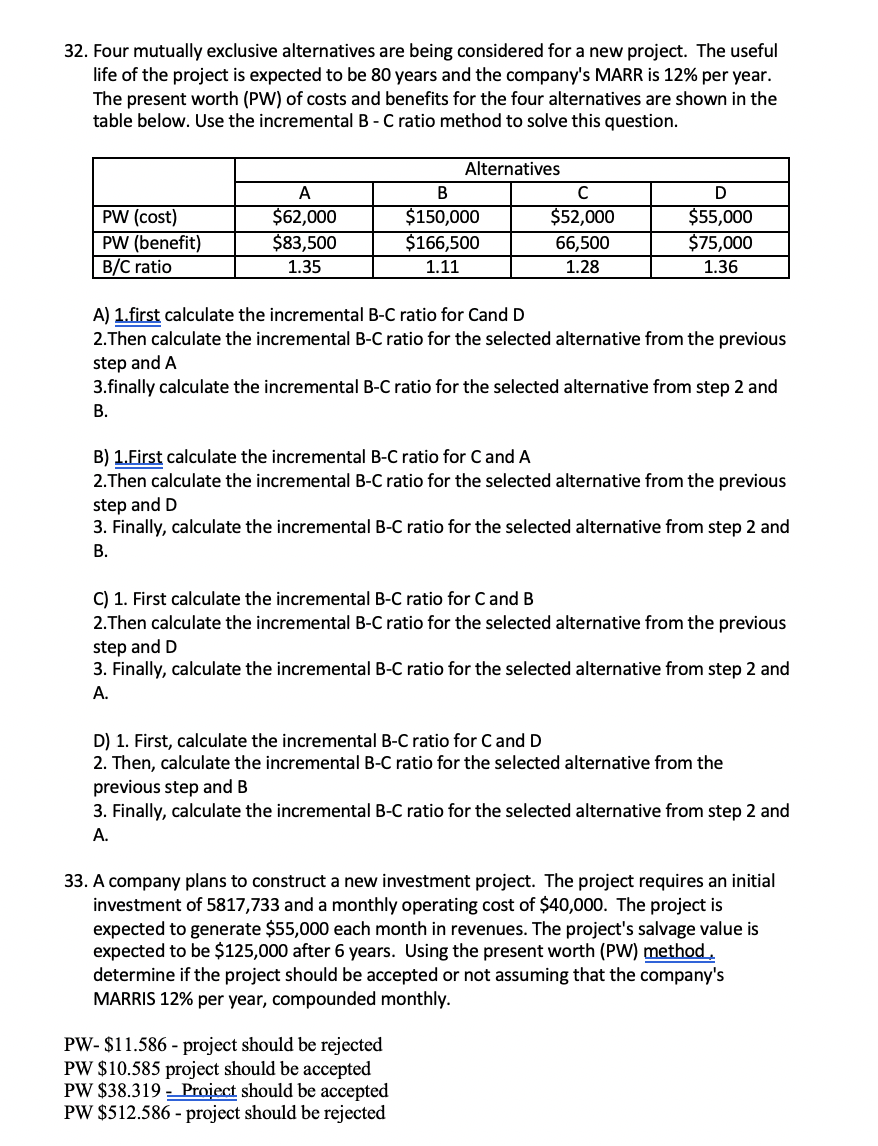

32. Four mutually exclusive alternatives are being considered for a new project. The useful life of the project is expected to be 80 years and the company's MARR is 12% per year. The present worth (PW) of costs and benefits for the four alternatives are shown in the table below. Use the incremental B - C ratio method to solve this question. PW (cost) PW (benefit) B/C ratio A $62,000 $83,500 1.35 Alternatives B $150,000 $52,000 $166,500 66,500 1.11 1.28 D $55,000 $75,000 1.36 A) 1.first calculate the incremental B-C ratio for Cand D 2.Then calculate the incremental B-C ratio for the selected alternative from the previous step and A 3.finally calculate the incremental B-C ratio for the selected alternative from step 2 and B. B) 1.First calculate the incremental B-C ratio for Cand A 2.Then calculate the incremental B-C ratio for the selected alternative from the previous step and D 3. Finally, calculate the incremental B-C ratio for the selected alternative from step 2 and B. C) 1. First calculate the incremental B-C ratio for Cand B 2.Then calculate the incremental B-C ratio for the selected alternative from the previous step and D 3. Finally, calculate the incremental B-C ratio for the selected alternative from step 2 and A. D) 1. First, calculate the incremental B-C ratio for Cand D 2. Then, calculate the incremental B-C ratio for the selected alternative from the previous step and B 3. Finally, calculate the incremental B-C ratio for the selected alternative from step 2 and A. 33. A company plans to construct a new investment project. The project requires an initial investment of 5817,733 and a monthly operating cost of $40,000. The project is expected to generate $55,000 each month in revenues. The project's salvage value is expected to be $125,000 after 6 years. Using the present worth (PW) method. determine if the project should be accepted or not assuming that the company's MARRIS 12% per year, compounded monthly. PW- $11.586 - project should be rejected PW $10.585 project should be accepted PW $38.319 - Project should be accepted PW $512.586 - project should be rejected