Answered step by step

Verified Expert Solution

Question

1 Approved Answer

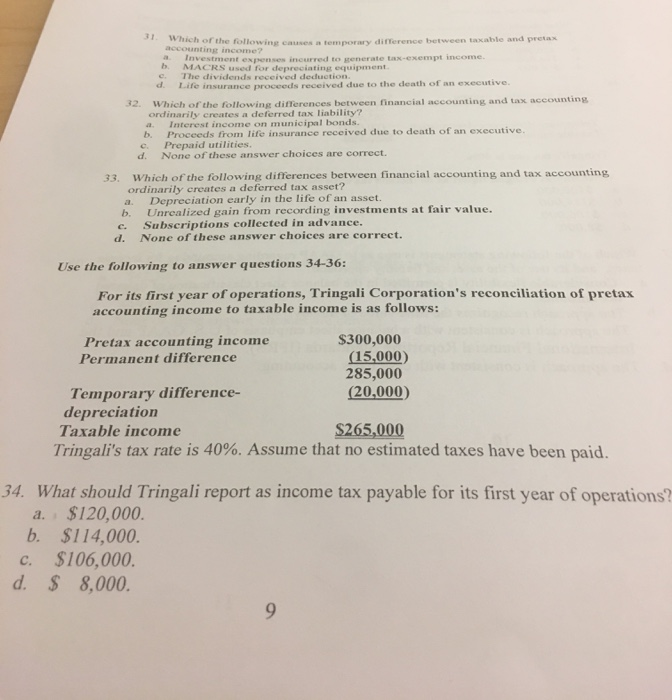

32. 33. a. b. 31. Which of the following causes a temporary difference between taxable and pretax accounting income? a b. b. c. d.

32. 33. a. b. 31. Which of the following causes a temporary difference between taxable and pretax accounting income? a b. b. c. d. C. $106,000. d. $ 8,000. Investment expenses incurred to generate tax-exempt income. MACRS used for depreciating equipment. The dividends received deduction. Life insurance proceeds received due to the death of an executive. Which of the following differences between financial accounting and tax accounting ordinarily creates a deferred tax liability? Which of the following differences between financial accounting and tax accounting ordinarily creates a deferred tax asset? Depreciation early in the life of an asset. Unrealized gain from recording investments at fair value. Subscriptions collected in advance. c. d. None of these answer choices are correct. Interest income on municipal bonds. Proceeds from life insurance received due to death of an executive. Prepaid utilities. C. d. None of these answer choices are correct. Use the following to answer questions 34-36: For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income Permanent difference Temporary difference- depreciation $300,000 Taxable income $265,000 Tringali's tax rate is 40%. Assume that no estimated taxes have been paid. (15,000) 285,000 (20,000) 34. What should Tringali report as income tax payable for its first year of operations? a. $120,000. b. $114,000. 9

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

31 Temporary difference is the difference between carrying amount of an asset or liability in the ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started