Answered step by step

Verified Expert Solution

Question

1 Approved Answer

32. How to solve? Answer: 7.80% Similar to the example given in class on compensation to general partners and returns to limited partners in a

32.

How to solve? Answer: 7.80%

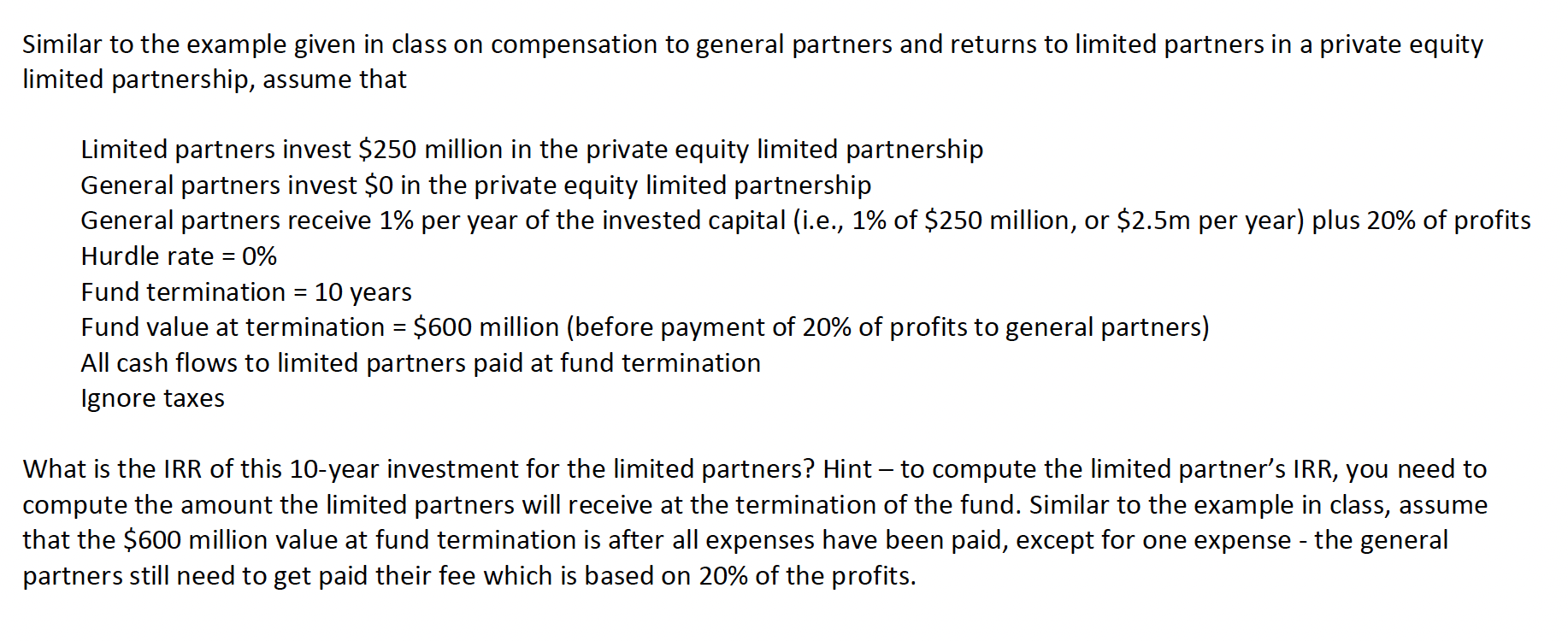

Similar to the example given in class on compensation to general partners and returns to limited partners in a private equity limited partnership, assume that Limited partners invest $250 million in the private equity limited partnership General partners invest $0 in the private equity limited partnership General partners receive 1% per year of the invested capital (i.e., 1% of $250 million, or $2.5m per year) plus 20% of profits Hurdle rate = 0% Fund termination = 10 years Fund value at termination = $600 million (before payment of 20% of profits to general partners) All cash flows to limited partners paid at fund termination Ignore taxes = What is the IRR of this 10-year investment for the limited partners? Hint to compute the limited partner's IRR, you need to compute the amount the limited partners will receive at the termination of the fund. Similar to the example in class, assume that the $600 million value at fund termination is after all expenses have been paid, except for one expense - the general partners still need to get paid their fee which is based on 20% of the profitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started