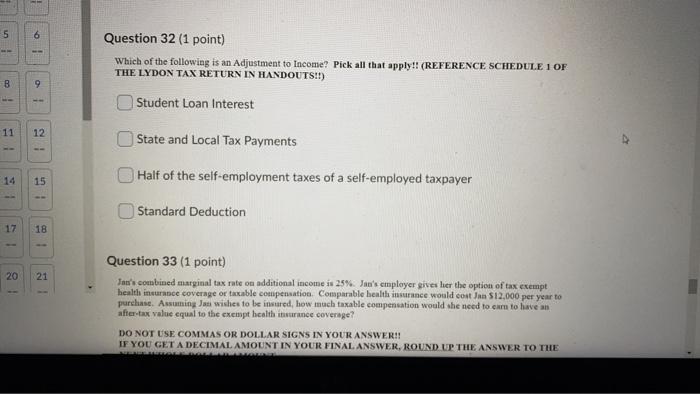

1 5 ! Question 32 (1 point) Which of the following is an Adjustment to Income? Pick all that apply!! (REFERENCE SCHEDULE 1 OF THE LYDON TAX RETURN IN HANDOUTS!!) B 9 Student Loan Interest 11 12 State and Local Tax Payments 15 Half of the self-employment taxes of a self-employed taxpayer Standard Deduction 17 18 20 21 Question 33 (1 point) Jan's combined marginal tax rate on additional income is 25% Jau's employer gives lier the option of tax exempt health insurance coverage or taxable compensation Comparable health insurance would cost Jan $12,000 per year to purchase. Asuming Jan wishes to be insured, how much taxable compensation would she need to em to have an after-tax value equal to the exempt health insurance coverage? DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!! IF YOU GET A DECIMAL AMOUNT IN YOUR FINAL ANSWER, ROUND UP THE ANSWER TO THE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started