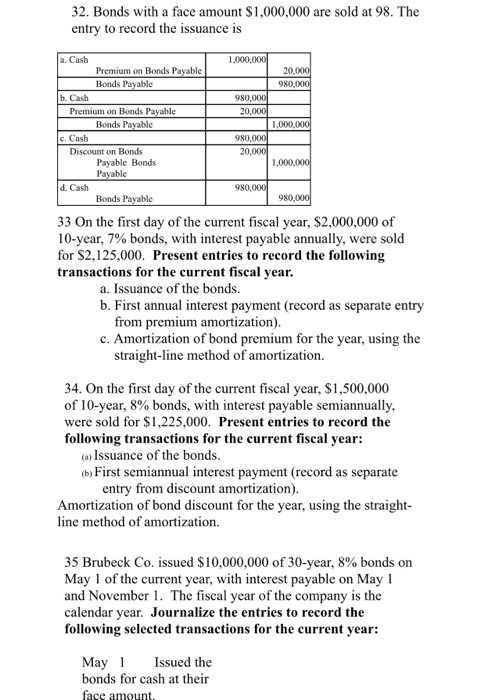

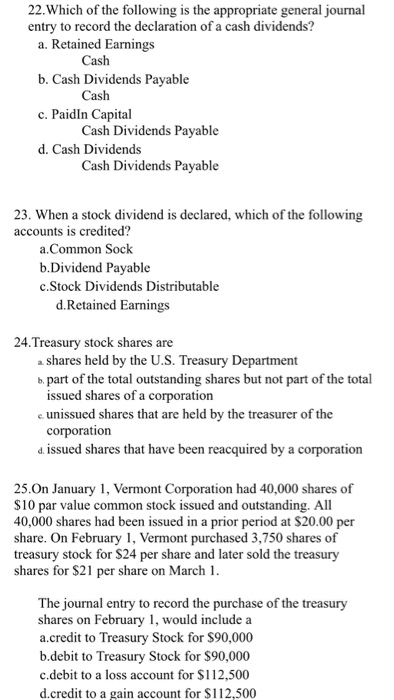

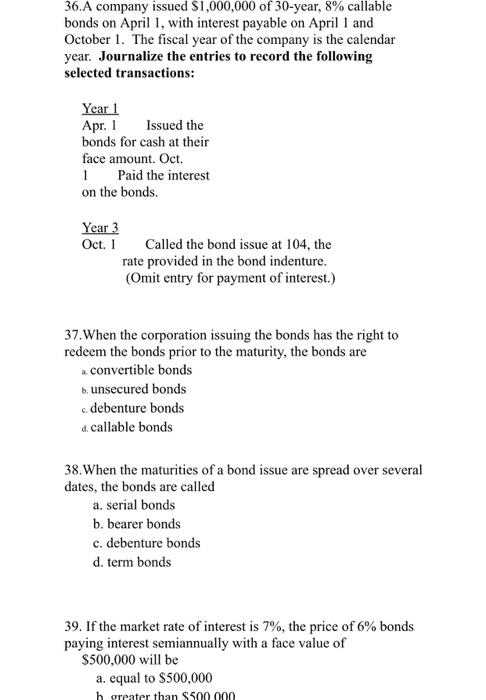

32. Bonds with a face amount $1,000,000 are sold at 98. The entry to record the issuance is a. Cash 1,000 Premium on Bonds Payable Bonds Payable 980,0 b. Cash 980,00 0,000 Premium on Bonds Payable Bonds Payable 1,000,000 c, Cash 980,00 Discount on Bonds 20,00 Payable Bonds Payable 1,000, d. Cash Bonds Payable 980 33 On the first day of the current fiscal year, $2,000,000 of 10-year, 7% bonds, with interest payable annually, were sold for S2,125,000. Present entries to record the following transactions for the current fiscal year a. Issuance of the bonds. First annual interest payment (record as separate entry from premium amortization). c. Amortization of bond premium for the year, using th straight-line method of amortization. 34. On the first day of the current fiscal year, $1,500,000 of 10-year, 8% bonds, with interest payable semiannually were sold for $1,225,000. Present entries to record the following transactions for the current fiscal year: o) Issuance of the bonds. b) First semiannual interest payment (record as separate entry from discount amortization) Amortization of bond discount for the year, using the straight line method of amortization. 35 Brubeck Co. issued $10,000,000 of 30-year, 8% bonds on May 1 of the current year, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar vear. Journalize the entries to record the following selected transactions for the current year: May Issued the bonds for cash at their 22.Which of the following is the appropriate general journal entry to record the declaration of a cash dividends? a. Retained Earnings b. Cash Dividends Payable c. Paidln Capital d. Cash Dividends Cash Cash Cash Dividends Payable Cash Dividends Payable 23. When a stock dividend is declared, which of the following accounts is credited? a.Common Sock b.Dividend Payable c.Stock Dividends Distributable d.Retained Earnings 24.Treasury stock shares are shares held by the U.S. Treasury Department b part of the total outstanding shares but not part of the total issued shares of a corporation e unissued shares that are held by the treasurer of the corporation d issued shares that have been reacquired by a corporation 25.On January 1, Vermont Corporation had 40,000 shares of S10 par value common stock issued and outstanding. All 40,000 shares had been issued in a prior period at $20.00 per share. On treasury stock for $24 per share and later sold the treasury shares for $21 per share on March l February 1, Vermont purchased 3,750 shares of The journal entry to record the purchase of the treasury shares on February 1, would include a a.credit to Treasury Stock for $90,000 b.debit to Treasury Stock for $90,000 c.debit to a loss account for 112,500 d.credit to a gain account for $112,500 36.A company issued $1,000,000 of 30-year, 8% callable bonds on Apr, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions: Year 1 Apr.Issued the bonds for cash at their face amount. Oct. Paid the interest on the bonds. Year 3 Oct.Called the bond issue at 104, the rate provided in the bond indenture (Omit entry for payment of interest.) 37.When the corporation issuing the bonds has the right to redeem the bonds prior to the maturity, the bonds are a convertible bonds b unsecured bonds e debenture bonds d. callable bonds 38. When the maturities of a bond issue are spread over several dates, the bonds are called a. serial bonds b. bearer bonds c. debenture bonds d. term bonds 39. If the market rate of interest is 7%, the price of 6% bonds paying interest semiannually with a face value of S500,000 will be a. equal to $500,000 h greater than $500 000